Natural gas deliveries for March posted widespread discounts as it remained unclear whether material late-season cold would develop and be sustained beyond the next couple of weeks. With production generally holding not far off record highs and storage inventories sitting unusually high, NGI’s Bidweek National Avg. plunged $2.565 month/month to $2.870/MMBtu.

Multi-dollar price decreases on the West and East coasts drove the March 2023 average $1.555 below the year-ago March bidweek price and within a nickel of 2021 levels.

Meanwhile, the March Nymex gas futures contract enjoyed a recovery off recent sub-$2.000 lows in its final days of trading. The March contract expired at $2.451.

That momentum has largely continued for the April Nymex contract, which has notched five straight days in the black amid a mix of technical momentum, robust power burns amid the lower price environment and short-term weather demand. Operations also are ramping up at the Freeport LNG terminal. Once full approvals are received, the liquefied natural gas export facility could produce 2.38 Bcf/d.

EBW Analytics Group noted that natural gas prices have moved from multi-year lows to one-month highs in under a week. From a technical perspective, the bulk of the recent rally is largely recovering from oversold conditions, according to the firm. It said the rally closing above the 20-day moving average on Friday may fuel an extended move higher. Technically, prices could approach $3.000 within the next 10 days.

On the weather front, the American Global Forecast System (GFS) and European model show colder-than-normal temperatures over much of the northern half of the country from March 8-15. During this time, overnight lows could tumble close to zero in some areas, while some parts of the southern United States could see temperatures slip into the 20s.

Beyond mid-March, however, the pattern is less clear. Some long-range models showed a “rather cold U.S. pattern” continuing through March 20, according to NatGasWeather. The firm noted, though, that colder-than-normal temperatures in mid- and late March don’t carry the same weight as they do in January and February. There’s also been the trend this winter in which colder long-range weather models ultimately trend warmer in time.

“To our view, if the afternoon or overnight European model were to shed demand, it could lead to a quick move lower to back under $2.70,” NatGasWeather said.

On Wednesday, the April Nymex contract settled higher for a sixth straight day, up 6.8 cents to $2.815.

Without assistance from sustained colder weather, futures prices may have a hard time sustaining or progressing the recent rally. After all, the blowtorch weather that occurred throughout most of the winter has left storage inventories – struggling throughout the summer to rise from steep deficits – at a healthy surplus on the cusp of the injection season.

Estimates ahead of the Energy Information Administration’s (EIA) upcoming inventory report, to be published Thursday, point to yet another paltry withdrawal when compared with historical pulls.

Reuters polled 13 analysts, whose estimates ranged from withdrawals of 66 Bcf to 84 Bcf and produced a median decrease of 76 Bcf. A Wall Street Journal poll of 12 analysts had a tighter range and averaged a draw of 74 Bcf. Bloomberg’s survey of eight analysts produced a median draw of 74 Bcf. NGI modeled a 76 Bcf pull.

For comparison, the EIA recorded a 137 Bcf withdrawal in the same week last year, while the five-year average pull is 134 Bcf.

As of Feb. 17, inventories stood at a plump 2,195 Bcf, which is 395 higher than year-earlier levels and 289 Bcf above the five-year average, according to EIA.

Chillier weather on the horizon, at least for a brief period, could provide a fundamental backdrop of elevated spot demand and fading storage surpluses to provide a tailwind for the recent rally higher, according to EBW. Still, the firm cautioned that as normal temperatures wane seasonally into the end of winter, colder anomalies are mostly maintaining national heating degree days largely flat.

“Exceptional Arctic blasts forcing widespread production freeze-offs, as occurred in December and early February, are unlikely,” EBW senior energy analyst Eli Rubin said.

Massive Sell-Offs

Against that backdrop, huge price decreases were seen in the Northeast and West Coast for the March bidweek period. This is ironic given that these regions – and few others – are likely to see messy winter storms driving up demand.

AccuWeather said a blockbuster winter storm later this week would unleash heavy snow across the Midwest and Northeast. Boston could receive up to four inches of snow, with heavier amounts to the north and west from Friday to Saturday. Depending on how quickly a secondary storm forms along the coast, a wedge of cold air could keep snow going for a long period of time. If that occurs, snowfall could be double or triple the amount, according to AccuWeather.

What’s more, the forecaster said warmer weather may be hard to come by moving forward this month – and perhaps April. More persistent cold air combined with storms may lead to more opportunities for snow, according to the AccuWeather.

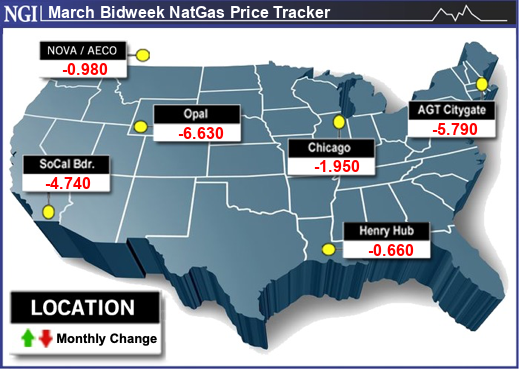

Despite the frosty forecast, New England’s Algonquin Citygate dropped $5.790 month/month to average $5.225 for March baseload delivery. Transco Zone 6 non-NY fell $3.110 to average $2.360.

Upstream in Appalachia, the majority of locations posted price declines of less than $1.000 month/month. The exception was Texas Eastern M-3, Delivery, which plummeted $3.150 to $2.395.

Similarly steep price declines were seen on the West Coast, where a storm that first hit California was moving farther inland midweek. The National Weather Service (NWS) said the powerful mid- to upper-level flow would move across the Southwest and into the southern High Plains through Thursday and then toward the Lower to Middle Mississippi Valley on Friday. This should bring relief to California for the next few days with dry conditions expected. However, temperatures are forecast to remain below average, although not as cold as in past days.

“Still there is potential for record low morning temperatures Thursday across portions of Central and Northern California,” NWS forecasters said.

Despite the continuation of messy winter weather out West, March bidweek prices tumbled. In California, losses upward of $6.000 month/month were seen at Malin, which averaged $5.495 for March baseload gas. The SoCal Border Avg. fell $4.740 to $5.210.

Similar prices extended into the Desert Southwest and Rockies. Northwest Sumas averaged $5.605 for March baseload delivery, off $4.200 on the month.

Elsewhere across the Lower 48, price declines either side of $1.000 were common as traders looked ahead to more moderate spring weather. Waha in West Texas averaged $1.315. Chicago Citygate averaged $2.490.