Natural gas futures reversed early steeper losses but held the downside following the latest storage data, which outlined a largely expected injection for the week ended Aug. 23.

In its debut as the lead contract, October Nymex natural gas futures were down 4.0 cents to $2.057/MMBtu ahead of the 10:30 a.m. ET government report. The freshly anointed prompt month contract pared losses as the data hit the screen to $2.077. By 11 a.m. ET it was trading down 1.5 cents at $2.082.

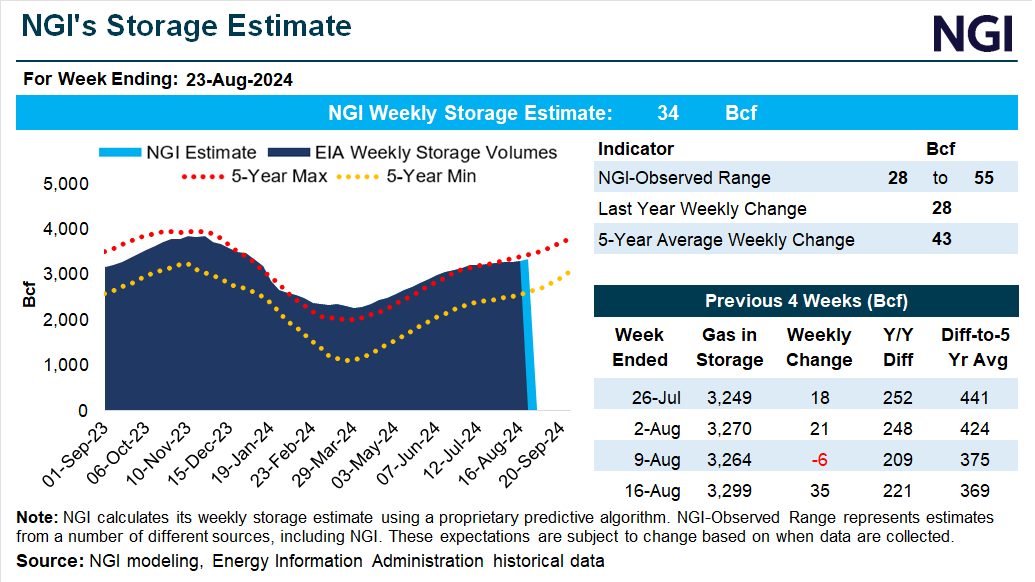

The U.S. Energy Information Administration (EIA) data showed a 35 Bcf build to storage facilities across the Lower 48. The injection was within the wide range of estimates ahead of the print.