Woodside Energy Group Ltd. is betting on a big future for LNG and the U.S. Gulf Coast’s role in it after making a bold move last month to acquire Tellurian Inc. and its Driftwood liquefied natural gas export project in Louisiana.

The 27 million metric ton/year (mmty) Driftwood project would add to Woodside’s existing 20 mmty portfolio placing it as one of the largest global LNG suppliers, according to Wood Mackenzie.

“This is the first time a large portfolio player has taken full strategic control of a U.S. project,’ said Wood Mackenzie’s Daniel Toleman, the firm’s Perth-based research director for Global LNG. “We’ve seen companies take strategic non-operated positions before. But this suggests Woodside wants to control its own destiny by taking control of one of the best remaining LNG development sites on the Gulf Coast.”

A final investment decision for Driftwood’s first 11 mmty phase is expected early next year. If the project gets the greenlight, it would significantly increase Woodside’s Atlantic Basin LNG position. Woodside CEO Meg O’Neil said the acquisition “creates opportunity for value optimization and arbitrage between the basins, underpinned by multiple competitive cost-of-supply LNG sources.”

Australia-based EnergyQuest CEO Rick Wilkinson told NGI having certainty around Driftwood’s permitting is viewed as a distinct advantage compared to the recent LNG project history in Australia, where legal challenges and ambivalent regulatory support have created hurdles.

The Driftwood site is fully permitted, including a license to export LNG to non-free trade agreement countries that doesn’t expire until May 2026. The Biden administration has stopped approving those licenses as it reviews its process for issuing them, creating hurdles for some less advanced projects.

The site also has access to some of the world’s lowest priced natural gas, thanks to the success of unconventional developments, Wilkinson pointed out. He added that the location should prove competitive for selling into the attractive European market, which is currently distant from Woodside’s focus on Asian LNG buyers given that most of its assets are in Australia.

According to Poten & Partners’ Jason Feer, global head of business intelligence, Woodside has been looking to become a more active participant in the LNG market for some time.

An important plus for Woodside’s acquisition “is that it's become difficult to find large sites on the U.S. Gulf Coast, as many have been snapped up by other LNG and petrochemical projects,” Feer told NGI. “The Driftwood site is well located and a lot of site preparation has been done. So that adds to its appeal.”

O’Neil told Bloomberg last month that Woodside will now have an opportunity with the Tellurian acquisition to “put together the dream team of LNG.”

The company indicated it is looking to bring aboard partners to help develop Driftwood, spread capital risk, and support marketing efforts. O’Neil said the company won’t agree to any potential partnerships until the Tellurian deal is completed, which is expected in the fourth quarter.

[NGI’s 2023 Map of North American Natural Gas Pipelines, LNG Facilities, Shale Plays & Market Hubs includes 460+ locations and facilities. Bonus: Bundle with NGI’s 2024 Mexico Map today.]

Feer said it has become increasingly common for U.S. LNG projects to have equity investors.

“Since they are planning to finance the project, it makes sense to find investors to reduce the amount of capital they have to put in and reduce the overall risk,” he added. “Several international majors have been discussed, as have a couple of Middle Eastern national oil companies.”

Woodside would achieve a premium on the Tellurian transaction if investors become more confident about the project’s development progress, according to Wood Mackenzie. It is a model the company has followed before, when it purchased the Scarborough LNG project and subsequently sold down its participation as the development progressed.

“Woodside’s LNG operations and marketing experience gives the Driftwood LNG project much greater credibility,” Toleman said. “The project gets a foundation offtaker, which will allow other high-quality partners to enter the development.”

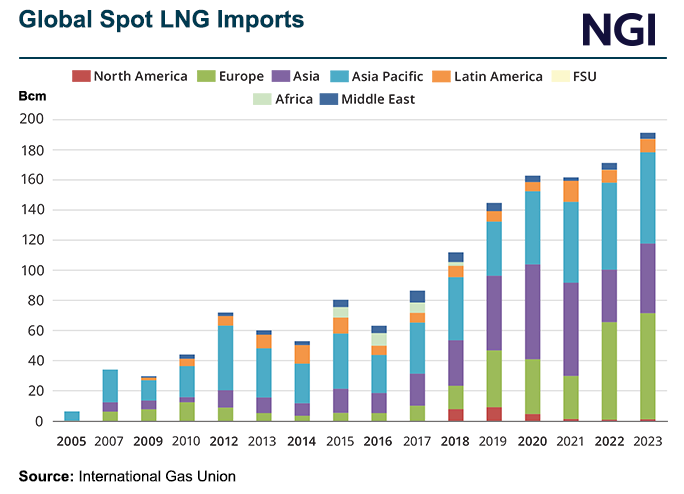

While there appears to be little downside to the acquisition, Driftwood could ultimately enter the market later in the decade alongside a surge of capacity expected from other projects across the Gulf Coast and the Middle East, leaving volumes uncommitted.