Natural gas futures rallied five out of six sessions leading into Wednesday in large part because of expectations for a paltry storage print this week.

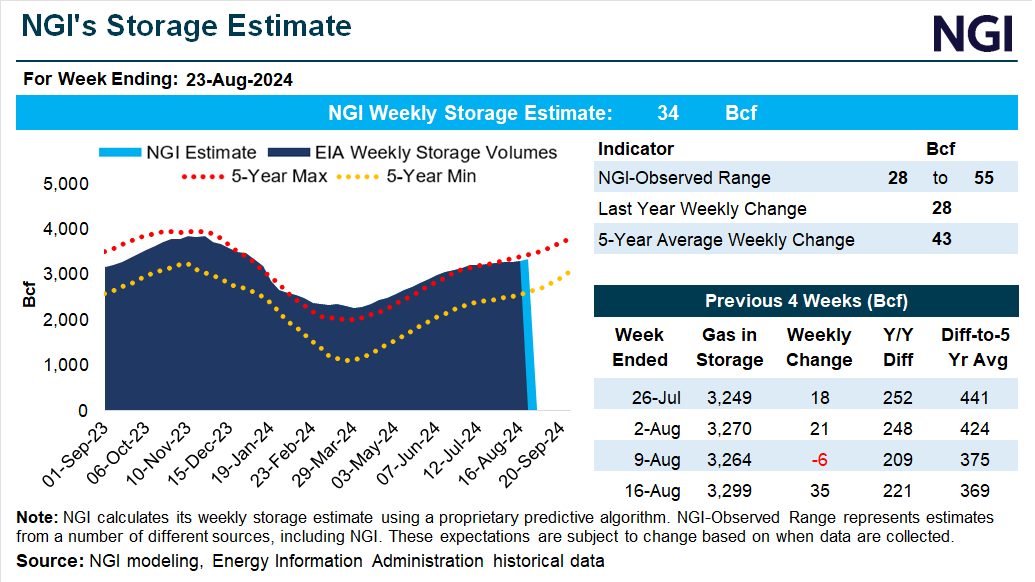

NGI modeled a meager 1 Bcf injection for the week ended Aug. 9. If realized, it would fall 42 Bcf below the five-year average. Initial Reuters’ polling found some analysts projecting a draw, with a pull of 8 Bcf at the low end. Bloomberg’s survey as of early Wednesday landed at a median 1 Bcf increase, with estimates ranging as low as a 3 Bcf pull.

“Almost all of the net change can be attributed to increased power demand in the South Central region,” said NGI’s Pat Rau, Senior Vice President of Research & Analysis.

The September Nymex natural gas futures contract, which dipped below $2.00/MMBtu before the recent rally, was trending upward again Wednesday morning and hovering above $2.200. NGI’s Spot Gas National Avg. has trailed prompt month futures, but it advanced several cents early this week and clocked in at $1.670 on Tuesday.

Heat has scorched portions of Texas and neighboring states – as well as Mexico – while wind generation proved erratic. Gulf Coast LNG demand also climbed in late July. This resulted in increased natural gas demand across July and into early August as well as four consecutive South Central storage withdrawals ahead of this Thursday’s Energy Information Administration (EIA) inventory report. That, Rau noted, is a rare streak for the heart of summer. No other region posted multiple draws, and storage overall grew consistently in that period.

An overall Lower 48 August withdrawal is unheard of in recent memory.

In government records going back to 2010, “there has never been a weekly Lower 48 storage withdrawal in August,” Rau said. “The lowest weekly August injection was 11 Bcf back in 2016. So from a historical standpoint, it is significant, and is certainly welcomed by the bulls, considering storage is currently 242 Bcf higher than last year and 424 Bcf versus the previous five-year average.”

Rau also said reduced Canadian imports accounted for roughly 3 Bcf of the lower expected storage build, and net U.S. production slipped as well, led by a 3.6 Bcf drop in East region output. Indeed, the East could be the wildcard this week following power outages and drenching rains imposed by the former Hurricane Debby last week.

[Forward Look: Quickly understand where the price of natural gas is headed with these graphic day-on-day comparisons of NGI's forward curves at 70 locations. View Now.]

Rau estimated total gas consumption in the East was down roughly 2 Bcf/d week/week.

As of Aug. 2, natural gas stockpiles totaled 3,270 Bcf, or 15% above the five-year average. Expectations for that surplus to narrow have fueled price rallies in early August.

“A withdrawal in August would certainly cut into those deficits somewhat, but it's going to take a lot more than one withdrawal in August to make much of a dent in the total storage picture,” Rau said. He noted that production continues to hold consistently above 100 Bcf/d and is strong by historical standards.

Jacob Thompson, managing director at Samco Capital Markets, echoed that thinking. Still, he noted that the National Hurricane Center (NHC) predicted a highly active storm season this year. NHC projected an above-average number of hurricanes and targeted August to October as the heart of the season. This could cause further demand destruction in the form of power outages, cooler air or interruptions to liquefied natural gas terminals. Freeport LNG was knocked offline by Hurricane Beryl in early July, trimming demand by about 2 Bcf/d.

“Anytime you have a hurricane, all kinds of possibilities get thrown on the table,” Thompson, who is based in Texas, told NGI. That said, he added, “forecasts here show triple-digit temperatures for the foreseeable future, and while that’s par for the course in August, it’s still pretty darn hot.”