Weekly natural gas cash prices moved higher as hot weather in the West gave the country its first decent bout of the summer-like cooling demand. Futures, anticipating more sweltering heat in the weeks ahead, leapt higher.

NGI’s Weekly Spot Gas National Avg. for the June 3-7 trading period gained 16.5 cents to $1.715/MMBtu.

Gains were widespread across regions, led by price increases in the Rockies, California and South Central region.

Among the top weekly gainers, Northwest Sumas in the Rockies rose 37.0 cents week/week to average $1.350. In South Louisiana, benchmark Henry Hub added 30.0 cents to $2.430.

Disruptions to gas supply in Louisiana added volatility to Henry Hub daily cash prices, which notched one of their biggest daily gains of the year on Monday (June 3). TC Energy Corp.’s ANR Pipeline Co. announced a pair of force majeure outages that pinched southbound flows to key markets in Louisiana.

Among the handful of laggards, Westcoast Station 2 in Canada fell C60.0 cents to C27.0 cents/GJ after seeing some trades below zero at the start of the week. Columbia Gas in Appalachia fell 7.5 cents to $1.375.

In futures markets, July Nymex futures on Friday settled at $2.918, up 9.7 cents on the day and up 33.1 cents from the previous week’s close.

That strong weekly gain came after bulls and bears wrestled for control of market direction, sending the July contract up and down wildly through Wednesday. However, bulls were able to shake off a bearish government storage print Thursday and extend gains into Friday, aided by warmer forecasts for late June.

Wait For It

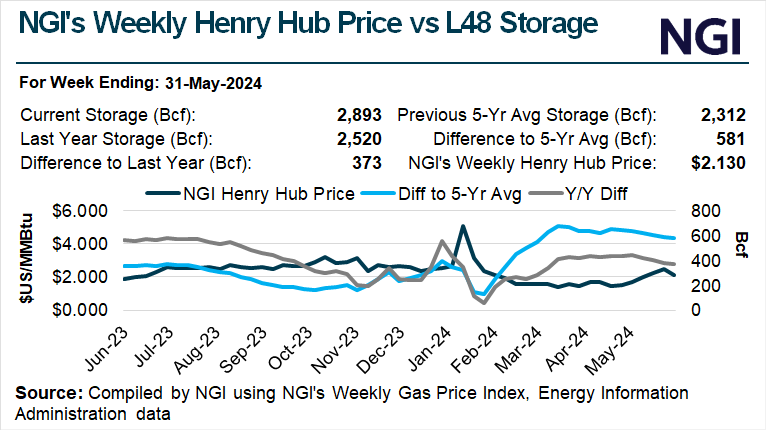

On Friday, trading just shy of the $3 level, the front month Nymex price series had gained 51% since May 1, when it last settled below the $2 level. The price gains have drawn some production to come back online, but those increases have not been enough to stop a tightening of projected market balances.

Late June forecasts trended hotter this week in both the European and American weather models, which now advertise enough demand to shave off more than 100 Bcf from natural gas storage surpluses by the end of June, NatGasWeather said.

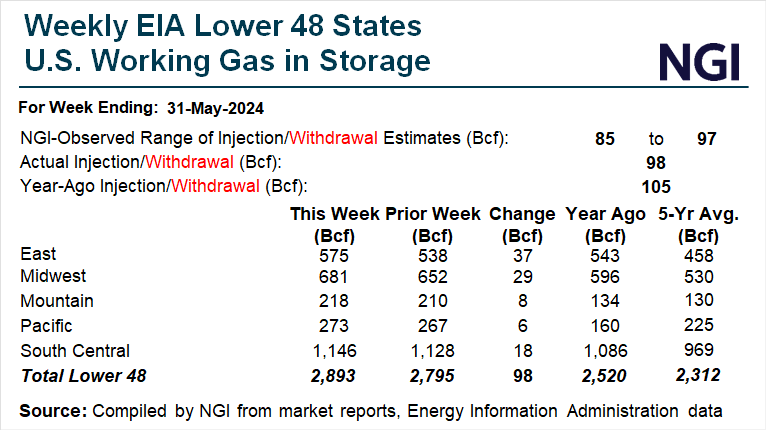

The Lower 48 surplus of gas in storage stood at 581 Bcf to the five-year average in the week ended May 31.

