September Natural Gas Futures Stumble into Final Session

The September Nymex gas futures contract on Wednesday limped along early on its last day at the front of the curve. It was down 1.1 cents to $1.893/MMBtu as of 8:40 a.m. ET.

The September Nymex gas futures contract on Wednesday limped along early on its last day at the front of the curve. It was down 1.1 cents to $1.893/MMBtu as of 8:40 a.m. ET.

Pressured ahead of Wednesday’s expiration, September Nymex natural gas futures slid another 5.2 cents Tuesday in low volume trade.

With the prompt month contract on the doorstep of expiration and fundamentals providing little support, natural gas futures fell early Tuesday.

Natural gas futures on Monday picked up where they left off last week – slumping amid hefty supply levels and signs of fading demand.

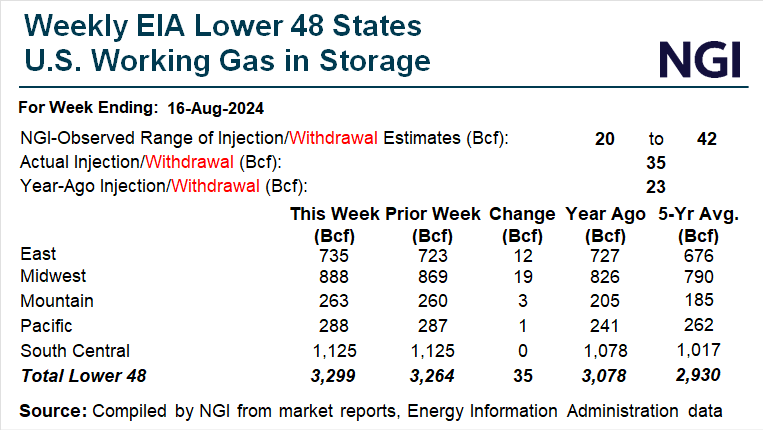

Natural gas futures slipped again Friday as the market digested a bearish storage print, looming fall weather and mounting expectations for hurricane activity that could dampen demand.

September Nymex natural gas futures were pummeled Thursday as the latest storage report outlined a relatively large build that, combined with shoulder season demand expectations, stoked end-of-season supply concerns.

Natural gas futures traded in a narrow band early Wednesday as traders contemplated favorable late-summer fundamentals alongside the specter of fall weather and the inevitable swoon in cooling demand that it delivers.

September Nymex natural gas futures’ early attempt to extend a rally into Tuesday’s session failed amid expectations for demand weakness as weather outlooks pointed to increasingly mild conditions across major natural gas-consuming regions.

Employment in Texas’ upstream oil and gas industry rose by 1,600 jobs in July versus June, according to the Texas Independent Producers and Royalty Owners Association (TIPRO).

Natural gas futures traded up a few cents early Tuesday as market participants digested an uneven weather demand forecast, a dip in production and ongoing progress toward addressing a supply overhang.