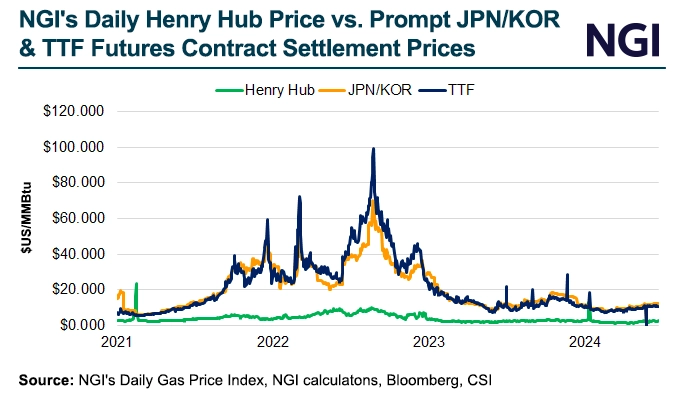

Cheniere Energy Inc. said it earned less for its LNG during the second quarter as lower global natural gas prices and smaller gains on its derivatives cut into margins.

Mild weather and stronger storage inventories helped push the Japan-Korea Marker 24% lower year-over-year in the second quarter to an average of $9.56/MMBtu. The Title Transfer Facility fell 16% over the same time to an average of $9.58, Cheniere said.

The company earned less even though it loaded 155 cargoes, or 552 TBtu of liquefied natural gas during the second quarter. That was up from 149 cargoes, or 534 TBtu in the year-ago period.

However, supply disruptions and stronger demand pull from Asia amid hotter summer weather as restocking efforts picked up have lifted prices, which have traded closer to $12 more recently.

[Want to visualize Chicago Citygate, Henry Hub, Houston Ship Channel or any of our 170+ spot natural gas price indexes? Check out NGI's daily natural gas price snapshots now.]

Cheniere is the largest U.S. LNG exporter. More American cargoes have been headed to Asia this summer to capture higher prices, which the company expects will continue to support long-term growth as more supplies come online this decade.

“Ahead of this supply cycle, we expect the market to continue to balance primarily on the demand side,” said Chief Commercial Officer Anatol Feygin during a call with financial analysts to discuss second quarter results. “The expectation of growing supply from 2026 onwards should alleviate the constraints on demand growth, especially as moderate prompt LNG and gas prices prevail.”

CEO Jack Fusco said the company also completed its “major maintenance programs” during the second quarter at its Sabine Pass and Corpus Christi LNG (CCL) export terminals. Expansion projects at both facilities remain on track too, he added.

The company expects to produce first LNG at its CCL expansion project in South Texas by the end of this year. The company also is planning to introduce natural gas to Train 1 in two months, management said.

Management said the company has energized the Train 1 liquefaction and utility substations and started regulatory filings in preparation for commissioning. The CCL Stage 3 expansion project would add seven trains and 10 million metric tons/year (mmty) of capacity to the existing 15 mmty facility.

The project was nearly 63% complete at the end of the second quarter, and 4,000 construction workers are currently on site, management said. All seven trains are expected to be online by 2026.

Plans for two more trains that would add another 3 mmty at the site received a positive environmental assessment from federal regulators in June. Cheniere expects to sanction the Midscale Trains 8 and 9 project next year.

The company also continues working toward a final investment decision on a major expansion project at the 30 mmty Sabine Pass facility in Louisiana that would add another 20 mmty.

Earlier this week, a federal appeals court vacated Federal Energy Regulatory Commission authorizations for the Rio Grande and Texas LNG terminals. The decision could create lengthy delays for those projects. It also signals what could be ahead for others as opposition groups have stepped up resistance to the Gulf Coast LNG buildout.

Fusco stressed that the decision did not impact Cheniere’s facilities or even its CCL expansion project, neither of which are subject to appeal.

He added that the company, which shipped the first LNG export cargo from the Lower 48 in 2016, has been working for over a decade to advance projects.

“There’s a significant amount of work that we do with the regulators to ensure that we have a robust record underpinning all of our permits, and we’re thoughtful and accurately responding to their information requests as well as comments from affected stakeholders,” Fusco said.

Cheniere reported second quarter net income of $900 million ($3.84/share), compared with net income of $1.4 billion ($5.61) in the year-ago period. Second quarter revenue was $3.3 billion, down from $4.1 billion in 2Q2023.