Natural gas futures on Thursday fell early but gained ground through midday trading as a bullish government assessment of supplies in storage overshadowed near-term weakness in weather demand. However, the prompt month then retreated to near even in early afternoon trading. Spot prices slipped.

Here’s the latest:

- September Nymex gas contract down seven-tenths of a cent to $2.105/MMBtu at 2:20 p.m. ET

- U.S. Energy Information Administration (EIA) posts 21 Bcf injection into underground supply

The inventory report for the week ended Aug. 2 narrowed a long-running surplus to the five-year average by a percentage point to 15%. It fueled Thursday’s burst of momentum.

The result was lower than the survey expectations for a build in the upper 20s Bcf to lower 30s Bcf. NGI modeled a 30 Bcf build. The actual injection also fell shy of a 38 Bcf five-year average increase.

Another bullish print may follow, despite the one-two punch this week of mild northern temperatures and demand destruction caused by former Hurricane Debby, which made landfall Monday in Florida as a Category 1 storm. It caused widespread power outages and has tracked along the East Coast this week, causing flooding and ushering in cooler air.

Early storage estimates submitted to Reuters for the week ending Aug. 9 ranged from a withdrawal of 8 Bcf to an injection of 30 bcf, with an average increase of 19 Bcf. The estimates compare with an increase of 33 Bcf a year earlier and a five-year average build of 43 Bcf.

Another meager injection may be needed to further galvanize bulls. “The gas market is still seasonally oversupplied,” said EBW Analytics Group analyst Eli Rubin.

- LNG export terminals scheduled to receive more than 12 Bcf of feed gas Thursday, in line with prior days this week, per NGI data

- Production estimated at 100.6 Bcf/d Thursday, down from recent highs near 103 Bcf/d

Liquefied natural gas demand held steady this week, despite the harsh weather caused by Debby. Key export terminals in Georgia and Maryland lied in its path.

Wood Mackenzie on Thursday noted production was lower because of maintenance events across several regions impacting flows. It was down notably from the 30-day average and year-earlier level – both above 102 Bcf/d. However, the firm projected that output would return to the 102 Bcf/d level in the coming week as repair and inspection projects culminate.

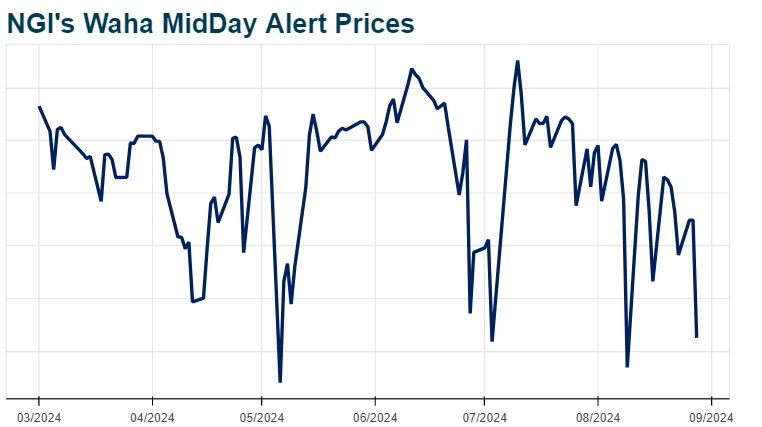

- Cash prices at Henry Hub averaging $1.870, down 11.5 cents, NGI’s MidDay Price Alert shows

- Cove Point in Maryland sheds 20.0 cents to average $1.500

NatGasWeather said the seasonally mild weather that settled across northern markets this week would extend into mid-August. Yet extensive heat is likely to return later this month.

Beginning around Aug. 15, “very warm to hot upper high pressure will rule most of the U.S. with highs of mid-80s to 100s,” driving strong cooling demand and laying a foundation for meager storage prints later this month.

On the pipeline front, Wood Mackenzie noted that Transcontinental Gas Pipe Line Co. LLC plans maintenance work on Friday and again on gas days Aug. 13, 15, 20 and 24. The work is slated to commence as Debby lingers as a tropical storm. The project will impact southbound flows at Station 190 in Maryland. It could cut 702,315 MMBtu/d from Thursday’s nominations of 2,452,315 MMBtu/d, Wood Mackenzie said.