The first cargo of Texas natural gas liquefied in Mexico could be heading from the east coast to an import terminal on the country’s isolated Pacific Coast by mid-August, according to New Fortress Energy Inc. (NFE).

The company disclosed Friday it was expected to end the commissioning process of its 1.4 million metric tons/year (mmty) capacity Fast LNG (FLNG) facility offshore Altamira by Aug. 9. After commissioning ends, NFE expects its first cargo to be loaded on the Energos Princess and delivered to the Pichilingue liquefied natural gas import terminal in La Paz on Mexico’s Pacific Coast.

NFE has a supply agreement with Mexico’s Comisión Federal de Electricidad (CFE) to provide up to 0.3 mmty of LNG to the import terminal in southern Baja California. A non-free trade agreement permit for NFE’s FLNG projects and proposed onshore trains at Altamira are currently paused by the U.S. Department of Energy, limiting exports to the company’s customer base in North America, the Caribbean and South America.

“Being able to supply our customers with our own LNG has been a goal for the company for many years,” CEO Wes Edens said. “Natural gas and power supply are critical components of a sustainable, affordable and cleaner energy system and we are grateful to now be able to provide an end-to-end solution for our customers.”

Following its first shipment, NFE said the unit will undergo scheduled maintenance for several days before ramping up to full production by the end of the month.

NFE updated its target for the first LNG cargo shipment last month after disclosing it had reached first production at the facility. Delays in installation and a malfunction in April have pushed the project’s timeline by several months.

In July, the company closed a $700 million loan for a second FLNG unit, being developed in partnership with CFE. Completion of the second unit was targeted for the first half of 2026.

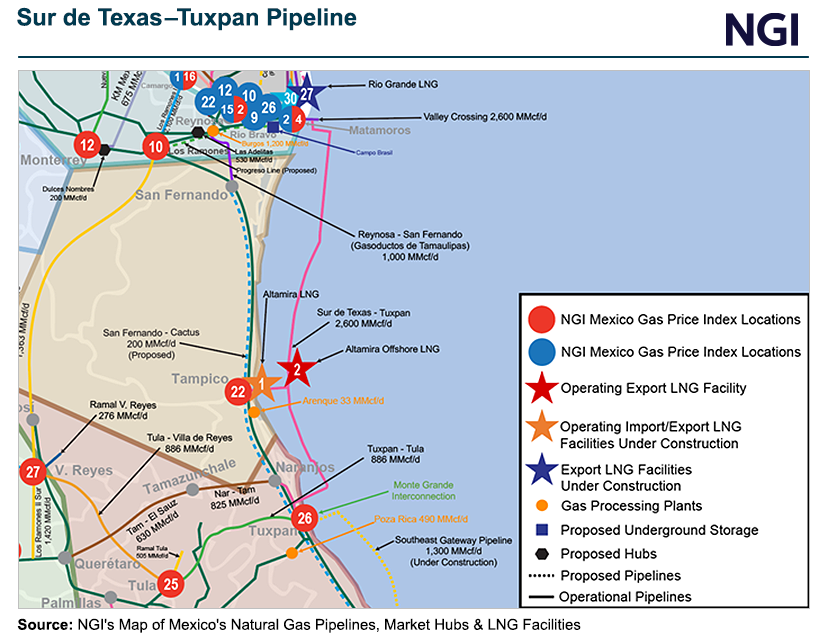

The FLNG units and successive onshore phases are supplied feed gas by CFE’s gas marketing arm, CFEnergía, from the Agua Dulce Hub in South Texas via the Valley Crossing pipeline. CFE transports volumes on the Sur de Texas-Tuxpan pipeline.

NGI’s forward fixed prices at Agua Dulce for September delivery were $1.598/MMBtu as of Friday. Summer 2025 prices were trading at $2.535. Agua Dulce basis prices were quoted 46 cents below Henry Hub for summer 2024, and 49.3 cents below the benchmark for summer 2025.