Weekly natural gas cash prices sank as former Hurricane Debby curbed demand in the East and West Texas prices sank deeper into the negative.

NGI’s Weekly Spot Gas National Avg. for the Aug. 5-9 trading period fell 17.5 cents to $1.585/MMBtu.

Declines were widespread in nearly every region, with West Texas and the Northeast leading the way lower.

Weather conditions were uneven across the Lower 48. Debby cooled down the Southeast, lingering there before it quickly moved up through the Northeast. Cooler air also descended through the Great Plains mid-week. Meanwhile, a heat wave held its grip on the Southern Plains and Lower Mississippi Valley.

In the Permian Basin, pipeline constraints and oversupply continued to keep prices below zero. El Paso Permian fell 71.0 cents to negative $1.285.

Iroquois Zone 2 in the Northeast fell 43.0 cents to $1.670. Transco Zone 4 in the Southeast slid 7.0 cents to $2.175.

Meanwhile, natural gas futures mounted a four-day rally in the week, which followed a run of nine declines over 10 sessions. The September Nymex futures contract on Friday settled at $2.143, down 1.6 cents on the day but up 17.6 cents from the previous week’s close.

A slowdown in production fueled the strength in futures in the week. Lower 48 gas output trended lower as maintenance work and producer shut ins, particularly in the Marcellus Shale, tapped the brakes on flows that recently topped 103 Bcf/d for the first time since late February.

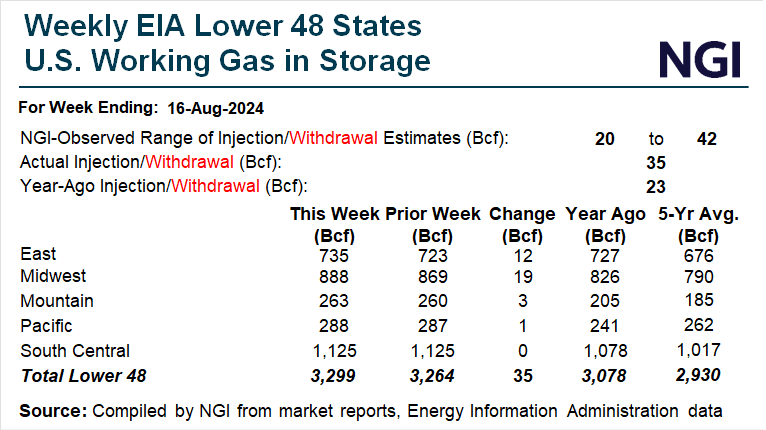

Additionally, a seasonally light weekly government storage build on Thursday hinted at steeper-than-expected production cuts in the East.

“Gains have been aided by yesterday's bullish EIA storage report miss that suggested the supply/demand balance is tighter than expected, and potentially due to US production being lighter than stated,” NatGasWeather said.

The forecaster said weather for the second full week of August would start off light as weather systems tracked across the country. Southern regions would still be warm, but overall demand “won’t be strong enough to intimidate until later in the week.”

Into the second half of August, the forecast is expected to turn hotter than normal for most of the Lower 48, though as has been the case all summer, the modeling could cool down and lose a few cooling degree days over time, the firm said.

Waiting On LNG

Besides weather, LNG exports are the other major driver of demand for Lower 48 natural gas markets, accounting for more than 10% of all flows.

The next wave of liquefied natural gas export capacity is starting to take root, with Venture Global LNG Inc.’s Plaquemines LNG terminal in Louisiana furthest along, ramping up a first phase this year.

The largest U.S. exporter of LNG, Cheniere Energy Inc., also said it plans to start producing LNG at its Corpus Christi LNG expansion project in South Texas by the end of the year. Cheniere management noted on an earnings call that more American cargoes have headed to Asia this summer to capture higher prices. The company expects the trend will continue.

In Mexico, Sempra Infrastructure’s Energia Costa Azul LNG export project is scheduled to begin service in mid-2025.

In Canada, LNG Canada is on track to ship the first LNG cargo by the middle of 2025.

With these projects in mind, East Daley Analytics’s Jack Weixel, senior director of Energy Analysis, said his firm anticipated 4 Bcf/d of incremental LNG export capacity coming online by October 2025.

ExxonMobil announced the Golden Pass LNG terminal on the upper Texas coast would be delayed until the second half of 2025. East Daley anticipated the project’s first train would begin service in January 2026, Weixel said.

East Daley projected another 7.4 Bcf/d of capacity arriving by October 2028. That surge of capacity would come from Golden Pass, a second Plaquemines phase, Sempra’s Port Arthur project southeast of Houston, a second phase of Sempra’s Cameron LNG facility in Louisiana and Saguaro Energia LNG terminal on Mexico’s west coast, among other projects.

“All the South Texas LNG projects will really help open up some production in both the Permian and the Eagle Ford,” Weixel said.

However, new regulatory hurdles have appeared for some LNG projects in August.

A federal appeals court vacated FERC authorizations for the Rio Grande and Texas LNG terminals, the first time a court has sent an LNG terminal approval back to the Federal Energy Regulatory Commission.

Rapidan Energy Group said the decision was likely to delay progress at Rio Grande LNG and “hinder efforts to reach” FID on Texas LNG.

In addition, the Biden administration’s pause of worldwide LNG export permits delayed authorizations for projects that could limit their potential customers or stall their development. Among the projects affected, New Fortress Energy Inc.’s Fast LNG facility offshore Altamira in Mexico was set to ship its first LNG cargo by mid-August.

West Texas Plunge

Physical spot markets moved lower on Friday for Saturday-to-Monday delivery as gains in the eastern half of the country were drowned out by West Texas hubs tumbling further below zero.

Waha slumped $3.195 day/day to average at a negative $4.305. That’s the lowest price since negative $4.595 in early May.

Permian supply, which is partly immune to lower prices because of its associated gas production, is waiting on the 2.5 Bcf/d Matterhorn Express Pipeline to come online this fall to ease pipeline constraints out of the basin.

That weakness did not extend to other areas of Texas. Katy added 7.0 cents to $1.840.

Also trending lower on Friday were hubs in California. SoCal Citygate fell 13.5 cents to $1.935.

Meanwhile, gains dotted the rest of the country. Chicago Citygate gained 8.0 cents to $1.775. Texas Eastern M-2, 30 Receipt in Appalachia rose 8.0 cents to $1.355.

National Weather Service (NWS) data showed mild weather across northern markets extending into early next week. Former Hurricane Debby, meanwhile, was forecast to quicken its pace up the East Coast, with its drenching, cooling rains passing through the Northeast by Sunday.

Northeast pricing mostly moved higher despite the cooler conditions. Algonquin Citygate near Boston rose 5.0 cents to $1.525.

More summer heat is in store after this round of cooler conditions. Rystad Energy analyst Christoph Halser noted that NWS forecasts for the second half of August advertised a return to above average temperatures across the Lower 48. The outlook “paints a bright picture for gas demand,” he said.

Downside demand risks remain from the ongoing hurricane season that runs through the end of November, Halser said. He cited the 85% probability for above-normal hurricane activity this season estimated by the National Oceanic and Atmospheric Administration’s Climate Prediction Center.