Natural gas prices pushed higher in key regions during the first day of June bidweek trading on Friday as production leveled off below 100 Bcf/d, storage surpluses narrowed and forecasts pointed to a hot start to summer.

NGI’s Bidweek Alert (BWA) showed strength from Texas to the Rockies – important production regions – to kick off a bidweek trading period that resumes May 28 and culminates May 29.

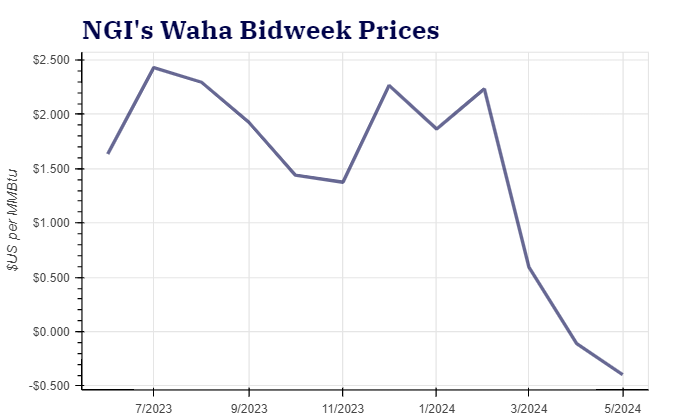

Looking at fixed prices, Waha in West Texas averaged 29.0 cents on day 1 of June Bidweek. This compared with an average of minus 39.5 cents for May bidweek. In the Rockies, CIG fixed prices averaged $1.355, up from $1.125 during the previous month.

The improvements developed after fundamentals shifted largely in bulls’ favor late in the shoulder season, including the culmination of pipeline maintenance work that had backed up Permian Basin supplies and suppressed West Texas prices much of the spring season.

On the production front, Wood Mackenzie’s estimate on Friday pegged the seven-day average at 98.5 Bcf/d. It forecasted that, over the week ahead, output would essentially hold flat at 98.6 Bcf/d. That marked a substantial pullback after output reached record highs last winter around 107 Bcf/d. Major producers slowed down activity during the spring to align supply/demand following a mild heating season.

NatGasWeather said trading Friday was influenced by expectations for “moderately” strong cooling demand in Texas and elsewhere in the South for the long Memorial Day weekend, though lighter commercial and industrial demand over holiday breaks tend to offset weather.

Looking ahead, the firm added, the outlook was favorable for bulls, with mostly mild weather anticipated for the week ahead but intensifying heat emerging in early June and becoming widespread by the second week of the month. “Highs of 90s gain in coverage to increase national” cooling degree days, the forecasters said.

Profit-taking sapped Nymex natural gas futures late in the past week, with the June contract losing ground Thursday and then shedding another 13.7 cents on Friday to settle at $2.520/MMBtu.

Traders “ignored” bullish fundamentals and “opted instead to lock in profits ahead of the long holiday weekend,” analysts at The Schork Report said.

They noted that the slump, however, followed an extensive May rally that saw futures advance about 40% from the start of the month through Wednesday.

“We remain cautious of a natural gas pullback after the May rally added more than $1.00,” EBW Analytics Group’s Eli Rubin, senior analyst, said Friday. “Still,” he added, “the 30-45 day outlook remains supportive – particularly if bullish weather tailwinds remain intact.”

The National Weather Service forecasted above-average temperatures across the vast majority of the Lower for June and summer overall.

Early summer-like heat arrived across the South in May. This, in concert with the lower production levels, curtailed inventory excesses and powered the May upswing.

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 78 Bcf natural gas into storage for the week ended May 17. The medians of major polls coalesced around the mid- to upper-80s Bcf. NGI modeled an 83 Bcf build.

The increase from the latest week brought inventories to 2,711 Bcf, according to EIA. Stocks remained well above the five-year average – 29% – but the surplus has narrowed notably. It was down from 35% at the end of April.

For the EIA storage report covering the week ended May 24, early injection estimates submitted to Reuters ranged from 80 Bcf to 86 Bcf. The estimates compare bullishly with a five-year average increase of 104 Bcf.

Tudor, Pickering, Holt & Co. analyst Justin Martin noted that, in addition to rising domestic demand and production leveling off at relatively light levels, Mexican calls for U.S. gas exports are on the rise as summer-like heat settles across that country. Martin modeled a 76 Bcf/d build for the next EIA print.

NatGasWeather also noted that Freeport LNG has ramped back up demand for feed gas after winding down maintenance projects, supporting liquefied natural gas export activity.

While futures “are down the past couple sessions, strong gains the past month have been driven by bullish EIA weekly storage report misses, Freeport LNG showing strong flows of 1.9 Bcf/d, much lighter year/year production that remains near 98 Bcf/d by most estimates, bouts of early season heat over Texas, and the expectation the combination of a hot summer and a tight balance will steadily decrease surpluses over time,” the firm said.

“To this point, the next three EIA reports are expected to print smaller versus normal builds to reduce surpluses towards 550 Bcf.”