Baseload natural gas prices advanced during the first day of July bidweek trading on Monday, supported by intense heat taking grip across the Lower 48, with forecasts pointing to more of the same in July.

NGI’s Bidweek Alert (BWA) showed prices strengthening across most regions in anticipation of more summer demand for gas and ongoing declines in gas surplus inventories. Forecasts call for more extreme heat to blanket most of the country well into July. Stronger pricing was especially evident in the West as bidweek trading kicked off.

Fixed price trades for Waha West Texas averaged at 56.0 cents/MMBtu on day 1 of July Bidweek. This compared with 30.5 cents for June bidweek. If the trend holds, July would be the second month for the Permian Basin benchmark to trade in positive territory after falling below zero in the spring.

In California, SoCal Citygate averaged $2.960, up from $1.720 during the previous month. Higher baseload prices for the state came as its cash markets were expected to avoid the price spikes of past years thanks to hefty levels of natural gas in storage and hydropower resources.

For the rest of the country, too, higher levels of gas in storage have weighed on prices in 2024. To counter that, producers have curtailed output since late winter and cut into the surplus of gas in working storage. An injection of 71 Bcf into storage for the week ended June 14 put the surplus 23% above the five-year average, down a percentage point from the previous week.

But those curtailments have been ending since natural gas prices began to rebound ahead of summer. Wood Mackenzie’s estimate on Monday pegged the seven-day average at 100.8 Bcf/d. That’s up from spring lows in the mid-90s Bcf/d, but below highs around 107 Bcf/d notched early this year.

In basis trade on Monday, price discounts in Appalachia narrowed, supported by the startup of the Mountain Valley Pipeline LLC (MVP) this month. The pipeline expanded the reach of Appalachian Basin gas into the Southeast.

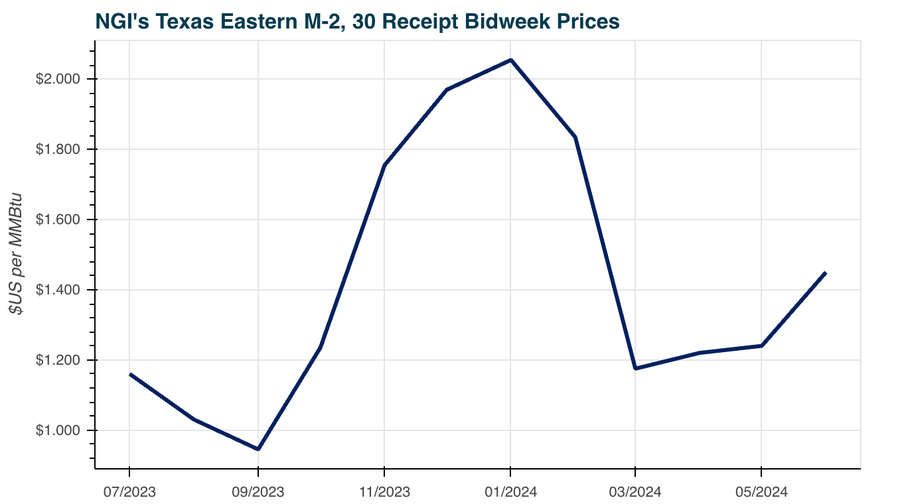

Texas Eastern M-2, 30 Receipt saw July basis deals between minus 82.5 cents and minus 75.0 cents for an average of minus 80.0 cents, BWA data show. That’s narrower than the average of minus $1.040 for June.

In the Northeast, some hubs flipped slightly positive in basis trading after trading negative in June. Deals for Algonquin Citygate averaged at plus 2.8 cents, with no deals lower than zero. That compared with an average of minus 64.5 cents for June.

Futures offered some support on the first day of July bidweek trading. July futures, set to expire on Wednesday, rose 10.6 cents to settle at $2.811 Monday. Meanwhile, August added 11.2 cents at $2.948.