The rally continued for natural gas futures through midday Thursday as a leaner-than-expected weekly inventory injection kept bulls on the offensive.

Here’s the latest:

- June Nymex futures up 6.6 cents to $2.482/MMBtu at around 2:20 p.m. ET

- U.S. Energy Information Administration’s (EIA) reported storage injection misses bullish at 70 Bcf

- Lower 48 surplus to five-year average trimmed to 620 Bcf, versus 640 Bcf a week-earlier

The EIA report “was lower than many market participants expected, causing an impulse move higher upon the report’s release, tagging the front-month June contract’s yearly open of $2.56 before reverting back down,” Gelber & Associates analysts said Thursday.

The latest EIA print came in tighter than surveys for a second straight week, Wood Mackenzie analyst Eric McGuire noted.

For the two weeks in question, “weather-normal balances have flipped to much tighter than what we have seen up to this point in the season,” McGuire said.

When compared to degree days and normal seasonality, the latest EIA report implied the market was 3.6 Bcf/d tight versus the prior five-year average, slightly looser versus the week-earlier period, according to the analyst.

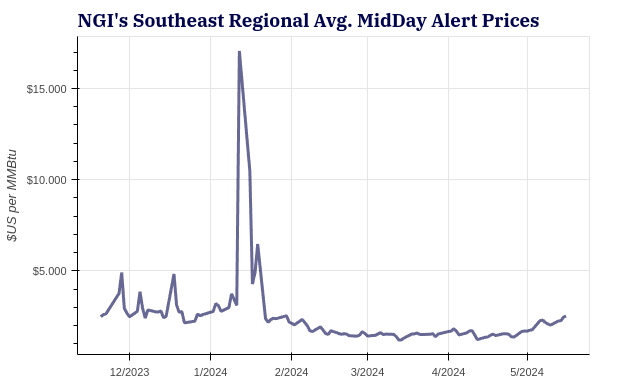

- Cash climbing across Gulf Coast and Southeast

- Henry Hub spot prices averaging $2.340, up 19.5 cents, according to NGI’s MidDay Price Alert

“Rain will spread across the Southern Plains and Gulf states as a hot, moist airmass settles in across the South,” the National Weather Service said Thursday. The forecaster warned of a “stint of unusually hot temperatures for South Florida and Texas, with heat indices rising above 100 degrees.”

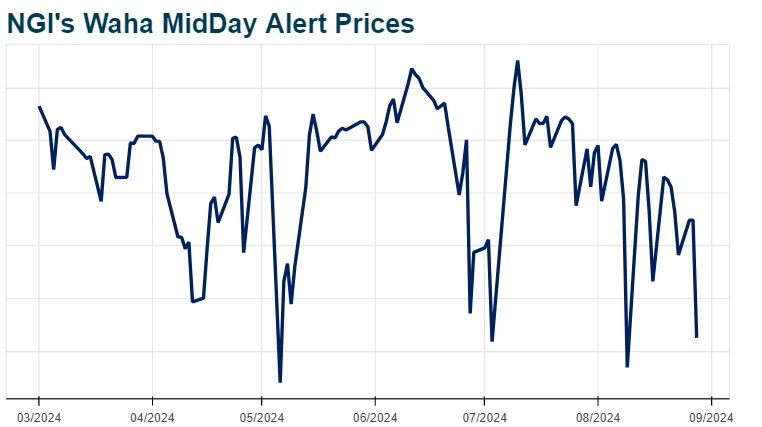

- Waha spot prices down 32.5 cents but averaging above zero

The conclusion of recent maintenance on the El Paso Natural Gas (EPNG) and Natural Gas Pipeline Co. of America (NGPL) systems has helped support incremental strengthening in Waha spot prices, Wood Mackenzie analyst Kara Ozgen said.

This past weekend, EPNG concluded work that had been restricting around 414,000 MMBtu/d of westbound flows, while NGPL concluded maintenance on Monday that was shutting in around 380,000 MMBtu/d, according to Ozgen.

“Additionally, we’re now on the tail end of Permian Highway Pipeline’s (PHP) maintenance,” the analyst said. “PHP should return to full capacity tomorrow if everything goes to plan, and Gulf Coast Express is not too far behind.”