October Natural Gas Futures Debut as Prompt Month Amid Cautious Trading

In its first session at the front of the curve, the October Nymex gas futures contract early Thursday was lower and in a holding pattern amid an evolving supply/demand outlook.

In its first session at the front of the curve, the October Nymex gas futures contract early Thursday was lower and in a holding pattern amid an evolving supply/demand outlook.

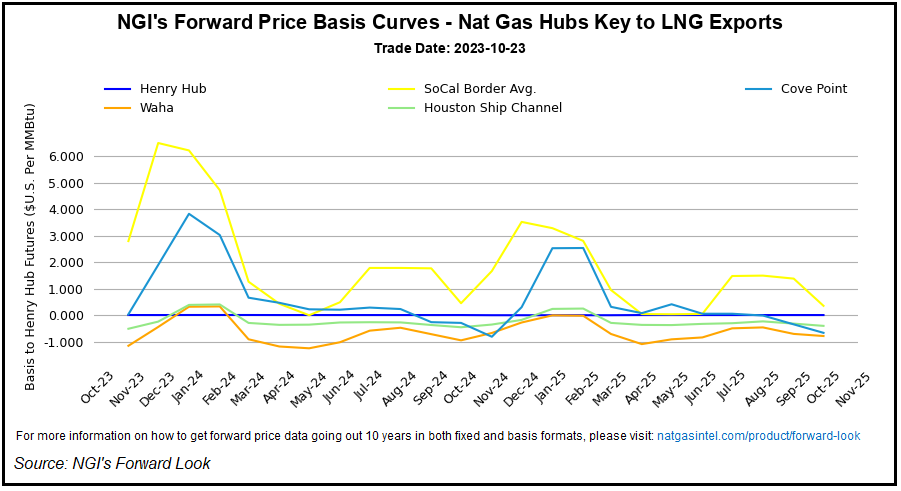

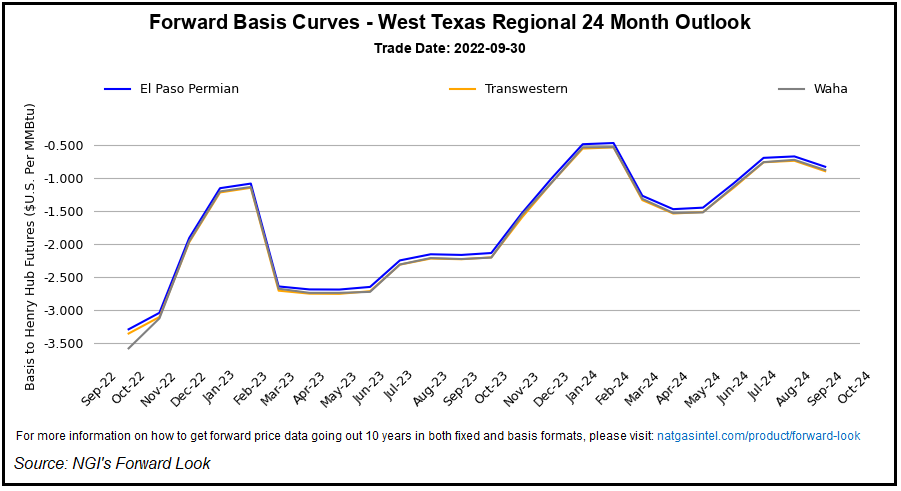

Natural gas futures pushed higher Monday, supported by the return of hot weather this week, a 12-week high in U.S. LNG exports and crimped supply in key South Central markets.

Natural gas futures mounted momentum Tuesday and posted a second-straight gain, as forecasts pointed to frigid northern weather and production estimates pulled back sharply.