“We expect surpluses to be near 450 Bcf by late June, then with potential to be near or under 200 Bcf by mid or late Fall,” according to NatGasWeather. “This clearly would set up a much tighter balance compared to the end of this winter when surpluses were near 600 Bcf.

“We believe this is a big reason prices have gained overall the past six weeks as major players front run this expectation,” NatGasWeather said. “And when there’s any decent selloff, bulls buy the dips. Until this trading behavior changes, we give bulls the benefit of the doubt they have the edge.”

Weather forecasts for June showed the month “backloaded” with demand, putting it on pace to be “the hottest on record,” EBW Analytics Group analyst Eli Rubin said. National cooling demand could exceed 80 cooling degree days in both the second and third weeks of the month, he said.

But ahead of that spell of hot weather, temperatures were expected to moderate next week and “near-term downdrafts remain a distinct possibility first.” Still, the medium-term outlook “remains bright,” Rubin said.

A hot summer has been in the cards. The National Weather Service forecast a scorcher of a summer across large areas of the country.

However, a mild start to the season did not advertise that possibility in May. Enverus’s Rob Allerman, senior director of power analytics, said the firm’s summer demand forecasts planned for a summer starting out a bit on the cooler side, especially east of the Rockies.

But the weather would “then get quite a bit hotter as we get into later in the summer, especially July and August,” Allerman said. Renewables could also compete with gas for power loads in Texas early in the summer, with solar boosted by new capacity and wind by higher utilization, he said.

However, Enverus is forecasting higher renewable output in July in Texas, but by August, that output could turn lower. Allerman said. That trend, in addition to more coal retirements, could boost natural gas burns. “Toward the latter half of the summer, I think there can be some pretty decent gas burns,” he said.

Physical Prices

Spot natural gas prices fell across the country in Friday trading for weekend through Monday delivery, led lower by sharp declines in West Texas.

Permian Basin benchmark Waha slumped 45.0 cents day/day to average 34.0 cents. Declines elsewhere in Texas were more shallow. Katy in East Texas declined 12.0 cents to $1.930. Tennessee Zone 0 South in South Texas moved lower by 20.0 cents to $1.710.

Triple-digit heat was expected to ease in California and large portions of Arizona and Texas by Sunday, the National Weather Service said. However, excessive heat warnings and advisories would remain in many portions of the states, the forecaster said.

In California, PG&E Citygate fell 14.0 cents to $1.825. The hub can be priced among the highest in North America. But the hub and others in California saw no huge price spikes during this week’s heat wave, and market participants credit stout gas supply and added renewable power capacity as moderating influences.

Through the middle of next week, overall national demand for power was expected to be moderate “as a hot upper high ridge shifts over the western half of the United States with highs of 80s to 100s,” NatGasWeather said. Conditions would be hottest from California to South Texas, it said. Meanwhile, cooler weather systems were expected to track across the eastern half of the country with highs in the mid-60s to 80s for below normal cooling demand, the firm said.

In the Northeast, cash prices fell by low double digits amid normal early June weather, similar to levels a year ago. Algonquin Citygate near Boston was down 20.0 cents to $1.195. In Appalachia, Texas Eastern M-2, 30 Receipt shed 19.0 cents to $1.075.

To the south, prices and demand are much higher. Transco Zone 5, which runs from Virginia to the Carolinas, rose 9.0 cents to $3.390. Likewise, Florida Gas Zone 3 rose 14.0 cents to $3.740.

To the south, prices and demand are much higher. Transco Zone 5, which runs from Virginia to the Carolinas, rose 9.0 cents to $3.390. Likewise, Florida Gas Zone 3 rose 14.0 cents to $3.740.