Weekly natural gas cash prices dropped in the final week of June – after rallying through the first three weeks of the month – despite exceptional early summer heat and forecasts for more to come.

NGI’s Weekly Spot Gas National Avg. for the June 24-27 period fell 7.0 cents to $2.040/MMBtu.

Near-record temperatures spanned much of the western and southern expanses of the country during the covered period, bolstering cooling demand, natural gas consumption and calls for fuel in the physical markets.

But production climbed through June, lifting supplies to lofty levels and keeping prices in check. As the trading week closed, Transco Zone 5 in the Southeast was down 36.0 cents to $3.085, while PNGTS in New England was off $1.095 to $2.590, and Dawn in the Midwest was 4.5 cents lower to $2.105.

What’s more, prices plummeted into negative territory in West Texas during the week, dragging on the national average. As has occurred multiple times this year, pipeline maintenance events backed up supply in the Permian Basin. Waha dropped $1.800 to negative $1.215.

The July Nymex futures contract, meanwhile, fluctuated during its final days, but ultimately finished on a low note due to ongoing concerns that, even with strong demand, the market still has too much supply in storage. It settled at $2.628 on Wednesday, down 3% from the prior week’s close, before rolling off the books.

The August contract moved to the front of the curve on Thursday and fell 6.0 cents. On Friday, it settled at 2.601, down another 8.4 cents.

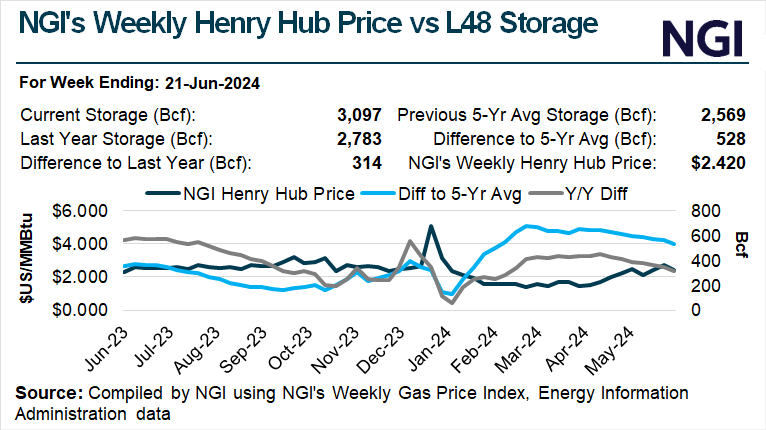

Production during the week hovered above 100 Bcf/d, up substantially from the spring lows in the mid-90s Bcf/d, according to Wood Mackenzie data. With output at solid levels, a natural gas storage surplus relative to the five-year average, while narrowing, remained substantial deep into June. This kept supply/demand balance concerns simmering and emboldened bears roaming in the futures market.

“Immediate-term volatility risks remain elevated,” EBW Analytics Group analyst Eli Rubin said.

Still, National Weather Service forecasters anticipated more heat waves and robust cooling demand in the month ahead, with searing temperatures engulfing even far northern markets. This could bolster the August contract in coming sessions, Rubin said.

“As the severity of the scorching forecast rolls forward and August finds technical support, natural gas price upside may emerge” amid “a historically hot July,” he said.

Andy Huenefeld, managing partner at Pinebrook Energy Advisors, agreed. “That kind of heat sets up a supportive backdrop for the market,” he told NGI.

