Natural gas prices nosedived in February bidweek trading under the pressure of enduring benign weather, light heating demand and robust production.

NGI’s February Bidweek National Avg. sunk $8.290 month/month to $5.430/MMBtu. That compared with the $6.785 average for the year-earlier period.

Prices dropped across the Lower 48 during the Jan. 25-27 bidweek trade, with natural gas hubs in the West leading the downward momentum. The Rockies and California absorbed unusually harsh winter storms earlier in January – an exception to an overall mild weather start to 2023 – fueling surges in western spot markets. But as the cold subsided ahead of bidweek and forecasts showed expectations for an average February, prices plummeted.

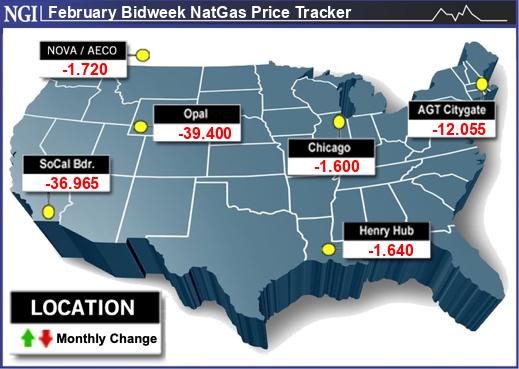

In the Rockies, El Paso San Juan dropped $22.580 month/month to average $11.490 and Opal sank $39.400 to $11.925.

On the West Coast, SoCal Citygate lost $41.100 to $13.205, while PG&E Citygate fell $36.980 to $12.540.

Elsewhere, Chicago Citygate slid $1.795 to $4.245, and Algonquin Citygate near Boston shed $12.055 to $11.015.

During the covered period, the February Nymex natural gas futures contract rolled off the board at $3.109/MMBtu. It closed the week down 2% after losing 7% the prior week. The prompt month through most of January traded at roughly half the highs of December 2022, when genuine winter weather permeated the country and caused well-head freeze-offs that interrupted production.

March took over as the front month contract on Monday of this week and dropped lower. It traded sideways on Tuesday and then settled Wednesday at $2.468/MMBtu, down 21.6 cents on the day.

The weather shifted into an unusually mild pattern last month. Aside from areas of the West and far north, temperatures were above average for the vast majority of January. EBW Analytics Group estimated overall heating degree days last month would amount to one of the weakest natural gas demand Januaries in 15 years.

Production also rebounded in January, hanging near or above 100 Bcf/d most of the month – and at times touching record levels just above 102 Bcf/d, according to Bloomberg estimates.

Freeport LNG Uncertainty

What’s more, LNG demand is substantially lower than it otherwise would be because of the protracted repair period for a key liquefied natural gas plant in Texas following an explosion and fire last June. After regulatory delays in 2022, the Freeport LNG export plant had targeted a mid-January relaunch. That came and went without major action at the facility. It has in recent days begun the restart process, but the timing of full restoration is still unknown and, in the meantime, 2.38 Bcf/d of demand remains idle.

“Production has been at record highs, an exceptionally warm start to January suppressed demand, and LNG exports have been hobbled since last June when Freeport LNG went offline,” RBN Energy LLC analyst Sheetal Nasta said. “After one of the tightest gas markets of the last decade in 2022, the stage is set for one of the most oversupplied markets we’ve seen in years.”

Inventories of gas in underground storage, by extension, are high compared to averages.

The Energy Information Administration (EIA) said utilities pulled 91 Bcf of natural gas from storage for the week ended Jan. 20 – far lower than the five-year average draw of 185 Bcf.

The latest withdrawal lowered inventories to 2,729 Bcf, but it left stocks above the five-year average of 2,601 Bcf. That print came on the heels of a similarly meek result for the prior EIA period and a rare January injection in the first week of the new year.

For this Thursday’s storage report, covering the week ended Jan. 27, estimates showed analysts anticipating a pull in the 130s-140s Bcf. NGI modeled a draw of 141 Bcf. The projections compare with a five-year average decline of 181 Bcf.

Enverus Intelligence Research said Wednesday Nymex natural gas prices could struggle to climb back and stay above the $3 threshold. At the start of the year, its analysts already anticipated production would exceed demand this year. Stout storage “worsens the oversupply already expected for midyear,” said Bill Farren-Price, the firm’s director.

Weather Wildcard

Looking ahead, Rystad Energy analysts said, bulls would inevitably focus on weather. A burst of winter storms and freezing temperatures did arrive for the current trading week. It has fueled stronger demand across the nation’s midsection and parts of the East, and in the process, also forced pauses in production. Output on Wednesday hovered around 96 Bcf/d.

However, the cold shots were forecast to prove short lived, with warmer weather in the cards by next week and a production rebound expected to accompany it. Forecasts for all of February call for more cold than the prior month – and storage draws could increase -- but temperatures are projected to be slightly below average.

The cold snap “will only modestly impact supply balances in the coming weeks,” Rystad analyst Ade Allen said, noting the prolonged absence of demand from Freeport LNG.

“The actual restart date is still shrouded in mystery, as market watchers speculate on minimal evidence of activity,” aside from early steps, Allen said of Freeport. “Our expected timeline for restart remains mid-March. We expect it will take about 60 days from restart to 100% utilization.”

On a forward basis, Allen added, “the outlook for prices remains skewed to the downside. Even with the recent forecast for a cold blast in early February, we foresee Henry Hub prices struggling to find upward momentum…We will see if the recent cold forecast can change that, but chances seem bleak.”