Weekly natural gas cash prices were higher amid demand impacted by a heat wave and former Hurricane Beryl, while a slow inventory reduction that was spooking the futures market empowered the bears.

NGI’s Weekly Spot Gas National Avg. for the July 8-12 period was up 44.0 cents to $1.940/MMBtu.

Futures, meanwhile, ended a mostly down week with a modest gain. The August Nymex contract closed the trading period on Friday at $2.329, up 6.1 cents. The settlement was less than a penny above the Fourth of July shortened prior week’s finish at $2.319.

“The heat is on,” said analysts at The Schork Report. The firm said that for the first four days, natural gas demand for electricity generation rose 20% week/week (4,376 GWh), the rough equivalent of 26 Bcf of gas.

Demand was spurred by a deep and well-entrenched upper-level ridge stationed over the West, which created conditions for “extreme heat,” the National Weather Service (NWS) said. Forecasts called for the “hazardous heat” to expand in coverage over portions of the central and eastern areas of the country through the weekend and into next week. NWS said the heat was expected to persist longer over portions of the Southeast and the East Coast.

The week also saw former Hurricane Beryl barrel into Texas as a Category 1 storm. Strong winds and heavy rain battered the region, knocking out power to about 2.7 million electric customers across the state. The Houston region’s CenterPoint Energy Inc. said 2.2 million customers were without power Monday. By Friday, the utility had restored service to about 1.3 million customers, while more than 870,000 remained without power.

CenterPoint CEO Jason Wells said during a hearing Thursday at the Public Utility Commission of Texas that nearly 500,000 customers may have to wait another week for power.

On the physical market front, natural gas prices were higher in West Texas, despite the outages, as sizzling temperatures supported gains. Waha added $3.330 week/week to average 73.5 cents. El Paso Permian at 92.5 cents gained $3.465 on the week.

Gains came as the Agua Dulce Corpus Christi pipeline entered commercial service on July 1, according to Whistler Pipeline LLC, a joint venture with WhiteWater Midstream LLC, MPLX LP and Enbridge Inc.

The pipeline is designed to transport 1.7 Bcf/d of natural gas to Cheniere Energy Inc.’s Corpus Christi liquefaction facility from markets on Whistler Pipeline’s Agua Dulce Header in South Texas. Whistler said the receipt points in Agua Dulce provide Cheniere direct access to Permian Basin and Eagle Ford Shale volumes.

Hot weather conditions across the West also sent prices mostly higher at California hubs. Heavy volumes were traded at SoCal Citygate. Prices were 24.5 cents higher at $2.480, while the SoCal Border Avg. was up 34.0 cents to $2.305. Bucking the wider regional trend, PG&E Citygate slipped 2.5 cents to an average of $3.005.

Meanwhile, Beryl’s impact reverberated through the futures market, where concern focused on LNG. The market watched feed gas flows to liquefied natural gas facilities for signs of the return of Freeport LNG Development LP. The LNG facility on the Texas coast remained shut for a sixth day Friday. It had been shuttered before Beryl stormed ashore.

[Charting the course of global markets: Did you know NGI provides daily data of Netback Prices, Arbitrage Curves, U.S. LNG Export Flow Data, Shipping Costs, Vessel Rate Curves (West of Suez) and more? Check out the LNG+ Data Suite now.]

“At this point, the number of outages is relevant to price less so because of power demand impacts but instead because of implications for LNG,” Gelber & Associates analysts said.

The slow pace of natural gas inventory surplus erosion drove additional market volatility.

Slow Storage Decline

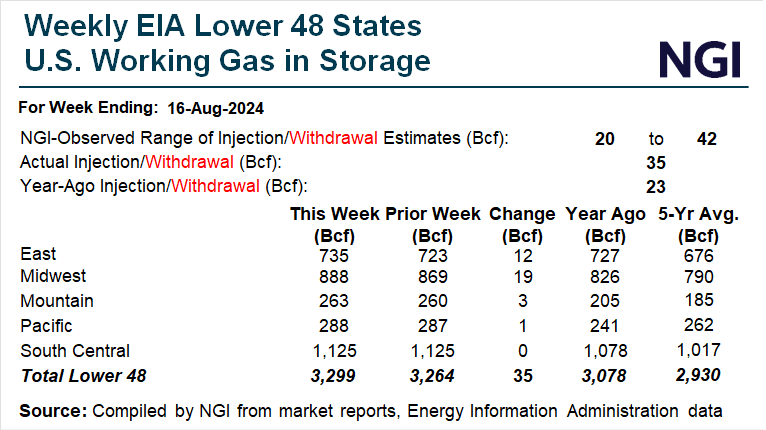

The U.S. Energy Information Administration’s (EIA) latest storage report showed a 65 Bcf injection for the week ended July 5.

The print was in-line with the high end of expectations. It exceeded the 57 Bcf build in both the prior year period and the five-year average increase.

Total working gas supplies were lifted to 3,199 Bcf, 283 Bcf more than last year and 504 Bcf above the five-year average.

According to Schork, the natural gas supply was up about 940 Bcf thus far this injection season. That is “a meager amount given the seasonal norm is 1,094 Tcf,” Schork analysts said.

Last year’s injection was 1,051 Bcf. “Yet, because of the massive surplus in gas after the end of last winter, 60% of last winter’s delivery has been replenished, and we still have 18 weeks left in the season,” the firm said.

Schork analysts said that recent movements in the gas markets reflect how short-term demand fluctuations because of weather can impact prices and volatility. Ultimately, however, the long-term implications of the natural gas supply “play a more significant role,” Schork analysts said.

Natural gas surpluses have not been declining “at a fast enough pace, evidenced by it taking until early August before surpluses drop to 400 Bcf,” NatGasWeather said.

“We view this as a big reason why natural gas prices have steadily sold off the past three weeks,” NatGasWeather said.

Natural gas inventories for the week ending July 12 were expected to be impacted by heat-related demand, as well as the lower consumption attributed to the loss of generation from Beryl.

Early estimates from Reuters ranged from additions of 18 Bcf to 55 Bcf, with an average increase of 38 Bcf. That compares with an increase of 43 Bcf during the same week last year and a five-year average increase of 49 Bcf.

Friday’s Cash Market

Cash prices varied for a three-day package traded on Friday. The weekend days included in the Saturday-Monday package and shifting weather patterns supported both gains and losses.

West Texas hub prices tumbled on lower demand, and were weakened by ongoing power outages. Waha slid 94.0 cents to negative 7.0 cents. Elsewhere in the region, El Paso Permian slid 71.5 cents, still holding to the plus side to average 26.0 cents.

California hubs were also down sharply, with SoCalBorder Avg. leading the retreat, down 63.0 cents to $1.835.

Conversely, in the Southeast, Transco Zone 4 gained 7.5 cents to $2.600 in heavy volume trade, and Appalachia’s Texas Eastern M-2, 30 Receipt added 22.0 cents to $1.725.

The price trends came as scorching temperatures in the West are expected to move to the South and East this weekend after a brief reprieve, Maxar’s Weather Desk meteorologist Bradley Harvey said on the online energy platform Enelyst.

The East is forecast to see highs near 100 degrees in Atlanta and Washington, DC, with a heat index as high as 105-110 degrees early next week, he said.

Monday is projected to have 16.3 power-weighted cooling degree days (PWCDD), he said. That would be the hottest day nationally since 1950 based on PWCDDs. Sunday and Tuesday would rank 10th and 12th, per the forecast.