The first of three planned onshore LNG import projects in Germany has broken ground as the country continues its journey as one of the fastest growing destinations in Europe for the super-chilled fuel.

After roughly two-and-half years since Germany imported its first volumes of liquefied natural gas, Europe’s largest consumer of the fuel has flipped from relying on Russian supplies to meet over 50% of the country’s demand to a combination of Norwegian pipeline and U.S. LNG imports.

In response to Russia’s invasion of Ukraine in 2022, the German government has progressed and approved plans for up to a dozen offshore and onshore LNG import facilities.

The first onshore project to make a final investment decision (FID) was the 13.3 billion cubic meter (Bcm) project at Stade on the River Elbe, managed by Hanseatic Energy Hub GmbH (HEH). The HEH joint venture is a partnership with Buss Group GmbH & Co. KG, Enagás SA and Dow Chemical Co. Ltd.

[In the Eye of the Storm: North American LNG project developers continue to grapple with the Biden administration's pause on non-FTA permits. Has the pause given impetus to other projects? How are Mexico LNG projects advancing? Tune in to hear from LNG industry analyst Sergio Chapa in the latest episode of NGI's Hub & Flow.]

HEH has disclosed agreements with two major German energy suppliers – EnBW AG and state-controlled Securing Energy for Europe – as well as Czech energy company ČEZ Group. All together, firms have booked a total of 12 Bcm, or 90% of the terminal’s capacity.

Czech Industry and Trade Minister Jozef Síkela has said imports through the Stade terminal starting in 2027 are expected to cover a third of the country’s demand.

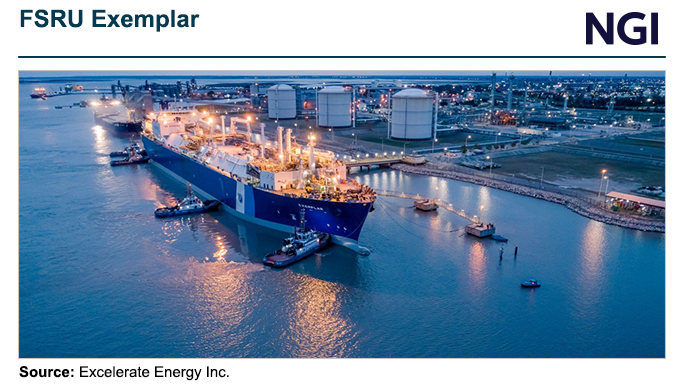

A floating storage and regasification unit (FSRU) leased by Germany’s federal government arrived in Stade in March, and is expected to start importing gas in September until the terminal comes online in 2027. Stade is a “future flexible” terminal with infrastructure also approved for bio-LNG and a blend of hydrogen and carbon dioxide that simulates natural gas, known as e-methane.

State-owned Deutsche Energy Terminal GmbH (DET) is responsible for marketing the regasification capacities of Germany’s LNG facilities.

DET spokesperson Dirk Lindgens told NGI the company would operate four FSRU terminals in Brunsbüttel, Stade and two in Wilhelmshaven. Brunsbüttel and the first phase of Wilhelmshaven are in operation. Stade and the second phase of Wilhelmshaven could startup later this year.

“We are expecting a trend of 17 Bcm capacity at the four sites,” Lindgrens said. “Three of the FSRUs will cease operations six months after completion of the land-based terminals. Only Wilhelmshaven Phase 1 will operate for 10 years.”

DET did not receive any bids for capacity at the FSRU facilities in Brunsbuttel and Wilhelmshaven following marketing rounds issued in May, which the company said is not uncommon given lower European gas prices and falling demand. It plans to launch new capacity auctions.

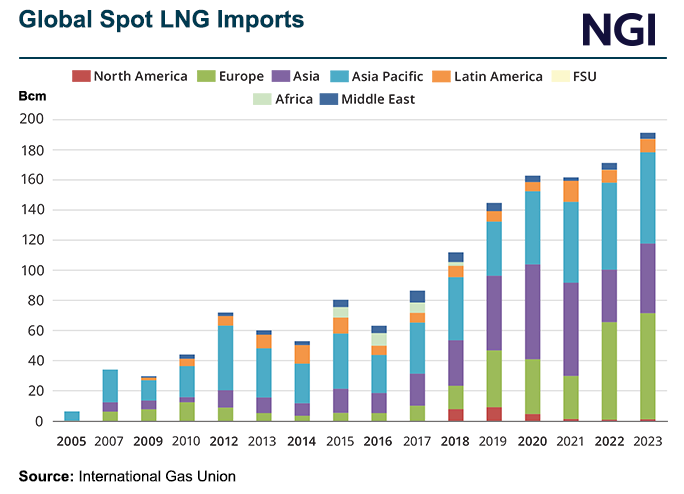

Germany last year increased imports to 5.53 million metric tons (mmt) through multiple points in the country and adjoining nations versus the 0.27 mmt brought in in 2022 through one FSRU, according to data from Kpler. So far this year, Germany has imported 2.80 mmt, 2.5 mmt of which came from the United States.

The United States has been the top LNG supplier to Germany since the end of 2022. Around 80% of Germany’s total imports last year came from U.S. terminals, according to Kpler data.

Two more land-based terminals are planned. German LNG’s (GLNG) facility is planned to be located at Brunsbüttel on the River Elbe and is in the permitting process. The Tree Energy Solutions (TES) import terminal at Wilhelmshaven, part of the Wilhelmshaven Green Energy Hub could eventually offer the import of both conventional LNG and e-methane. The project is expected to reach FID later this year.

Operator Deutsche Regas GmbH & Co. KGaA received its second FSRU in July at the Deutsche Ostsee terminal in the port of Mukran and could eventually offer capacity up to 13.5 Bcm/year.