The UK’s new Labour government won in a landslide election earlier this month and has promoted the island country as a “clean energy superpower,” moving away from the previous government’s emphasis on oil and natural gas.

Although Prime Minister Keir Starmer has supported a green energy plan, he has ensured a “phased and responsible transition” away from drilling in the North Sea. The new government recognized the need for keeping existing natural gas-fired power stations running, but has planned to halt the construction of any new gas plants.

EnergyAspects analyst James Waddell told NGI that policies under Labour may accelerate the energy transition, “thereby cutting UK gas demand faster than would have otherwise been the case.”

[Check out a Special Edition of NGI's Daily Gas Price Index, 'Ports Unknown,' to delve into the price impacts of new LNG supplies, and where those supplies will be needed most later this decade and beyond. Download now.]

The transition would likely make the UK even lower priced against neighboring hubs for LNG, and further cement the UK’s position as a market of last resort for liquified natural gas. “The UK's National Balancing Point, or NBP, will therefore be providing price signals to send LNG elsewhere, but this is not just specific to U.S. LNG exports,” Waddell added.

UK natural gas pipeline and LNG imports fell by nearly 20% in the first quarter of 2024 compared with the same period last year. This was partially attributed to reduced demand for transshipments through the UK. LNG imports dropped by over 45% year/year in 1Q2024.

Despite this fall in imports, Norway and the United States remained the largest source of gas imports, accounting for 93% of total UK imports in 1Q2024, the UK Department for Energy Security and Net Zero noted in its June EnergyTrends report.

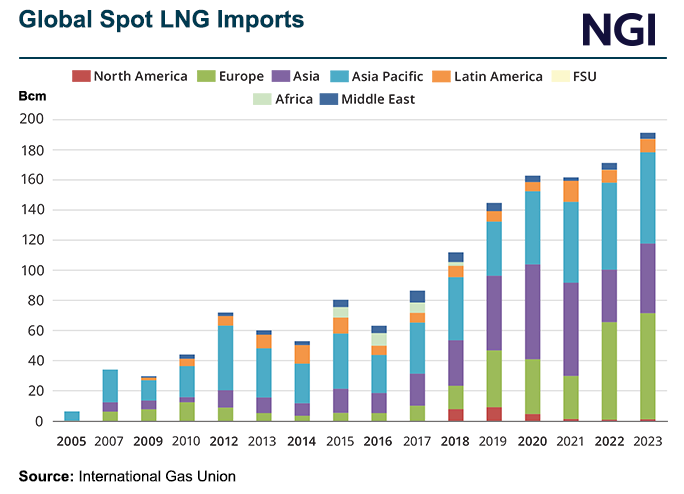

UK natural gas demand has stayed persistently low this year against previous years since the gas crisis, and is seasonally low in April. Waddell explained that when Asia starts to pull LNG away from Europe, as it did in 2Q2024, there is spare LNG import capacity in continental Europe. In that case, the UK takes very little LNG supply and becomes a dumping ground for excess supplies.

Europe now has more spare LNG import capacity, especially with the build-out of German capacity over the last few years, so the UK would likely continue to be the market of last resort within Europe over the coming years. But EnergyAspects expected the massive expansion of liquefaction capacity across the world between 2025 and 2028 could boost aggregate European LNG supply. The firm estimated some of it would land in the UK.

Top of Labour’s energy agenda is an ambitious target to transition to a carbon-free electricity grid by 2030, by increasing the use of renewables. So far, the new government has revoked the Conservative ban on building onshore wind farms – and fast-tracked planning approvals for solar farm projects.

UK renewable electricity generation reached a 51% share of total generation in 1Q2024. Wind contributed more electricity than gas-fired generation for the second consecutive quarter despite outages, according to the energy security department.

However, the UK’s National Grid Electricity System Operator (ESO) raised questions over whether Labour can meet its 2030 carbon free targets without gas as part of the power generation mix in a report released this month. The conclusions were made prior to the general election.

An ESO spokesperson said the operator expects LNG, continental and Norwegian LNG imports to continue until 2050 “in all the net-zero pathways and counter factual scenarios” as the country’s demand is expected to exceed domestic production.

The UK currently consumes the annual equivalent of 872 TWh in natural gas, according to the ESO, forecasting gas demand to be between 642 and 724 TWh in 2030.

“Even after power sources such as wind and solar are generating the lion’s share of electricity, it will still be necessary to keep some gas-fired capacity in reserve to ensure the lights stay on,” ESO said.