Calgary-based Tourmaline Oil Corp., the largest natural gas producer in Western Canada, has struck a deal to buy crosstown explorer Crew Energy Inc. to build its gas-heavy reserves In the Montney Shale.

Tourmaline, which reports in Canadian dollars (C$1.00/73 cents), agreed to acquire all of the exploration and production (E&P) company’s common shares and debt in a transaction estimated at $1.3 billion. The takeover is expected to be completed in October.

The acquisition is an “important component” to consolidate northeastern British Columbia (NEBC) acreage, where the Montney is the primary natural gas producer, Tourmaline noted. The purchase would put the E&P on track to produce 750,000 boe/d “over the next five years, with further growth opportunities extending into the next decade. The company plans to sequence the timing of major capital projects, and associated volume growth, with improving commodity markets…”

The deal comes at an “opportune time for consolidating natural gas assets prior to imminent major growth,” Tourmaline executives said. Executives reiterated what was noted during the recent second quarter conference call that producing natural gas would continue to be a driving force for the independent.

Highlighting reasons for the merger, executives pointed to the Shell plc-led LNG Canada export project, which is to draw feed gas from the Montney. The export project is due to begin commercial operations in 2025. Tourmaline also has broad market opportunities across the United States. It now supplies roughly 25% of the Northern California natural gas market.

Tourmaline CEO Mike Rose said Crew had assembled “one of the premier, concentrated Montney asset bases in NEBC, with significant upside.” The company’s “scale, execution capability and ability to generate strong free cash flow in all parts of the commodity cycle will allow Crew shareholders to realize the material embedded upside on an accelerated timeline.”

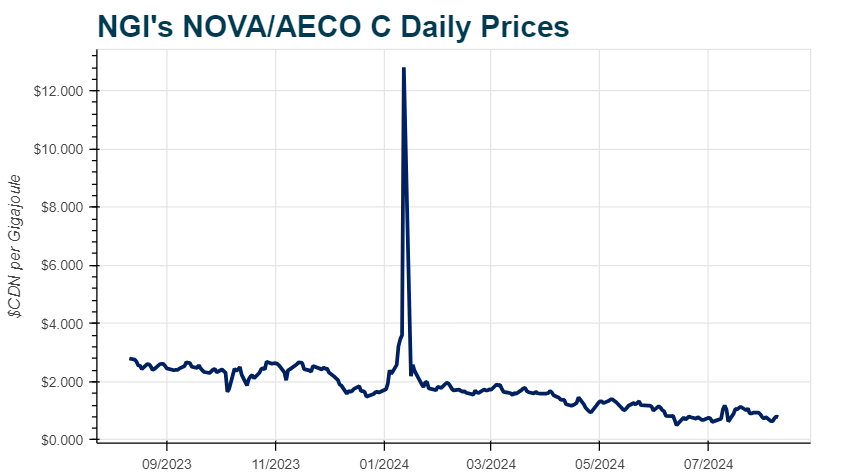

Crew, 71% weighted to natural gas, produced 29,254 boe/d during the second quarter. Gas output, estimated at 124 MMcf/d, represented 19% of sales. The quarterly output was partially offset by around 1,700 boe/d net of “predominantly dry gas that was shut in to preserve value given low natural gas pricing.”

Crew earlier this year had worked to expand its condensate production because of “weak” natural gas prices. However, in May the board launched a strategic review that included looking for a buyer.

Crew acreage is adjacent to Tourmaline's existing operated complex in the southern part of the Montney. Crew's Groundbirch development, including an “electrified deep cut gas processing facility, has the potential to approximately double the existing Crew production base,” Tourmaline noted.

“Tourmaline intends to proceed with the Groundbirch project within the next five years, with specific timing to be determined over the next year.”