An “exceptional” performance for Shell plc’s Integrated Gas trading unit, in parallel with higher LNG volumes, once again propelled profits in the final three months of 2023, with volumes set to climb higher as an Australian export project restarts, CEO Wael Sawan said.

The London-based major reported sharply lower fourth quarter profits year/year, notably lacking the natural gas price volatility wrought in 2022 following Russia’s invasion of Ukraine. However, the world’s largest liquefied natural gas trader held steady on volumes.

Look for that to continue in 2024, as Shell is set to restart the Prelude floating LNG project in Australia following a major turnaround.

During the quarterly conference call, Sawan reemphasized Shell’s “conviction in the growing demand for LNG…into the future.” The view is underpinned, he said, by both “energy security considerations,” as well as “very strong demand” in parts of Asia, including the Philippines and Vietnam, which recently have begun importing gas.

‘A Lot Of Latent Demand’

“There's quite a lot of latent demand,” Sawan said. “I think what you will find is that as the price…starts to stabilize again, and the market fundamentals reassert themselves, you will see a lot of that latent demand starting to come back to the market.”

Shell’s executive team has “a lot of confidence around the demand profile going forward,” Sawan said. “On the supply side for the next year or so, there's very little in terms of new capacity coming in. But indeed, you see that stepping up…predominantly into the second half of the decade.”

Because Shell plays “across the commodity exposures, for us, it's the ability to be able to pick up from Henry Hub and to be able to be exposed…” across all global prices, including Dutch Title Transfer Facility and the Japan Korea Marker.

Henry Hub futures prices recently have hovered close to the $2.00/MMBtu level. That’s about 50% lower than a year earlier, with prices suppressed by mild weather forecasts for early February and production around 105 Bcf/d – near record highs.

Physical prices are similarly under pressure. NGI’s January Bidweek National Avg., for example, fell 25.0 cents month/month to $3.075 and was well below the year-earlier average of $13.720.

“And so it is no bad thing to have a period of time with more supply coming into the market, because it allows us to contract on the side of offtake agreements, which we have done in the past. And so we're not looking to bet on one period or the next,” Sawan said.

“What we are looking to do is to continue to build an advantaged portfolio that allows us to take advantage of those cross-commodity exposures. And that has been the power of this LNG business for us and will continue to be.”

Venture Global Dispute

Sawan also was asked about the ongoing legal dispute with Venture Global LNG Inc. regarding the Calcasieu Pass export project in Louisiana. Long-term offtakers of Calcasieu Pass have accused Venture of hiding behind alleged technical issues to delay sending contracted cargoes in favor of selling spot volumes. In December, BP plc, one of the offtakers, filed a request with the Federal Energy Regulatory Commission requesting Venture be compelled to release confidential information about the extended commissioning process.

“As far as I can see at the moment in terms of what is publicly available, Venture Global has, I think, sold around 250 commissioning cargoes,” Sawan said. “What we see is that the plant is at or near capacity and has been consistently. So we're very much focused on continuing to enforce our legal rights and protect the sanctity of contracts that are there.”

The CEO said he could not discuss the legal wranglings. “Suffice it to say that we have pulled on the lever of arbitration that exists for us and continue to have the required discussions to be able to fundamentally point out that this is not just an issue between two counterparts. Actually, it's many counterparts, all of whom are not receiving the offtake commitments that Venture Global had committed to.”

Sawan reiterated what he and other executives with companies holding Venture contracts have said.

“It starts to undermine the confidence in U.S. LNG for the longer term, something which, of course, with the recent announcement of the pause by the U.S. administration, just continues to erode that confidence in the longer-term potential of U.S. LNG, which is a real shame, I think, given the potential it has.”

Impacts From Middle East Turmoil

Sawan also addressed the logistical challenges for Shell’s Integrated Gas business to transport cargoes through the Red Sea, as Mideast turmoil continues.

