After some delays and mixed signals from its vessel, New Fortress Energy Inc. (NFE) has confirmed the first shipment of U.S. natural gas liquefied in Mexico has been loaded and is on the water.

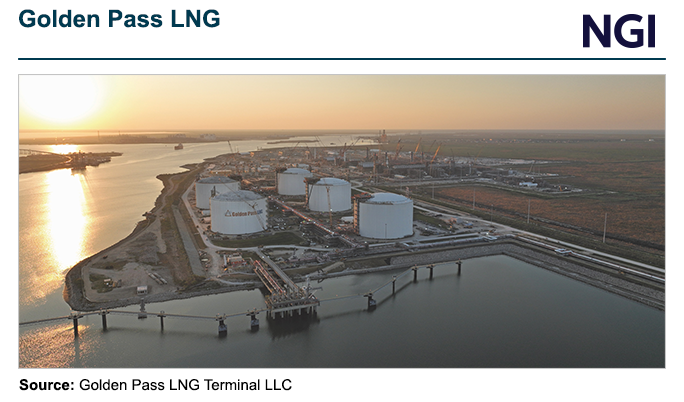

In a video published this week, New York-based NFE disclosed it had successfully loaded an LNG cargo at its 1.4 million metric tons/year (mmty) fast liquefied natural gas (FLNG) facility offshore Altamira. Earlier in the month, the company pushed its target for a first cargo shipment in late July to mid-August after a series of delays starting in April.

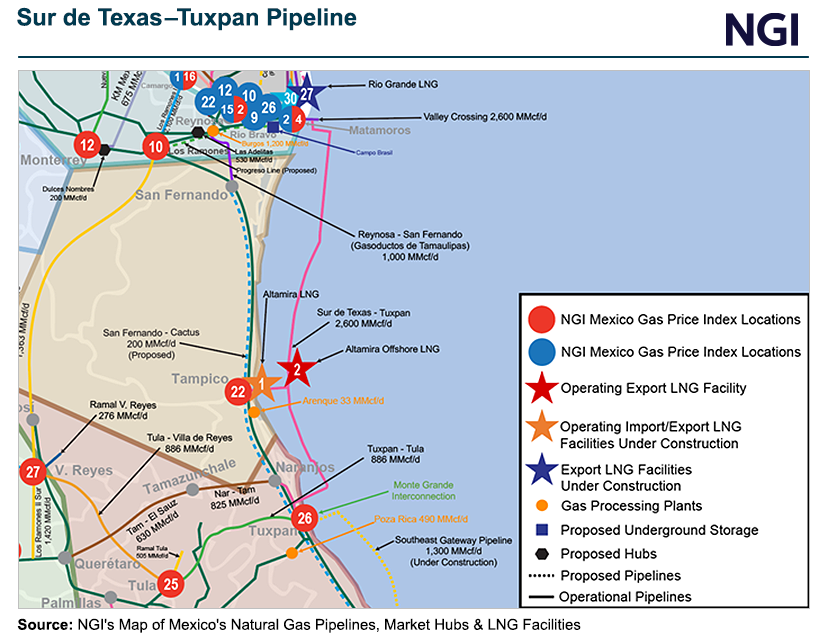

NFE also disclosed its first LNG cargo would be loaded on the Energos Princess and delivered to the Pichilingue liquefied natural gas import terminal in La Paz on Mexico’s Pacific Coast. NFE has a supply agreement with Mexico’s Comisión Federal de Electricidad (CFE) to provide up to 0.3 mmty of LNG to the import terminal in southern Baja California.

“The milestone of a first cargo is important because we have now proven the concept of Fast LNG as an innovative approach of producing LNG by combining modular topside facilities with pre-existing sub structures to accelerate the production and delivery of clean and affordable energy,” Barry Clayton, director of operations, said.

[Get Better Intel: Where are natural gas prices in Canada heading in the next few years? NGI's Forward Look now includes Westcoast Station 2! Don't delay in getting critical natural gas price data. Request a trial now.]

The FLNG units and successive onshore phases are supplied feed gas by CFE’s gas marketing arm, CFEnergía, from the Agua Dulce Hub in South Texas via the Valley Crossing pipeline. CFE transports volumes on the Sur de Texas-Tuxpan pipeline.

NGI’s forward fixed prices at Agua Dulce for September delivery were $1.79/MMBtu as of Wednesday. Summer 2025 prices were trading at $2.669. Agua Dulce basis prices were quoted 46 cents below Henry Hub for the remainder of summer 2024, and 49 cents below the benchmark for summer 2025.

Following its first shipment, NFE noted the FLNG unit will undergo scheduled maintenance for several days before ramping up to full production by the end of the month.

The Energos Princess reportedly left the FLNG facility on Aug. 8 with a partial load of roughly 6,300 tons, according to Kpler ship tracking data. It was heading south of Cuba as of Tuesday afternoon.

Kpler’s Troy Carney, a senior LNG and natural gas market analyst, told NGI there isn’t solid confirmation yet about the exact route of the ship but it is likely to head to southern Baja through the Panama Canal since its next destination is NFE’s LNG powered plant in Puerto Sandino, Nicaragua. The ship is targeted to be used as a floating storage unit at the facility.

“It would make sense to avoid sending the Energos Princess on a long trip around Cape Horn when the final piece of construction at Puerto Sandino is expected to be completed next month,” Carney said.

In July, the company closed a $700 million loan for a second FLNG unit that is being developed in partnership with CFE. Completion of the second unit was targeted for the first half of 2026.

NFE reported last week that delays in the startup of its first FLNG unit and the associated costs cut into its adjusted revenues, causing it to miss its 3Q2024 target of $275 million by about $155 million.

“While we are disappointed in the delay in placing FLNG 1 into service, it is now operational and we are very excited about the future of our business,” CEO Wes Edens said.

Earlier in the week, Fitch Ratings downgraded NFE from a BB- rating to a B+ and placed it on a negative watch. Analysts noted the company’s “significant refinancing risk and highly constrained liquidity position given its capital-intensive growth strategy” compared to its most similar competitors.