Traders over recent sessions fixated on rising natural gas production estimates and a government inventory print that exceeded market expectations. This cut off a late-spring price rally over the past week.

The July Nymex futures contract took over as the prompt month on Thursday and shed 9.4 cents. It fell further intraday on Friday.

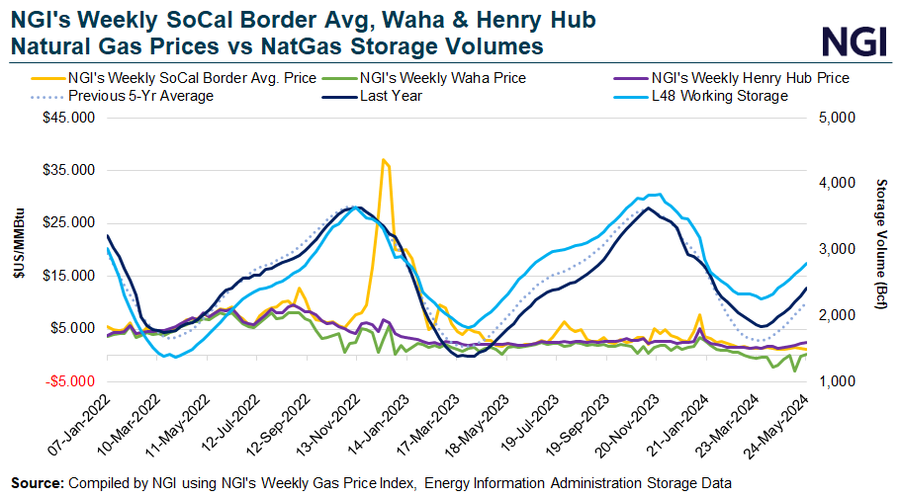

However, the downshift followed a solid month of advances overall. From May 1 through trading Wednesday, the June Henry Hub futures contract jumped 29% before it rolled off the books. NGI’s Spot Gas National Avg. gained 15% to $1.565 over the same period.

Some analysts on Friday noted that gas production was creeping up in anticipation of mounting summer demand – and only after output dropped to annual lows during the spring season. They also noted that injections of gas into underground storage, including the most recent print, have consistently proved lighter than the five-year average for weeks, narrowing the surplus of inventories relative to historical norms. They further emphasized that forecasts called for robust cooling demand this summer.

The U.S. Energy Information Administration (EIA) on Thursday reported an 84 Bcf injection into storage for the week ended May 24. The build exceeded expectations found by major polls for an increase in the upper 70s Bcf. What’s more, production was averaging 99.4 Bcf/d in the past week, according to Wood Mackenzie’s Friday estimate. That was up more than 2 Bcf/d from spring lows amid rumblings that major producer EQT Corp. had begun to ramp up output for summer.

Analysts at The Schork Report said the EIA data “failed to stem the bloodletting” in the futures market. They noted though, that the latest storage result was “shaded to the lower end” of historical norms.

In fact, the print came in well below the five-year average increase of 104 Bcf. It marked the fifth consecutive lighter-than-average weekly injection and put inventories at 2,795 Bcf. That was 586 Bcf – or 26.5% – above the five-year average of 2,209 Bcf. That surplus has since shrunk substantially from highs above 40% in March, which developed following a mild winter and production that reached record levels around 107 Bcf/d.

Still, output this spring has fallen by about 10 Bcf/d from those all-time highs. At the same time, early summer-like heat permeated vast stretches of the South in May.

In addition to the narrowing relative to the five-year average, the storage surfeit is falling swiftly when compared to last year, said RBN Energy LLC analyst John Abeln.

“The gas storage surplus to last year has fallen by more than 55% since the start of March,” he said. Prior to the recent “backsliding,” he said the June futures contract had reached final settlement at $2.493/MMBtu on Wednesday – a level 54% higher than May’s final close.

Preliminary injection estimates submitted to Reuters for the EIA storage period ended May 31 ranged from 73 Bcf to 95 Bcf, with an 86 Bcf average. The estimates compared bullishly with a build of 105 Bcf during the comparable week of 2023 and a five-year average increase of 103 Bcf.

NatGasWeather said while conditions in June are projected to prove somewhat sporadic, storage surpluses “will continue gradually decreasing” toward 500 Bcf.

Looking to the week ahead, the firm said, the Midwest and Northeast were expected to warm into the 80s, while the southern United States will continue to see highs from the upper 80s to the upper 90s for “strong national demand.”

More benign weather was forecasted for the second full week of June. However, NatGasWeather added, the “expectation is, as the second half of June progresses, most of the U.S. will again become warmer versus normal as highs of upper 80s and 90s gain in coverage to increase national cooling degree days above normal to further reduce surpluses.”

The National Weather Service’s full summer forecast called for above-average temperatures across most of the Lower 48. Forecasters based their outlook in part on an expected change from the current El Niño climate pattern to a La Niña during the coming summer. La Niña patterns tend to increase heat levels across the Lower 48.

“While immediate-term softness is possible and higher gas production is a bearish risk, rebounding heat could offer physical support as soon as early next week,” said EBW Analytics Group’s Eli Rubin, senior analyst. “We remain constructive on the 30-45 day window -- particularly if forecasts calling for stifling heat materialize in early July.”