June bidweek natural gas prices were mostly higher, supported by expectations that heat would soon become widespread, export demand could rise, and production may finally experience a sustained pullback.

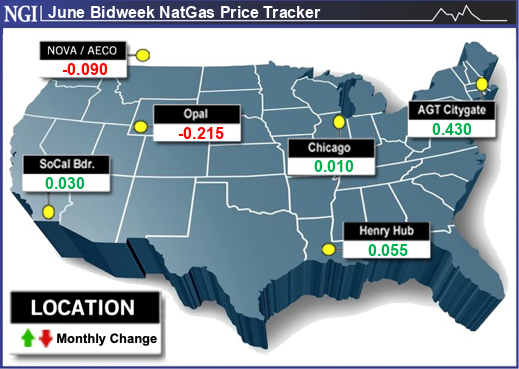

That said, price increases were moderate at best at the majority of U.S. locations, and weakness was seen throughout the West Coast. NGI’s June Bidweek National Avg. ultimately stayed flat at $2.020/MMBtu.

This paled in comparison to an average of $8.635 for June 2022 bidweek prices but was only about 16 cents below the June Nymex gas futures contract’s price of $2.181 when it rolled off the board on May 26.

With natural gas storage inventories more than 550 Bcf above year-ago levels, and Lower 48 output hovering on either side of the century mark, the gas market continues to await any signs of support.

On Thursday, Bloomberg estimates put U.S. dry gas production at around 99.3 Bcf/d, off about 1.8 Bcf from Wednesday. Declines were concentrated in the Haynesville Shale, Midcontinent and Rockies, with each region seeing output slip by 5% or more day/day.

However, the lower production figures may be related to seasonal maintenance events taking place on pipelines or in the field. As such, the lower output is unlikely to be sustained.

Furthermore, though recent rig data have indicated a slowdown in drilling activity, any impact to production is not expected for at least another couple of months.

EBW Analytics Group said supply expectations would remain the key barometer for prices going forward. Henry Hub June bidweek prices averaged $2.170, up only 5.5 cents month/month.

Tapering growth remains the most likely scenario, according to the firm, with slowing production growth tightening storage balances vis-à-vis the five-year average.

The latest Baker Hughes rig data reflected another four-rig decline in gas-directed drilling. Three rigs dropped were in the Haynesville as signals continued to mount of decelerating upstream momentum.

“The end of pipeline maintenance season may produce a near-term increase in production readings,” EBW senior energy analyst Eli Rubin said. “But the combination of pipeline-constrained output in the Appalachia and Permian, alongside steep declines in Haynesville momentum, appear likely to curb output growth to a sustainable level.”

On the natural gas pricing front, Appalachia’s Eastern Gas South prices continued to retreat for June bidweek, with prices averaging 31.5 cents lower month/month at $1.210. The Permian’s Waha Hub was up 54.0 cents to $1.635.

That said, Aegis Hedging Solutions analyst Rishi Rajanala said the threat of too much Haynesville production finding enough egress had dissipated. Likewise, regional basis prices should be under less pressure going forward as the rate of production growth moderates and new pipelines come online.

“This outlook is much different than only a few months ago when Nymex gas was priced much higher and incentivized operators to grow,” Rajanala said.

Sharing that sentiment, EBW added that as production growth tapers over the next two to four months, comparisons to the five-year average are likely to tighten absent realized growth from recent years. This eventually would help ease the storage surplus lower into the back half of the injection season.

Stout Stocks…For Now

For the time being, inventories continue to swell absent more significant heat and lackluster LNG feed gas demand.

The latest Energy Information Administration (EIA) storage report showed stocks for the week ending May 26 rising by a whopping 110 Bcf, the first triple-digit build of the injection season. Notably, the build surpassed the 82 Bcf injected in the same week a year earlier and the five-year average injection of 101 Bcf.

Industry expectations ranged from injections of 99 Bcf to 123 Bcf, but NGI hit the nail on the head with its 110 Bcf projection.

Inventories in the East region led with a 33 Bcf increase, with the Midwest following with a 31 Bcf rise in stocks, according to EIA. The South Central added a net 28 Bcf, which included a 10 Bcf build in salt facilities. Pacific stocks rose by 12 Bcf, while Mountain stocks climbed by 7 Bcf.

Notably, Pacific stocks remained sharply below historical norms. Inventories as of May 26 stood 35% below the five-year average but less than 25% below the year-ago level.

That said, prices in the West continued to retreat from the lofty levels of last winter and spring. In the Rockies, Northwest Sumas June bidweek prices tumbled 71.0 cents month/month to $1.825 and Opal dropped 21.5 cents to $2.300.

Steeper losses were seen in California. In the northern part of the state, PG&E Citygate June bidweek plunged $1.545 month/month to average $3.770. The SoCal Citygate was down 97.0 cents to $4.085.

Total working gas in storage hit 2,446 Bcf, which is 557 Bcf above year-earlier levels and 349 Bcf above the five-year average, EIA said.

Looking ahead, analysts expect additional triple-digit storage injections in the coming weeks, given continued lofty production levels and the absence of significant cooling demand.

NatGasWeather said the latest models maintained light national demand through June 10 since most of the United States is forecast to see comfortable highs of 60s to 80s. The midday Global Forecast System model showed rising demand from June 11-15 as daytime highs in the 90s gained in coverage across Texas, the South and Southeast.

“Longer-range weather maps maintain a rather hot U.S. pattern gaining ground during the second half of June as highs of 90s increase over the southern half of the U.S.,” NatGasWeather said.

There’s also the potential for other bullish trends to materialize as June progresses, according to NatGasWeather. This could be through hotter trends, declining production, strengthening liquefied natural gas exports or power burns proving stronger than expected.

“Clearly, the natural gas markets have been getting more impatient by the day waiting on widespread heat to arrive,” NatGasWeather said. “If hotter patterns don’t come through for mid- and late June, and if U.S. production doesn’t show any signs of declining, bears could have eyes for $2 sooner than later. Conversely, if hotter patterns were to come through for the second half of June, and if power burns prove more impressive than market expectations, we must expect a short covering rally.”