European natural gas prices declined on Monday, ending a charge higher last week that left the Title Transfer Facility (TTF) to close at its highest level since December.

TTF finished near $13 on Friday after Ukrainian troops pushed into Russia, where fighting broke out near key gas infrastructure. The incursion continued Monday, but natural gas continued to flow into Ukraine via the Sudzha intake point at Russia’s western border, and on to Europe. The market also was still bracing for the possibility of a retaliatory strike by Iran against Israel for the assassination of senior Hamas and Hezbollah leaders.

For now, however, fundamentals have remained largely unchanged, and TTF fell 2% Monday. Norwegian exports were flowing near capacity to the continent and other supplies remained stable. Storage inventories were at 87.3% of capacity on Monday, compared to the five-year average of 77.2% for this time of year.

Easing temperatures in some parts of Asia, meanwhile, have limited spot buying activity there. Most tenders over the past week have covered the winter months or beyond.

Back over in Western Europe, hotter weather is expected to sweep across the region in coming days, but temperatures are forecast to ease over the next two weeks.

TTF and the Japan-Korea Marker (JKM) are trading in a narrower range than they have been in recent weeks, incentivizing more cargoes to move to Europe. European LNG imports fell to 6.11 million tons in July, or a 34-month low amid soft demand during a stretch in which more U.S. cargoes in particular have headed to Asia.

Competition for liquefied natural gas cargoes between both regions could again intensify as a “stagnant pattern” of above and much-above normal temperatures is forecast for the Korean peninsula and Japan over the next 15 days, according to Maxar’s Weather Desk.

In the United States, Henry Hub futures climbed on Monday as they did last week. The September contract moved higher on the heels of favorable weather forecasts, lighter supply and bullish bets by fund managers. It gained four cents to finish at $2.18/MMBtu.

“All U.S. regions are expected to reach above-average temperatures towards the end of the month,” said Rystad Energy analyst Christoph Halser.

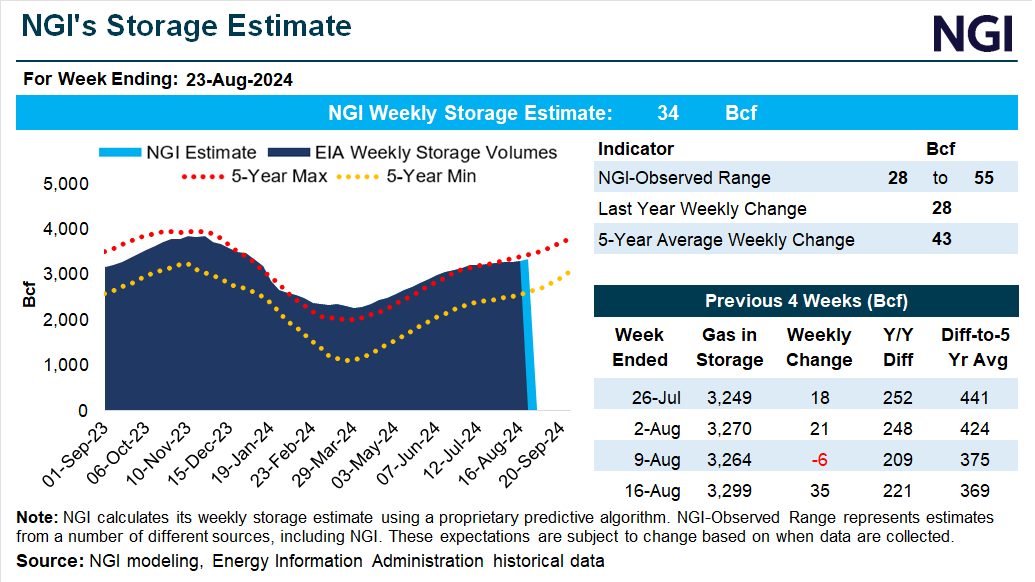

Wood Mackenzie on Monday estimated U.S. natural gas production at 100.9 Bcf/d, down from the 30-day average of 102.2 Bcf/d.

Meanwhile, feed gas demand at U.S. export terminals was stable as the week got underway at 12.3 Bcf, according to Wood Mackenzie. That’s in line with the seven-day average of 12.4 Bcf/d.

Elsewhere, another vessel docked over the weekend at the Arctic LNG 2 terminal in Russia’s Far North. According to Kpler, the Asya Energy tanker left the facility on Monday possibly carrying a cargo, even though it tried to hide its location from ship tracking to avoid Western sanctions against the facility.

It marked the second ship that has loaded at Arctic LNG 2 after concealing its location to avoid sanctions. The Pioneer vessel loaded the terminal’s first cargo earlier this month. It was offshore France on Monday, Kpler said. The ships are part of a shadow fleet used by Russia to navigate sanctions.

In other news last week, Abu Dhabi National Oil Co. (Adnoc) said it has signed a tentative deal to supply Osaka Gas Co. Ltd. with 0.8 million metric tons/year (mmty) of LNG annually from the Ruwais export project. Adnoc has signed deals covering 70% of capacity at Ruwais, which was sanctioned in June.

The company said it also was the first agreement signed with Osaka, as well as its first with a Japanese company since the 1990s. Adnoc has been working to expand its LNG operations.

In the United States, Argent LNG LLC said last week it met with the Federal Energy Regulatory Commission to move into the pre-filing phase for its Port Fourchon export project in Louisiana.

Argent said it now plans to file a formal application with federal regulators for the 25 mmty export terminal later this year. It is aiming to start operations at the end of 2029.

Earlier this year, Argent tapped Australia-based Worley to handle early design and engineering work for an LNG terminal at the Port of Fourchon southwest of New Orleans. The firm also disclosed it has signed a long-term lease for a 144-acre project site at the port.