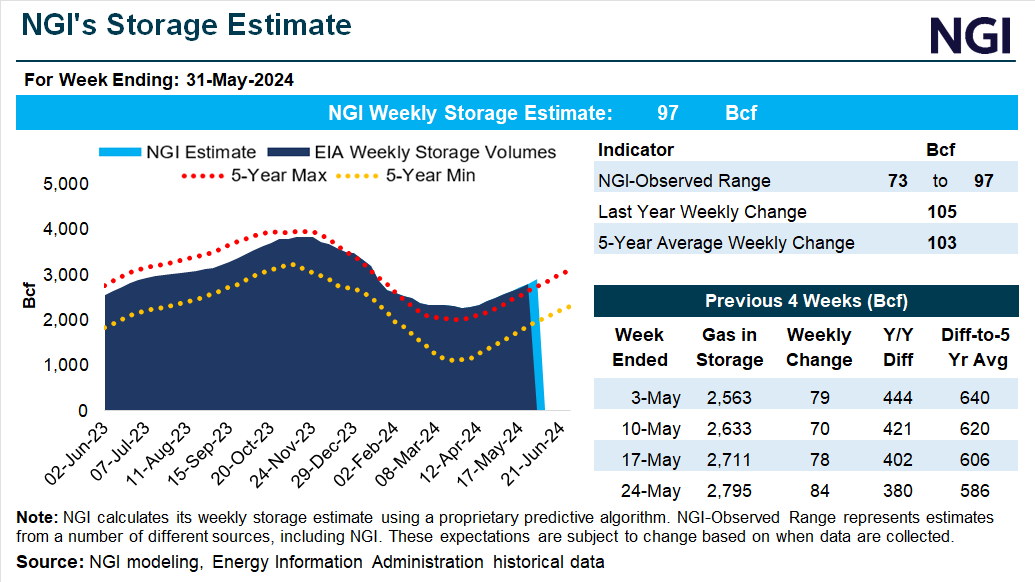

Natural gas futures on Tuesday forged ahead for the first time in three sessions, supported by production interruptions, cash market strength and expectations for a relatively modest storage injection.

