For the fourth consecutive week, underground supplies of natural gas in storage in the South Central dwindled, bucking seasonal norms as every other region injected excess fuel into underground stocks.

Utilities in the region pulled 5 Bcf of gas from storage during the week ended Aug. 2, driven by a decrease in salt facilities, the U.S. Energy Information Administration (EIA) reported Thursday. It followed a 10 Bcf pull the prior week. Both draws played outsized roles in consecutive overall lean storage prints relative to expectations and historical averages.

The latest result “sparked some bullish momentum,” analysts at Gelber & Associates noted, with front month Nymex natural futures rallying several cents after the report crossed the wires. It ultimately settled at $2.127/MMBtu for the day, up 1.5 cents.

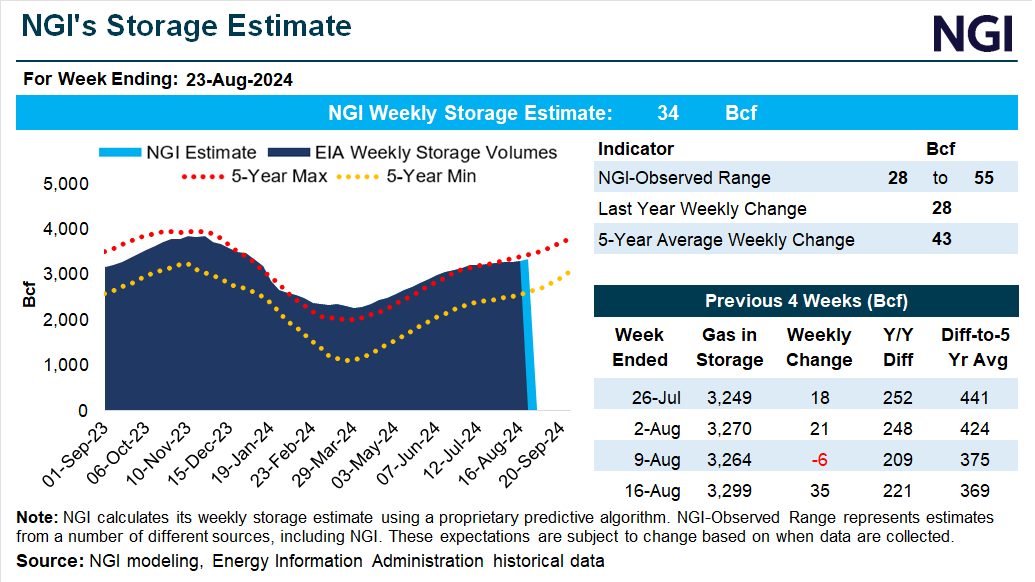

EIA reported a national increase in storage of 21 Bcf for the Aug. 2 period. It was lower than survey expectations for a build in the upper 20s Bcf to lower 30s Bcf. NGI modeled a 30 Bcf build. The actual injection also was far below the 38 Bcf five-year average increase.

Analysts said a confluence of factors are at play this summer in the South Central. Wind power in Texas, the heart of the region, has been erratic. This has motivated utilities to turn more to gas to meet consistently strong cooling demand across the Lone Star State during a hotter-than-average summer.

It is “not a significant surprise considering that the region has had some of the hottest temps during the injection season and will continue to see above and much above normal temps” through August if forecasts prove accurate, Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI.

Robust cooling demand in Mexico – and calls for U.S. natural gas pipeline imports – are also important. U.S. exports to Mexico hovered close to 7 Bcf/d in late July and early this month, according to Wood Mackenzie, up about 1 Bcf/d from year-earlier levels.

“Withdrawals during this time of the summer are getting more common in the South Central, especially in salt storage fields which have more flexibility in switching between injecting and withdrawing,” said NGI’s Dan Spangler, director of Analytics.

What’s more, a spate of maintenance work in the Permian Basin on multiple occasions this summer backed up supplies and likely contributed at points to withdrawal decisions. Spangler noted that flow from the Permian to East Texas is difficult to gauge because much of it travels on intrastate pipelines that are not required to report daily data. Still, the likelihood of “less gas coming from the Permian would mean that the South Central would need to pull more from other regions or tap into storage.”

What’s more, because of stranded supply in the Permian, West Texas cash prices have proven to be the softest in the country this summer. Permian benchmark Waha weekly prices averaged negative 48.0 cents for the Aug. 2 period. Waha weakness contributed to low prices overall, despite the heat. NGI’s Weekly Spot Gas National Avg. for the same period clocked in at $1.760, down from early summer highs above $2.00.

[Lower 48 Natural Gas Market Fundamentals: Join NGI's team of senior markets reporters to understand the supply and demand environment impacting natural gas prices, and where they may be heading into winter and beyond. Tune in to NGI’s Hub & Flow now.]

Beleaguered prices make gas more appealing than other sources of energy, adding to demand in Texas and adding motivation to withdraw from storage.

Winter Fallout

Additionally, storage levels were plump coming out of winter and utilities did not want to risk broaching overflow this summer.

Benign weather, anemic heating needs and strong wind generation in Texas last winter resulted in robust storage. South Central storage was 40% above the five-year average in early March. That surplus has come down substantially since, but it remained at 13% at the start of August.

The region’s storage levels “are near the five-year max for this time of year,” Spangler said.

The same remains the case at the national level. EIA’s total 21 Bcf injection for the Aug. 2 period lifted stockpiles to 3,270 Bcf, well above the five-year average of 2,846 Bcf.

It narrowed a long-running surplus to the five-year norm by a percentage point to 15%. But Blair said much more progress is needed before summer ends to support a sustained price rally.

Even though the overhang was reduced, “it is still not really enough of a reduction to make that much of a difference,” Blair said.

“I think that we need to see above and much above normal temps in basically the entire Lower 48” to bring the surplus into single digits and stave off bears, he added.