The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 21 Bcf natural gas into storage for the week ended Aug. 2. The result, slightly below expectations, came despite a jump in renewable power that threatened a bearish miss.

The September Nymex contract was down 6.6 cents at $2.046/MMBtu ahead of the 10:30 a.m. ET government report. Shortly after the print, the prompt month moved higher by around 2.0 cents. By 11 a.m. ET, futures had pushed even higher, with the contract down 1.4 cents day/day at $2.098.

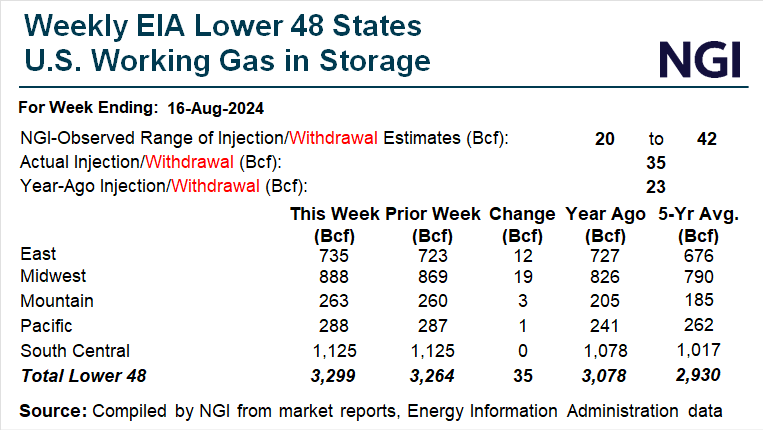

Prior to the report, estimates submitted to Reuters ranged from an injection of 16 Bcf to 35 Bcf, with a median of 26 Bcf. NGI modeled a 30 Bcf increase. The EIA report compared with an injection of 25 Bcf a year earlier and a five-year average build of 38 Bcf for the week.

The EIA report period saw hotter temperatures week/week, but some of that was countered by wind generation jumping 300% and solar strengthening slightly over the same period, NatGasWeather meteorologist Rhett Milne said on the online energy platform Enelyst. Ahead of the print, Milne said the jump in renewable output would be one reason for a bearish miss.

“The surprise to me is this is to the tight side again despite the large swing in renewables,” Wood Mackenzie analyst Eric McGuire said on Enelyst after the print.

The latest increase lifted inventories to 3,270 Bcf, putting stocks 248 Bcf above the year-earlier level and 424 Bcf over the five-year average.

The Midwest and East led with injections of 12 Bcf and 8 Bcf, respectively, according to EIA. Pacific inventories rose by 3 Bcf, while Mountain region stocks added 4 Bcf.

South Central gas stocks declined by 5 Bcf, including a 7 Bcf draw from salts and a rounded change of 0 Bcf from nonsalt facilities. Totals may not equal the sum because of independent rounding, EIA said.

Market participants noted the stronger pull from salts week/week. CLWS meteorologist Corey Lefkof noted that while overall wind output was higher in the country, it was low in Texas and the Southwest Power Pool in the week.

Some market participants also pointed to the lower build in the East, down from a 14 Bcf addition in the previous week, as the main driver of the bullish miss. The slower build could indicate production has pulled back in the East even though the trend was not picked up by pipeline nomination-based estimates.

Looking ahead to the next EIA print for the week ended Aug. 9, preliminary estimates submitted to Reuters ranged from injections of 8 Bcf to 30 Bcf, with an average increase of 19 Bcf.