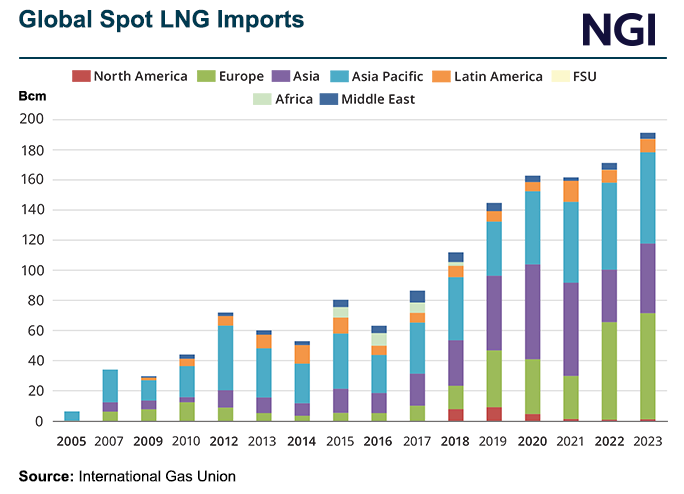

Despite efforts to ban Russian natural gas imports, Europe has been taking in more of it as higher spot prices in the Pacific Basin in recent weeks have drawn more American supplies toward Asia.

Last month, Europe imported nearly 35% of its LNG from the United States and 21% from Russia, according to Kpler. That compared to 39% from the United States and 19% from Russia in June. Over the same time, European LNG imports fell to 6.11 million tons, or a 34-month low amid soft demand.

Kpler analyst JP Lacouture told NGI that liquefied natural gas deliveries to Europe from PAO Novatek’s Yamal facility were marginally higher compared to the last few years, with July deliveries to Europe looking similar to 2020 and 2022. However, deliveries from Russia to Europe were up 53% year/year in 2023.

The European Union (EU) has imposed a long list of sanctions against Russia, even providing the ability for each member state to decide whether to ban Russian gas imports.

Sanctions imposed by the United States have severely limited the ability of the Arctic LNG 2 facility on the Gydan peninsula in the Russian Arctic to export the super-chilled fuel since production started last December. The terminal’s first shipment was sent earlier this month with a so-called shadow vessel used to avoid tracking due to the sanctions.

Two of the three liquefaction trains planned for Arctic LNG 2 have been delayed. The second train was originally scheduled to start up in 1Q2024, but international sanctions delayed receiving parts, which eventually had to be replaced by Chinese companies.

The platform carrying the second 6.6 million metric tons/year train is currently being towed from the company’s Murmansk shipyard via the Northern Sea Route to the project site, and is expected to reach the LNG facility by the end of the month, according to Russian newspaper Kommersant.

[Mexico Matters: Cross-border energy trade between the U.S. and Mexico was more than $66 billion in 2023. Understand this burgeoning trade flow – the projects, politics and natural gas prices – with NGI's Mexico Gas Price Index. Request a trial now.]

Following additional U.S. sanctions imposed in June, Chinese company Wison New Energies Co. Ltd. decided to exit the project. The company had built the modules for the second liquefaction train, but reportedly left the project without completing train 3.

While the sanctions have impacted operations, Russia is finding ways around them. The country is using a shadow fleet of vessels that are spoofing their location to skirt sanctions at the Arctic LNG 2 facility and load fuel. At least three of those ships have arrived at the terminal this month, according to various news media and vessel-tracking services.

Katja Yafimava, a senior research fellow at the Oxford Institute for Energy Studies, said western sanctions are also unlikely to completely stop future Russian LNG expansion.

“These sanctions could delay availability of Russian LNG in the short- to mid-term, but it is doubtful that they will reduce its availability in the longer-term,” she told NGI. “It is reasonable to expect that Russia will make every effort to find replacements for sanctioned technology, goods and services, either to be produced domestically or imported from non-Western countries.”