Mexico’s reliance on U.S natural gas to meet national electricity needs would continue to represent a short-term risk for the country in the event of extreme climate conditions, according to the credit rating agency Moody’s Ratings.

Throughout early May, Mexico experienced a nationwide heatwave that drove a surge in electricity demand across the country.

The national electricity grid was unable to support the increased demand, leading the power system operator, known as Cenace, to issue critical alerts for inadequate supply on 11 of the first 18 days of the month. The grid’s inability to meet national power needs led to blackouts in 21 of Mexico’s 32 states on May 7.

The natural gas system held up during the heatwave, but a lack of sufficient power generation supply crippled the electric grid.

If Mexico continues to delay its development of natural gas storage and energy generation projects, the country will become increasingly vulnerable to further blackouts in the short- and mid-term, which could negatively impact investment opportunities driven by the relocation of companies to the country, known as nearshoring, according to a recent report from Moody’s.

“The nearshoring initiatives demand growth in energy supply, which will depend on Mexico’s establishment of a clear trajectory for the energy transition that includes sufficient generation capacity and renewable energy transmission to satisfy growing power needs,” Moody’s analysts said in the report.

“The high dependency on the imports of natural gas from the U.S. exposes the Mexico electricity system to the risks of climate change, especially during the periods of extreme climate, and the environmental risks will continue to threaten to provoke supply or distribution interruptions,” they added.

More Demand, Inadequate Supply

Mexico’s electricity demand increased year/year by 3.8% in 2023, after growing year/year by 3.9% in 2022, exceeding the Energy Ministry’s projections of 2.5% annual growth.

With record high temperatures expected to continue in the upcoming years, as well as increased power demand driven by companies relocating to Mexico, the country would be pressed to expand its electricity capacity in the short-term to meet historic levels of demand, according to Moody’s.

“These conditions, as well as the long wait times to finalize new energy projects and the continued political uncertainty in the sector, will contribute to sustained increased electricity prices during at least the next three years,” the credit rating agency analysts wrote.

Abraham Zamora, President of the Mexican Energy Association (AME), said earlier this year that Mexico will need to attract more than $41 billion in investment to generate an estimated 37 GW of additional electricity capacity required to meet the increased energy demand anticipated by nearshoring.

The relocation of manufacturing and supply chains to Mexico is forecast to be a generational economic growth opportunity that could bring as much as $50 billion of investment and create four million jobs in the country.

“Expanding investments in capacity and transmission will be crucial to maintain the stability of the national electricity system and guarantee the availability of energy for all residential and industrial clients,” Moody’s wrote. “An increase in nearshoring operations could also push consumption above the base projections for the upcoming years, and for that reason generation capacity and energy transmission are factors that should be taken into account by companies considering the possible relocation of operations to Mexico.”

U.S. Gas Fueling Mexico’s Power

Given Mexico’s urgent need to expand electricity generation, the country would likely continue to increase its demand for U.S. natural gas, which is used to generate 68% of the national power grid, according to Moody’s.

Imports have accounted for 6.2 Bcf/d, or 72%, of the country’s gas supply year-to-date through May 22, according to Wood Mackenzie data. That is up by 541 MMcf/d from the same period last year.

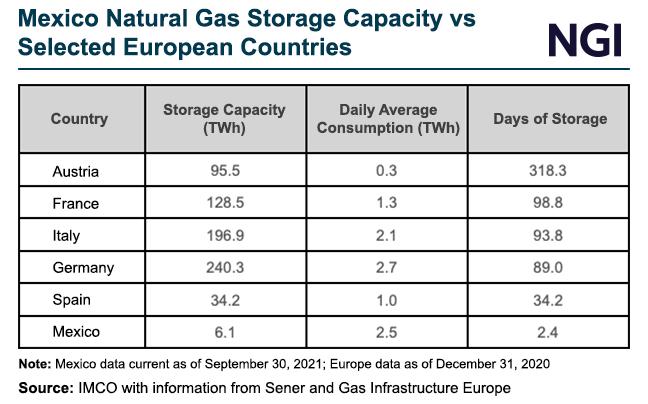

“Natural gas will continue to dominate Mexico’s energy matrix and will continue to be crucial to decarbonization efforts,” analysts said. “Mexico doesn’t have plans to expand its storage capacity nor has it implemented important improvements needed in transmission lines. This dependency and the delayed energy transition will increase the exposure of companies and energy generators to the risk of climate change, the risk of decarbonization and the volatility of commodities prices.”

Moody’s warned that another aberrational weather event, such as the Winter Storm Uri of 2021, could lead to further interruptions in the Mexico power grid should the country fail to develop natural gas storage capacity and increase electricity generation capacity.

Mexico will hold presidential elections on June 2, and the incoming president should prioritize strengthening the electricity grid and matrix in the short-term, Moody’s said.

“The next government of Mexico, which will begin its six-year term in October 2024, will have the opportunity to establish a clear plan for the energy transition with transparent policies and sufficient generation and transmission capacity to achieve its objectives,” analysts said. “The rapid increase in the electricity consumption in the country requires a clear action plan to maintain the stability of the system and guarantee the availability of energy to residential and industrial clients.”