Pressured ahead of Wednesday’s expiration, September Nymex natural gas futures slid another 5.2 cents Tuesday in low volume trade.

At a Glance:

- Natural gas futures down 5.2 cents

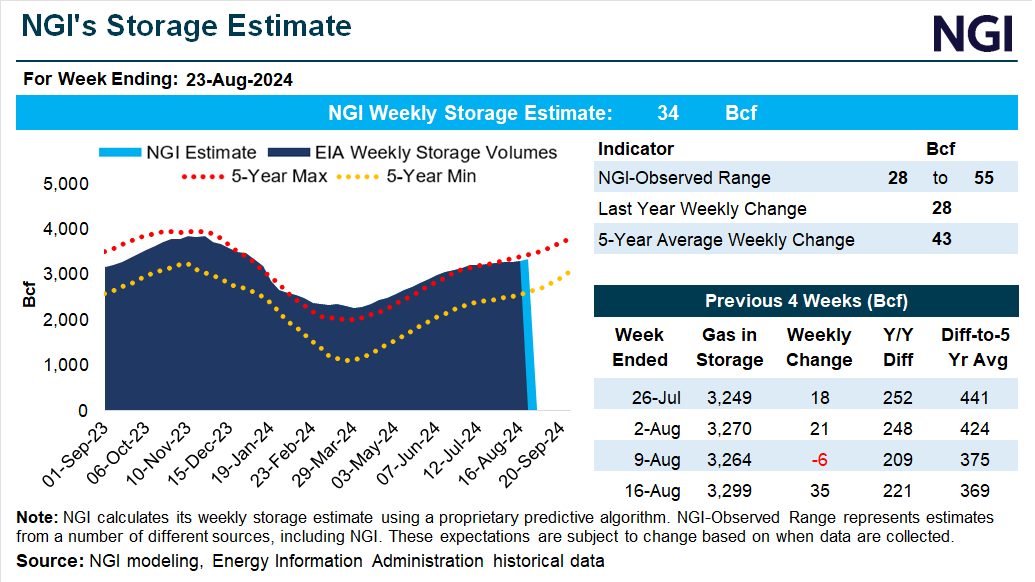

- Below average storage build expected

- Cooler temperatures ahead