Natural gas prices were a mixed bag in December bidweek trading, with some support coming via the arrival of robust heating demand in northern markets and new pipeline capacity out of West Texas broadening its sales base.

However, relatively balmy forecasts for early December and a hefty wall of new gas supply doused some of the typical uplift seen into the end of the year, to split the regional averages evenly between gains and declines.

NGI’s December Bidweek National Avg. climbed 19.0 cents month/month to $3.325/MMBtu. This was well below the year-earlier average of $8.395 for December 2022 Bidweek, but 61.9 cents above where the December Nymex natural gas futures contract expired on Tuesday.

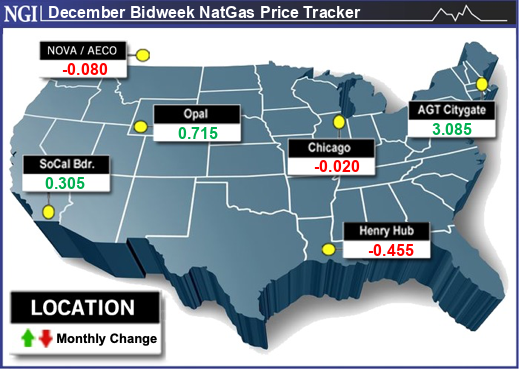

Several hubs in the Northeast and Appalachian regions, where freezing cold temperatures swept in during the final week of November, drove the overall increase. Among the biggest gainers, Algonquin Citygate soared $3.085 to average $6.625. In Appalachia, Texas Eastern M-3, Delivery advanced $1.170 to $3.310.

Gains were less pronounced in some parts of the Rockies, Midcontinent and California. Northwest Sumas, for example, rose 17.5 cents to $6.360.

Prices rose in West Texas in anticipation of the Permian Highway Pipeline LLC (PHP) adding 0.55 Bcf/d capacity from Dec. 1. The pipeline is a major supply route for Permian Basin gas to the Southwest and Southern California, but demand outstrips the throughput supply. With December’s somewhat easing of that constraint, Waha rose 89.0 cents to $2.265.

Downstream of that supply in California, SoCal Citygate sank $1.525 to average $6.525. In addition to the increased flows, Southern California Gas Co. (SoCalGas) topped up its core storage levels.

Meanwhile, declines elsewhere were not as steep as those in California. Most losses were spread across the middle and southern areas of the country. In Louisiana, Henry Hub fell 45.5 cents to $2.710. In the Midwest, Chicago Citygate shed 2.0 cents to $2.760.

The latest round of bidweek trading spanned the business days between Nov. 22-28. In that period, frigid temperatures blanketed the country from the Rockies to the East Coast, with the final day modeling as possibly the coldest day for the rest of the year. The chill was expected to drive a healthy withdrawal of gas out of storage in the week ending Dec. 1, with early estimates averaging at a 101 Bcf draw.

But early December is expected to be warmer than normal, and as a result lighten demand. Already on Thursday, “weather-driven demand dropped 4 Bcf,” EBW Analytics Group analyst Eli Rubin said. Weather models indicated demand would drop by 35 gas-weighted heating degree days (HDD) week/week, which “suggests softening spot market prices into early next week,” he said Friday.

NatGasWeather said Friday temperatures were expected to rapidly warm up into the weekend before a relatively mild weather system moved across the country in the first week of December. That would be followed by much warmer than normal temperatures across the southern and eastern halves of the country, the forecaster said.

As far as when cold might take a tighter grip of the country, the firm said hints of colder weather in late December were still just early reads and needed close monitoring.

Supply Demand Outlook

The U.S. Energy Information Administration (EIA) reported alternating storage trends all through November that extended the injection season beyond its traditional end in late October.

The agency reported an early month 6 Bcf draw, followed by a 60 Bcf build, 7 Bcf draw and a 10 Bcf build for the week ended Nov. 24. By the end of the latest period, gas in storage levels swelled to a 303 Bcf surplus to the five-year average, driven by record gas production levels magnifying November’s weaker gas demand trend.

The build in the week ended Nov. 24 ran counter to estimates for a decrease in stocks. Mobius Risk Group analysts called it a mixed signal for markets because the weaker weather-driven demand should have dumped gas usage by a larger amount.

“Anything sub plus-20 Bcf is not indicative of an oversupplied market, and yet it was still 2.5 Bcf/d bearish versus market expectations,” the analysts said. That gap to expectations was “roughly the same magnitude of the production increase of late, so some will view this as confirmation that production is in fact materially higher,” according to Mobius.

Mobius analysts said they “do not see evidence, outside of very real and material weather risks, to support” a breach of the 2 Tcf level at the end of March and 4 Tcf by next October.

That runs contrary to a growing chorus of caution by analysts, including Goldman Sachs Group’s Samantha Dart, that supply could breach those levels in 2024.

James Bevan, vice president of Criterion Research, recently said it’s hard to take an October 4 Tcf level off the table “until we start seeing production trend lower.”

EBW Analytics’ Rubin agreed with Dart’s warning of potential storage congestion by the end of next summer. “This analysis mirrors our own: cold winter weather can still drive sufficient demand gains to balance the market, but it is increasingly likely over the medium to long term that either production will have to recede or lower prices will materialize to drive power sector coal-to-gas switching, or both.”