When the long-delayed Mountain Valley Pipeline LLC (MVP) starts up in the coming weeks, the natural gas flowing south into downstream markets is not expected to be anywhere near the pipeline’s full 2 Bcf/d capacity.

That’s because past the southern terminus of the 303-mile pipeline, the Transcontinental Gas Pipe Line Co. (Transco) system faces bottlenecks during peak demand periods into the Mid-Atlantic and Southeast regions.

Transco’s capacity is heavily constrained to the north, south and east from its Compressor Station 165 in south central Virginia. Additional capacity to the line won’t arrive until late 2027.

“We don’t expect them to do much for at least the next three years,” according to Criterion Research’s James Bevan, vice president of Research regarding the impact of initial MVP flows.

Criterion estimates that Transco only has about 200 to 300 MMcf/d of room for additional southbound flows during the summer months on an average day. “So there’s not a lot of extra gas that can be delivered to flow in the southeastern United States,” Bevan said. Criterion’s net impact from MVP “optimistically is 200 to 300 MMcf/d of new production coming online thanks to the pipe,” he said.

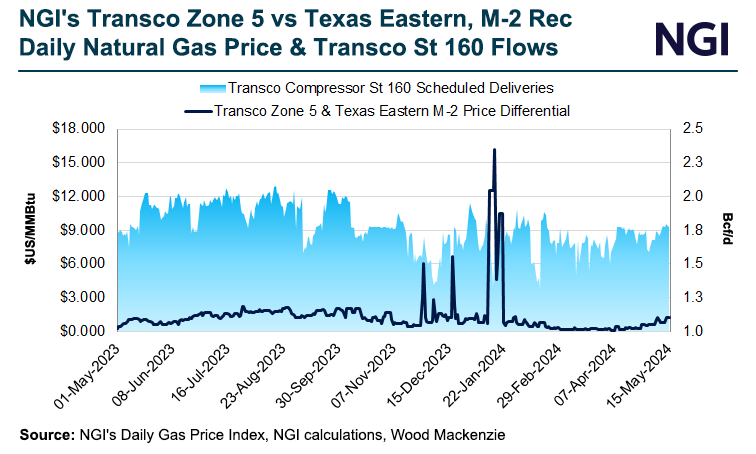

That estimate is based on average southbound summer gas flows through Transco’s Compressor Station 160 in North Carolina. The location averaged more than 1,900 MMcf/d over the past three summers, more than 200 MMcf/d below its design capacity, Bevan said. There was more spare capacity in winter when flows averaged between 1,600 to 1,700 MMcf/d, he said.

Wood Mackenzie data shows similar available space available at Station 160. Over the past three seasons, summer flows averaged about 268 MMcf/d below the 2,197 MMcf/d design capacity. Winter averaged 455 MMcf/d below capacity, the firm’s data shows.

However, in practice, Station 160’s operational capacity has been much below the design rating and closely matches flows — with no spare capacity in the summer and rarely much above 100 MMcf/d available in the winter, the data show.

‘Pretty Strong Pulls’

MVP’s start-up timeline has been pushed back by a week after a failed pipeline hydrostatic test, with the completion of construction and final commissioning activities expected “on or about May 31,” a spokesperson for the pipeline’s backer Equitrans Midstream Corp. told NGI.

With the start-up in time for summer, Transco is likely to “see some pretty strong pulls” of gas from MVP if power generation loads are as strong as expected, Williams CEO Alan Armstrong said on an earnings call this month. In the immediate term, gas supplies that serve the new pipeline will respond to the higher demand, but longer term Transco would start to take full advantage of those incremental supplies as its expansions come online, he said.

Transco’s Southside Reliability Enhancement Project would add around 400 MMcf/d of capacity from Station 166 into North Carolina by winter 2024. A proposed Southeast Supply Enhancement Project would boost its mainline capacity by 1.6 Bcf/d south from Station 165 by late 2027.

“That’s a huge positive for us to have high pressure supplies coming into our system right there at 165,” Armstrong said.

EQT Corp., the nation’s largest natural gas producer and soon-to-be owner of the MVP pipeline, is looking to sell more of its Appalachian gas via the pipeline into higher-priced markets in the Mid-Atlantic and Southeast.

