Natural gas futures pushed higher Thursday after the U.S. Energy Information Administration (EIA) reported a rare summer withdrawal of 6 Bcf from storage for the week ended Aug. 9.

The September Nymex contract was up 3.4 cents at $2.253/MMBtu ahead of the 10:30 a.m. ET government report. As the data hit screens, the prompt month jumped as high as $2.301. By 11 a.m. ET, the September contract was trading up 6.1 cents at $2.280.

The print was the first weekly withdrawal for August, according to EIA records going back to 2010.

Ahead of the print, estimates submitted to Reuters ranged from a withdrawal of 6 Bcf to an injection of 26 Bcf, with a median build of 4 Bcf. Bloomberg submissions ranged from a 4 Bcf draw to a 12 Bcf build, with a median addition of 1 Bcf. NGI modeled a 1 Bcf build.

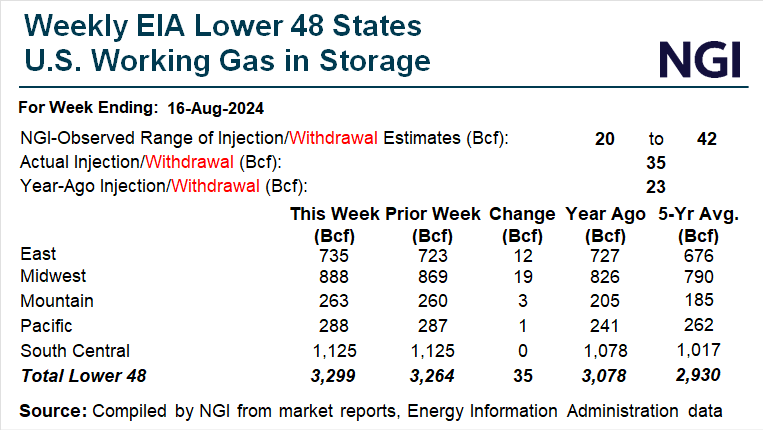

The EIA print compared with injections of 33 Bcf a year earlier and 43 Bcf on average in the previous five years. It lowered inventories to 3,264 Bcf, dropping the surplus to 375 Bcf, or 13% above the five-year average.

For the report period, temperatures were hotter than normal over most of the Lower 48, with cooler exceptions in the Midwest and Plains, according to NatGasWeather. Wind generation was also lighter week/week, much of that due to much less wind in Texas, the forecaster said.

Futures moved higher in six of the previous seven sessions, and analysts said a third straight bullish miss was a recipe for more upward momentum. “A rare midsummer draw could catapult Nymex gas over technical resistance near $2.27 into the mid-$2.30s,” according to EBW Analytics Group’s Eli Rubin, senior analyst.

August injections were on pace to be the smallest since at least 2000, with the next five weekly reports potentially reaching 150 Bcf, or 4.3 Bcf/d tighter than the five-year average, Rubin said. “If gas prices rise and speculators are forced to cover short positions, a rally and higher Nymex pricing could be ignited—despite seasonal fundamentals indicating oversupply,” he added.

By region, the Midwest and East increased stocks by 15 Bcf and 4 Bcf, respectively, according to EIA. Mountain region stocks added 3 Bcf.

A 27 Bcf decrease in gas stocks in the South Central region shifted the overall trend negative. That tally included draws of 14 Bcf from salts and 12 Bcf from nonsalt facilities. Pacific inventories also fell, down 2 Bcf.

The next two weekly storage prints could be “near to just slightly smaller than normal,” as demand is expected to be reined in by comfortable temperatures across northern and eastern states this week and next, according to NatGasWeather.

However, with hot weather still intact across the Southwest and Texas, some preliminary numbers leave open the door for a repeat of this week’s draw. Preliminary estimates submitted to Reuters for the next EIA report covering the week ended Aug. 16 ranged from a withdrawal of 3 Bcf to an injection of 52 Bcf, with an average increase of 33 Bcf.