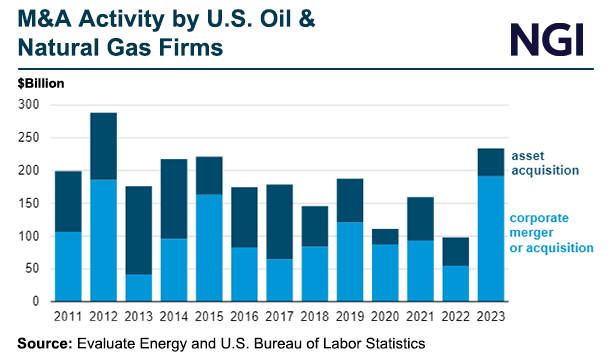

Natural gas-focused mergers and acquisitions (M&A) among upstream North American firms have slowed amid a historic slump in gas prices, according to a new analysis by Enverus Intelligence Research (EIR).

“Low prices have been a drag for deals as potential sellers are reluctant to bring assets to market, especially as they see hope on the horizon from higher gas prices powered by U.S. LNG exports,” EIR researchers said in their latest quarterly report on M&A activity. “A rally in natural gas prices towards the end of 2024 and into 2025 could generate a wave of deals as long-dated private equity investments rush to market.”

For now, gas-weighted privately held exploration and production (E&P) firms are “likely waiting on a rally in natural gas prices to divest more portfolio companies focused on that commodity,” the EIR team said.

With a few exceptions, such as TG Natural Resources LLC acquiring Rockcliff Energy II LLC for $2.7 billion and Chesapeake Energy Corp. merging with Southwestern Energy Co., “gas-focused M&A has been subdued,” EIR said.

U.S. natural gas prices have struggled to find their footing amid oversupply and sluggish demand in the North American market. NGI’s Henry Hub forward fixed price for the balance of summer averaged $2.038/MMBtu on Tuesday (July 30). The Energy Information Administration, meanwhile, is forecasting Henry Hub spot prices to average $2.90 during the final six months of 2024, up 80.0 cents from the first half of the year.

“Beyond rising gas prices, more non-core asset selling is another potential tailwind for M&A in the back half of 2024,” according to EIR.

The firm’s principal analyst, Andrew Dittmar, explained that, “Historically, when there has been a big wave of corporate consolidation like we’ve seen over the last 12 months, companies follow it up by trimming their portfolios and divesting less attractive assets. We should see some of this going forward from companies like Occidental Petroleum Corp. that have a specific mandate to reduce debt, but overall non-core asset selling will probably be fairly subdued because operators don’t want to surrender any hard won inventory.”

Other potential sellers to watch include Mewbourne Oil Co., which “now holds the deepest bench” of privately owned Permian Basin locations following the sale of Endeavor Energy Resources LP to Diamondback Energy Inc., EIR said.

Mewbourne ranked seventh in natural gas production among privately held Lower 48 producers in 2023, according to Enverus.

“A sales process by Mewbourne Oil would likely draw attention from all large companies active in” the Permian’s Delaware sub-basin, “potentially including even EOG Resources Inc. which has not made a significant acquisition since it last purchased private, family owned Yates Petroleum Corp. in the Delaware Basin in 2016,” the EIR team said.

Q2 Dealmaking Tops $30 Billion

Upstream dealmaking overall totaled $30 billion during the second quarter of 2024, with $22.5 billion coming from a single deal – ConocoPhillips’ acquisition of Marathon Oil Corp. “The deal, which is the fifth largest U.S. upstream deal of the last decade, is another historic name exiting the E&P space as Marathon Oil has roots that reach back more than 100 years,” said EIR. “Unlike most other big deals in the current consolidation cycle that focused entirely on the Permian Basin, Marathon Oil held a diversified asset base that included Permian exposure along with large positions in the [Eagle Ford Shale] and Williston Basin.”

[Check out a Special Edition of NGI's Daily Gas Price Index, 'Ports Unknown,' to delve into the price impacts of new LNG supplies, and where those supplies will be needed most later this decade and beyond. Download now.]

Premium acreage in the Permian is harder to come by after the recent M&A wave, according to Dittmar. “The increasing cost of buying drilling inventory, particularly in the Permian, has been the main story in upstream M&A throughout 2024,” said the analyst. “With the highest quality inventory selling at premium pricing, there has been a scramble for middle-tier inventory that provides strong returns even if it isn’t as economic as core Permian assets.”

Refracs, New Plays in Focus

In mature plays such as the Eagle Ford and Williston Basin, operators increasingly are looking to maximize the potential of older wells through recompletion or refracturing, aka refracs.

“The opportunity to revisit older wells is something companies are paying increasing attention to, both within their existing assets and when evaluating deal opportunities,” according to EIR. “Increased refrac potential should generate additional M&A interest in more mature areas like the Eagle Ford and Williston.”

In addition, companies are looking to underdeveloped zones such as the Uinta Basin to shore up their inventory.

“Proving up new economic drilling locations is a top priority for companies and has been the most cost-effective way to extend inventory life,” said Dittmar. “What is substantially different in this market, and a major shift in the industry, is that companies like Matador Resources Co. and SM Energy Co. are willing to prepay for inventory…that has yet to be fully proven up by horizontal wells.”

EIR said that privately backed sellers have divested more than $100 billion of upstream assets to publicly held buyers since the start of 2022, with EnCap Investments LP leading the way with roughly $20 billion divested since then. Other top sellers over that period include Lime Rock Resources, NGP Energy Capital and Quantum Energy Partners.