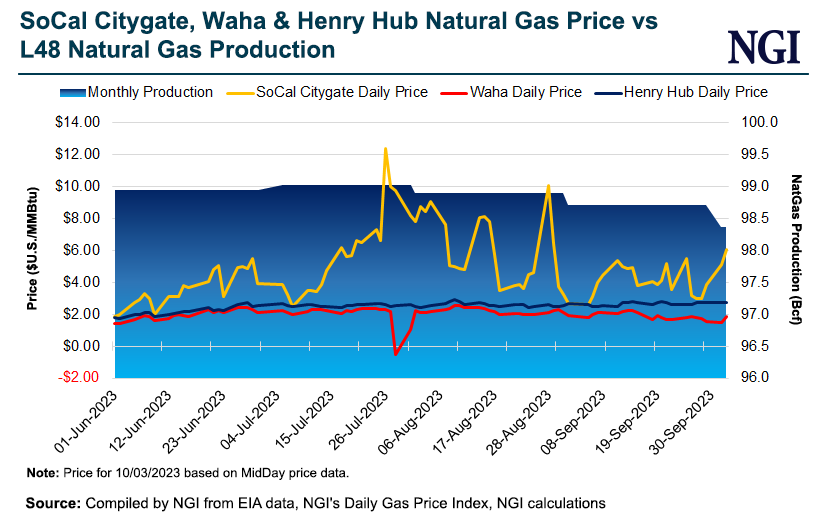

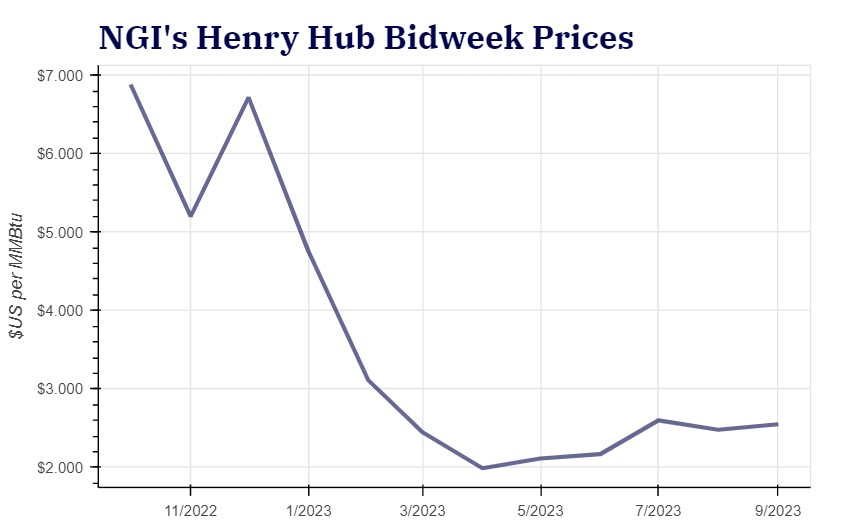

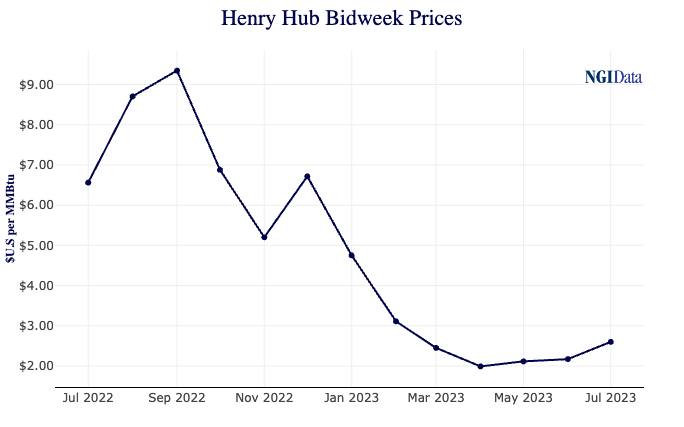

Natural gas prices were trending lower for October bidweek, dragged down by moderate temperatures, soft LNG demand and a host of other bearish factors as the fall shoulder season gets underway, according to NGI’s Bidweek Alert.

Natural gas futures flopped to start the first full week of September as production held strong and forecasts pointed to waning cooling demand as the month wears on.

U.S. natural gas prices have hit a floor and should strengthen modestly over the next six to 24 months, according to oil and gas executives surveyed by the Federal Reserve Bank of Kansas City.