“In the context of the Red Sea, by and large, we are not seeing massive amounts of disruption yet to LNG flows,” Sawan said. “With a portfolio like ours that's blessed with supply points on either side of the Red Sea, as well as on demand points, we are able to optimize and do swaps across the portfolio, which, of course, has always been our strength.”

Shell’s trading and optimization organization “creates value from discontinuities,” he said. “I think suffice it to say that the fourth quarter was a very, very strong quarter for us on trading and optimization in the LNG space….”

Arbitrage (arb) opened up “across the East-West,” and “we typically have length this season in the Northern Hemisphere…Now those arbs have compressed since the start of the year. The absolute prices of gas are lower at the moment. And so the question will be how much more volatility we will see, whether triggered by geopolitical considerations, [or] higher-than-predicted demand in China?

“All of that will be an important determinant of where the LNG and the Integrated Gas business particularly performs.”

Shell’s Integrated Gas segment includes LNG, converting natural gas into gas-to-liquids (GTL) fuels, and other products. It also includes gas and GTL exploration and extraction, as well as operating the upstream and midstream infrastructure.

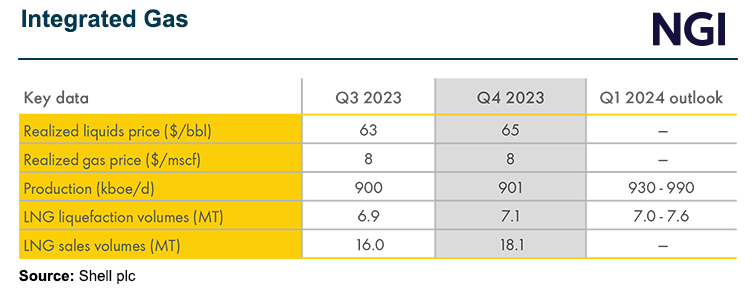

In the Integrated Gas segment, Shell fetched an average realized price in 4Q2023 of $8.00/MMBtu, flat from 3Q2023. Realized liquids prices dipped sequentially to $63/bbl from $65.

Production in the Integrated Gas segment was flat sequentially and down year/year to 900,000 boe/d from 917,000 boe/d.

LNG liquefaction volumes were up 3% year/year to 7.1 million tons (Mt) from 6.9, with sales volumes jumping 13% to 18.1 Mt from 16.82 Mt in 4Q2022. During 2023, LNG liquefaction volumes fell year/year by 5% to 28.29 Mt. LNG sales volumes increased by 2% from 2022 to 67.09 Mt.

For 1Q2024, Integrated Gas production is projected to increase to 930,000-990,000 boe/d on average. LNG liquefaction volumes also are forecast to improve to an average of 7.0-7.6 Mt.

The Upstream segment includes exploration and extraction of crude oil, natural gas and natural gas liquids. It also markets and transports oil and gas, and operates the infrastructure.

Upstream natural gas production available for sale declined year/year in 4Q2023 to 2.95 MMcf/d from 3.07 MMcf/d. Liquids output averaged 1.36 million boe/d, nearly flat year/year. Total production available for sale averaged 1.87 million boe/d, also nearly flat from a year earlier.

On a current cost of supply (CCS) basis, similar to U.S. net profit, Shell earned $474 million (7 cents/share) in 4Q2023, versus $10 billion ($1.47) in 4Q2023. Shell also recorded one-time impairments of $4 billion in the quarter, driven by macro outlooks and portfolio changes.

For the year, CCS came in at $20 billion for 2023 ($2.88/share) versus $42 billion ($5.76) in 2022.

Integrated Gas earnings fell by 20% in 4Q2023 year/year to $1.7 billion. Profits also declined sharply from 2022, down by 68% to $7.0 billion. For the Upstream business, profits increased to $2.2 billion in 4Q2023 from $1.4 billion in the year-ago period.

Total group capital expenditure totaled $24.4 billion in 2023, with spending this year set to average about the same.