Storage Scenario

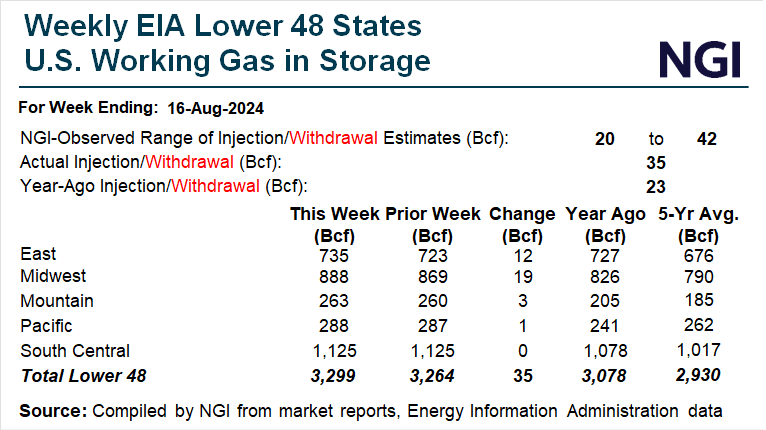

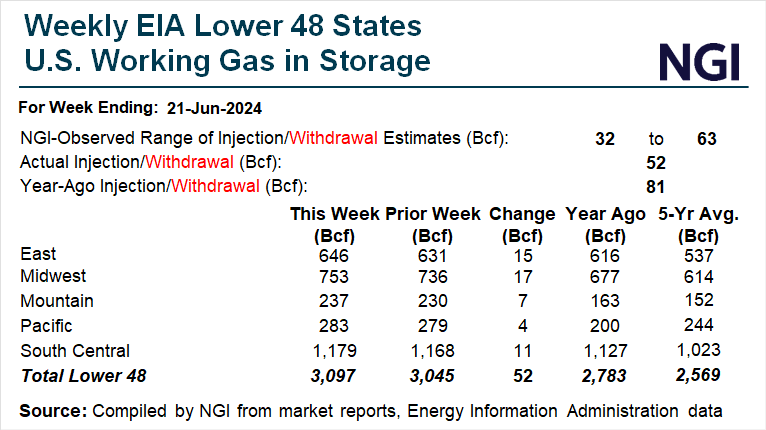

The latest U.S. Energy Information Administration (EIA) storage print – an injection of 52 Bcf for the week ended June 21 – essentially met expectations and had little impact on trading after its release Thursday.

Prior to the report, NGI modeled a 54 Bcf increase. The median of Reuters’ poll landed at 50 Bcf, while Bloomberg’s survey generated a median estimate of 54 Bcf.

“While weather remains hot, upside in the market remains limited this summer due to the current storage overhang,” analysts at Gelber & Associates said.

However, the result was well below the five-year average build of 85 Bcf. While the increase for the latest week lifted inventories to 3,097 Bcf and kept stocks above the five-year average of 2,569 Bcf, that surplus narrowed.

The surfeit to the five-year average declined by two percentage points to 21%, continuing a trend that spanned most of the spring season. The surplus had exceeded 40% in March.

While storage levels remain high, the trend is favorable and could support prices more notably if it extends through July, Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI.

“They are likely to narrow on a weekly basis as long as” forecasts for intense heat waves through much of July prove accurate and drive further “robust cooling demand,” Blair said.

For the latest EIA print, the Midwest and East regions led with injections of 17 Bcf and 15 Bcf, respectively. The South Central build of 11 Bcf followed. Mountain region stocks increased by 7 Bcf, while Pacific inventories rose by 4 Bcf.

Analysts looked for another anemic print for the final week of June. Early injection estimates submitted to Reuters averaged 41 Bcf. That compares with a five-year average increase of 69 Bcf.

Friday Cash Prices

Cash prices varied by region on Friday but gains in the West, where temperatures were expected to rise next week, supported the national average. NGI’s Spot Gas National Avg. was flat on the day at $1.755, leveling off after a slump earlier in the week.

Gas traded Friday was for delivery Monday.

SoCal Citygate jumped 37.5 cents day/day to average $2.425, and SoCal Border Avg. advanced 26.0 cents to $2.195.

KRGT Del Pool in the Southwest spiked 34.5 cents to $2.290, while Northwest Sumas rose 33.5 cents to $1.550.

Limited supply flowing out of the Permian to the West impacted pricing, according to observers on the online energy platform Enelyst.

NatGasWeather said that, for the week ahead, “strong high pressure will rule most of the southern two-thirds of the U.S. with hot highs of upper 80s to 100s, including highs of 90s well up the East Coast” at points. “The northern third of the U.S. will be nice to warm with highs of 70s and 80s as weather systems track through with showers.”

For the second week of July, the firm said even hotter conditions are in store, with highs of 80s to lower 90s over the northern markets and continued upper 80s to 100s over the southern United States. The most scorching temperatures are likely to stretch from the California deserts through the Southwest and Texas, the forecaster added.

NatGasWeather also said there was minimal near-term activity expected in the tropics. It noted on Friday a “weak tropical system currently tracking towards the southern Gulf of Mexico” that was “not expected to strengthen into anything formidable.

“However, a second system in the eastern Atlantic Basin has better chances of strengthening as it tracks toward the Caribbean Sea in the days ahead,” the firm added. “This second system will need monitoring as it has some potential to impact” the Lower 48.

Meanwhile, West Texas prices remained under pressure on Friday. Maintenance work and pipeline limitations in the Permian curtailed producers’ ability to unload excess gas, forcing them to pay to have it taken away and stored. This again resulted in negative prices on Friday, though hubs in the region recovered some ground.

Permian benchmark Waha gained $1.130 on Friday but still averaged negative $2.110.

Most of what is produced in the Permian is associated gas – fuel developed alongside oil. Crude production in the prolific basin is near record levels as U.S. companies remain highly active to meet strong global demand and favorable prices. This is why gas output in the region remains elevated even with limited takeaway capacity.

Hargreaves Lansdown’s Sophie Lund-Yates, lead equity analyst, noted Friday that Brent crude prices during the past week topped $85/bbl. “The trajectory in the very near future is more likely to be an upwards trend in the price,” she said, motivating producers to continue cranking out oil and gas.