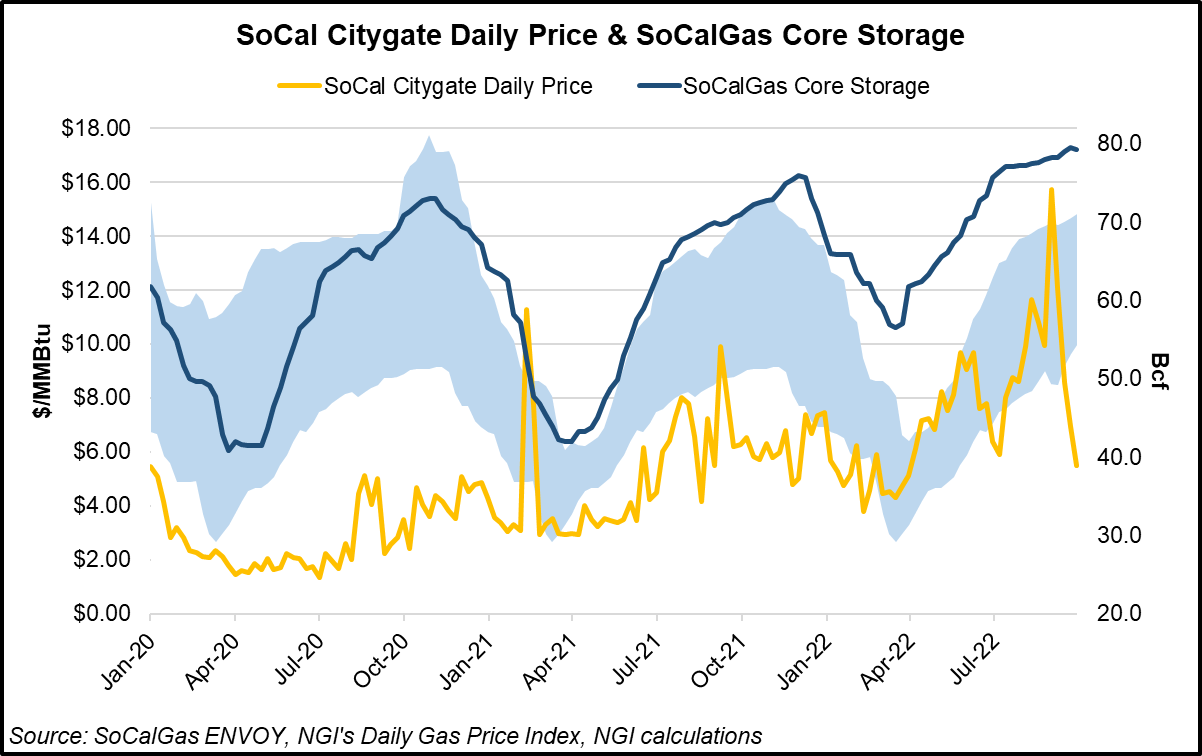

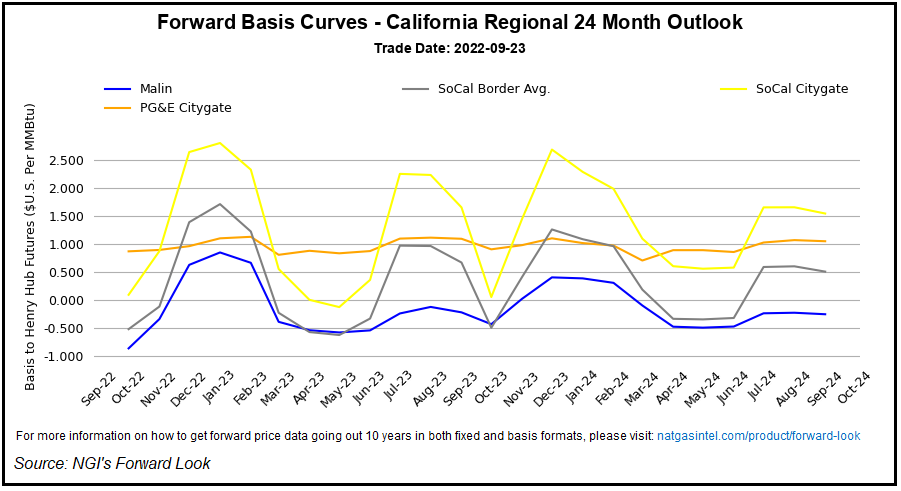

Editor’s Note: In this five-part series, NGI is taking an in-depth review of natural gas utility rates across the country and how – and why – they have escalated since 2021. Part 1 looked at the escalating consumer costs in New York and New England. Part 2 focuses on how natural gas rates on the West Coast have risen and what utilities and governments are doing as a result, and Part 3 looks at the costs consumers will be paying in the Southeast and Florida, which takes into account the fallout from Hurricane Ian. Part 4 goes on a trip to the Appalachian Basin to see how rates there are responding to winter fears, while Part 5 takes a dive into what consumers can expect in the coming months in the Midcontinent.

Natural gas futures plummeted on Monday, with a plethora of weak market signals – including the potential for five straight triple-digit storage injections – sending November prices as much as 46 cents below Friday’s close. The November Nymex contract ultimately settled Monday at $6.470/MMBtu, down 29.6 cents.

Coming off a 12% slump last week, natural gas futures clawed back into the green Monday amid estimates of record output and potential threats to production in the form of a hurricane en route to Florida. The October Nymex gas futures contract gained 7.5 cents day/day and settled at $6.903/MMBtu. November added 2.2 cents to $7.014.