State-owned LNG terminal operator Deutsche Energy Terminal GmbH (DET) reported it received no bids for capacity during its latest contracting period, attributing the lack of interest to low natural gas prices in Europe.

DET’s three marketing rounds took place between June 13 and July 3 for regasification capacity at the Brunsbüttel and Wilhelmshaven facilities. It offered short-term contracts for 2025 and long-term agreements for 2025-2029.

DET spokesperson Dirk Lindgens told NGI that marketing rounds without bids are not unusual and are a part of market behavior.

“All capacities at the DET terminals for this year have been marketed. Capacity utilization at the terminals is currently at a very good level of between 83-87%,” Lindgens told NGI.

Lindgens also attributed the lack of interest to DET’s position as a regulated, federally owned company with rates mandated by the German Federal Network Agency.

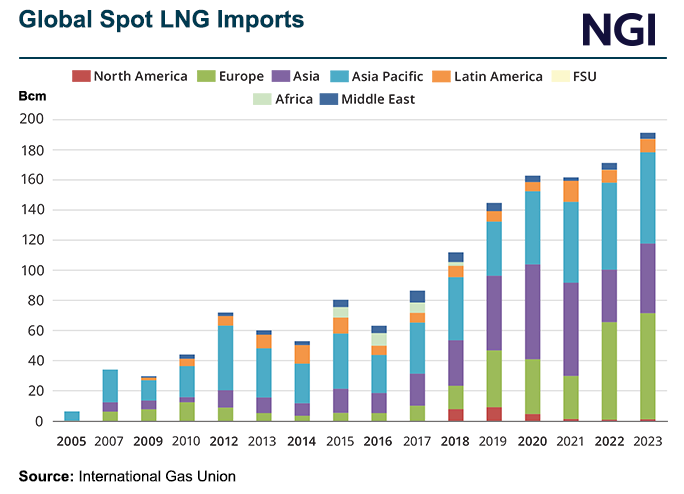

Meanwhile, European natural gas prices have continued to fall amid news of the restart of Texas-based Freeport LNG Development LP and European storage facilities nearing the 83% full mark.

The International Energy Agency estimated in its latest natural gas market report that Europe could see a 13 billion cubic meter year/year decline in gas demand for power generation in the first half of 2024, resulting in lower demand for LNG in Europe.

According to Institute for Energy Economics and Financial Analysis (IEEFA) analyst Ana Jaller-Makarewicz, lower gas prices in Europe reflect the trend of decreasing consumption in the continent. Germany’s plans to increase its LNG capacity are faced with uncertainty regarding future LNG demand, Jaller-Makarewicz added.

In the first half of 2024, Germany's overall gas consumption decreased by 2% year/year, according to IEEFA calculations, and was 16% lower than the average consumption from 2018-2021. While LNG imports increased 10% year/year, the average utilization rate of Germany’s import terminals was 47%.

Around 80% of Germany’s total LNG imports last year came from U.S. facilities, based on Kpler data.

DET plans to offer capacities again, but no date has been set. DET also is expected to offer capacities at the Stade and Wilhelmshaven 02 sites, which are scheduled to go into operation in the second half of the year.

DET would eventually operate four floating storage and regasification terminals in Brunsbüttel, Stade and two in Wilhelmshaven. Brunsbüttel and the first phase of Wilhelmshaven are currently in operation, and Stade and Wilhelmshaven 2 are expected to enter service this year.