“We conservatively assume EQT flows only a portion of our MVP capacity due to downstream limitations at Station 165,” CFO Jeremy Knop said on an earnings call in February. However, in winter months “we should be able to flow at higher rates on MVP and realize a greater premium on downstream pricing,” he said.

Spreads Narrowing?

Knop noted that higher downstream gas demand juxtaposed with relatively flat Appalachian gas supply “should provide a structural tailwind for local pricing over the coming years, which we do not believe is currently priced into the basis futures market.”

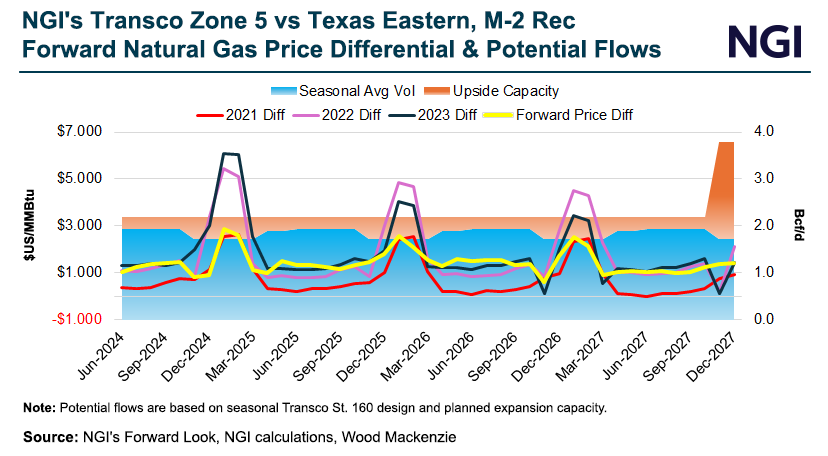

However, since that call in February, NGI forward basis differentials in locations such as Eastern Gas South and Texas Eastern M-2, 30 Receipt, have narrowed to Henry Hub across the 2024 strip.

In addition, the spread to downstream markets is flashing less of a premium for winter than the past two years.

Natural gas cash prices for Texas Eastern M-2, 30 Receipt, aka Tetco M2, are a key indicator for Appalachia that includes southwest Pennsylvania, West Virginia and Ohio. The hub typically prices at a discount to downstream markets in Transco Zone 5 that runs from Virginia to the Carolinas.

As of Friday (May 17), NGI’s forward curves had Transco Zone 5 trading at an average $1.513/MMBtu premium to Tetco M2 over the next 12 months.

A more granular look at the curve shows the Transco Zone 5-Tetco M2 spread for the upcoming summer is tracking in line with two of the last three years. For the upcoming winter, however, it’s tracking much lower than two of the past three years, according to NGI’s Forward Look data.

As of May 15’s trade date, Transco Zone 5’s premium to Tetco M2 for January 2025 stood at $2.886, below the $6.095 spread a year earlier and $5.444 in 2022 for January 2025. Three years ago, the January 2025 spread stood at a similar level to this year.

EQT has prepared for price spread compression. Knop said in February that the producer had roughly 500 MMcf/d of pricing exposure hedged through Station 165 via financial instruments and firm physical sales through 2025 to provide “downside protection should there be any further price pressure downstream of MVP over the next few years.”

Production Comeback?

With such higher premiums to be obtained with additional gas sales into the Southeast, the market is closely watching whether EQT would start to bring back its curtailed production when MVP comes online.

“We currently envision a medium probability that they will return that supply to the market in June and a high probability that production will return in July,” Criterion’s Bevan said of EQT on online platform Enelyst.

EQT was one of several major producers that cut production in late winter to address oversupply. Ahead of those cuts, Northeast gas output topped out at about 36.5 Bcf/d in February. The region’s production fell sharply into March and then steadily declined in the spring, falling to 32.86 Bcf/d on May 7, its lowest level since early 2023, according to Wood Mackenzie data.

This week, Northeast output has ticked higher to between 33.3 Bcf/d and 33.5 Bcf/d, the firm’s data shows.

That production uptick has come amid a rally in spot gas prices ahead of the onset of summer heat. Since the start of May, NGI’s Henry Hub is up 44% to $2.340, while Transco 5 prices are up 59% over the same period.

“Falling natural gas production may quickly be reversed in Appalachia…later this year as pricing improves and new infrastructure comes online,” EBW Analytics Group analyst Eli Rubin said.