Dallas-based EnLink Midstream LLC has sanctioned its first brownfield natural gas expansion project in Louisiana as it works to add 8 Bcf of capacity to the Jefferson Island Storage & Hub.

JISH, as it is known, “received strong commercial interest and is backed by investment-grade credit customers under long-term contracts,” CEO Jesse Arenivas said during the quarterly conference call last week.

First injections at JISH, estimated to cost $85 million, are expected in 2028. The expansion would increase working gas storage to 10 Bcf from 2 Bcf.

The decision to sanction JISH was announced as the Dallas-based midstream giant issued its second quarter results.

“Our Louisiana team is executing on a multi-prong growth strategy and moving projects toward commercialization, such as the Henry Hub to the River project announced last quarter and the JISH expansion,” Arenivas said.

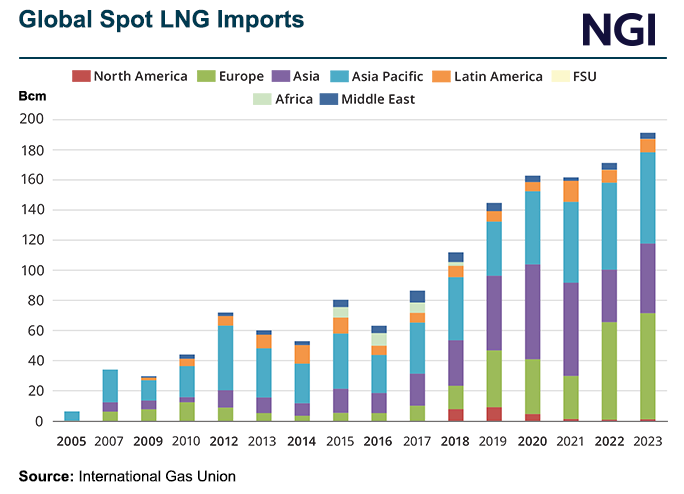

The CEO had discussed the ventures during the first quarter conference call. The projects are geared to “supply the high-demand market for natural gas,” including to export LNG to overseas markets.

The 26-inch diameter Henry Hub to the River pipeline, estimated to cost around $70 million, is expected to begin commercial operations in late 2025. It already is fully subscribed.

As EnLink management noted, “additions of new storage capacity have not kept pace” in the Lower 48. Since 2010, Louisiana gas demand (plus exports) has nearly quadrupled, while storage has only modestly increased.”

Within four years, U.S. liquefied natural gas feed gas demand “is expected to double from 13 Bcf/d,” with nearly all of the projects sited on the Gulf Coast.

“For the last several quarters, we have discussed the shifting Louisiana gas supply and demand market and how we are focused on meeting the needs of the market and creating value for our unitholders,” Chief Commercial Officer Dilanka Deimon told investors. “We are approaching the Louisiana gas opportunity in three phases.

“Last quarter, we announced the Henry to River project, which brings approximately 210 MMcf/d of capacity to the Mississippi River corridor…This project execution is progressing very well.

“We also commenced operations of another such previously announced project, expanding deliveries to Venture Global Inc.’s Calcasieu Pass LNG export facility.” EnLink’s 24-mile Bridgeline pipeline system delivers feed gas to the LNG export terminal.

“Both of these projects expand our capacity primarily through additional compression and, therefore, result in attractive economics,” Deimon said. “We have done several optimizations of our system” to increase flow rates to Bridgeline, Louisiana Intrastate Pipeline and Sabine Pipe Line LLC.

“We are presently marketing that increased capacity, and we continue to see a healthy funnel of these opportunities over time.”

EnLink now has 3,100 natural gas transmission lines in Louisiana, along with 11 Bcf of storage. In addition, it has two natural gas processing facilities with 710 MMcf/d capacity.

During the second quarter, natural gas transportation volumes in Louisiana were 20% higher year/year and rose 2% sequentially.

EnLink also provides midstream services in the Permian Basin, the largest segment, and in North Texas and Oklahoma.

In the Permian, average natural gas gathering volumes rose 17% year/year and were 7% higher sequentially. Natural gas processing volumes were up by 14% from 2Q2023 and were 6% from 1Q2023.

Oklahoma’s gas gathering volumes were 3% lower than a year ago but were 7% higher than in the first quarter. Average gas processing volumes also declined, down by 3% year/year but increased 8% sequentially.

Meanwhile, North Texas gas gathering and transportation volumes fell by 8% from 2Q2023 but were 2% higher than in the first three months of this year. Gas processing volumes fell by 8% year/year but increased from the first quarter by 1%.

”As we look forward, we are encouraged by the strong potential for new gas power generation and data center growth around our assets, particularly in the key North Texas market, where we are one of the largest gatherers and processors of natural gas,” Deimon told investors. “The diversity of EnLink’s assets in key locations in Louisiana, North Texas, the Permian and Oklahoma continues to set us up for commercial opportunities.”

Net income declined to $67 million (7 cents/share) from year-ago profits of $90 million (12 cents). Revenue was slightly higher year/year at $1.55 billion from $1.53 billion.