With warm air more typical of spring forecast to blanket much of the United States through the first two-thirds of January (at least), natural gas prices for January baseload delivery plummeted at a vast majority of locations.

The West Coast was a glaring exception. Harsh wintry conditions, including historic rainfalls that have caused severe flooding in some areas with more to come, combined with tight supplies and longstanding infrastructure issues to lift prices by more than $30 month/month.

NGI’s January 2023 Bidweek National Avg. ultimately climbed $5.325 month/month to $13.720/MMBtu.

Notwithstanding the huge natural gas price gains out West, the widespread losses that occurred elsewhere across the Lower 48 proved that weather is king in the natural gas market. While last month’s bidweek price increases were tied to cold snaps that permeated the West, central and parts of the East and resulted in surging demand and modest production losses tied to freeze-offs, this month’s freefall can be attributed to the polar opposite (no pun intended).

“Barely one week after Winter Storm Elliott – the most significant natural gas market disruption since Uri – production has recovered fully, extreme Arctic cold has been replaced by excessive warmth and supply adequacy concerns that plagued natural gas for most of the second half of 2022 have evaporated,” said EBW Analytics Group LLC’s Eli Rubin, senior energy analyst.

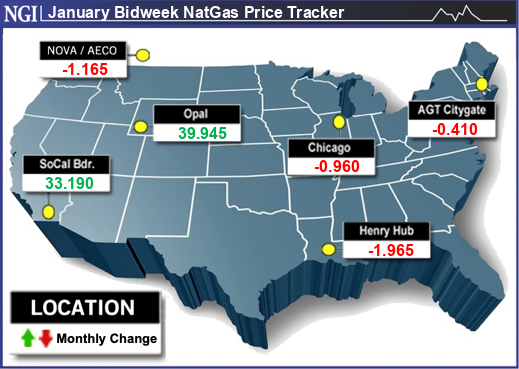

Notably, the $13.720 January 2023 bidweek average is more than double last year’s $6.075 average. However, a closer look at individual prices tells a different story. The benchmark Henry Hub averaged only $4.750 for January bidweek, down $1.965 month/month. For comparison, the January Nymex gas futures contract expired last Wednesday (Dec. 28) at $4.709.

“Further seasonal downside remains likely,” according to Rubin.

Indeed, the pressure is on Old Man Winter to return to provide bulls the much-needed fuel they need to stage a rebound in the gas market. Based on the latest weather models, that may be wishful thinking.

NatGasWeather said what makes the U.S. pattern “emphatically bearish” is recent data maintains a much warmer-than-normal pattern at the end of both the Global Forecast System (GFS) and European Centre (EC) models through Jan. 18-19. Instead, frigid cold remains locked over the northern latitudes.

The longer-range EC model released on Monday suggested colder-than-normal weather in the Lower 48 shouldn’t be expected until the first or second week of February, according to NatGasWeather. However, the firm noted that’s quite far out in time and where colder trends are possible.

“But if cold fails to show better potential soon, strong bearish weather headwinds will continue,” NatGasWeather said.

Indeed, the past week of balmy weather already has taken a dramatic toll on the gas market. In addition to the price deterioration – the February Nymex futures contract settled Tuesday at $3.988 – the warm weather has returned the vast majority of the 15 Bcf of production Elliott wiped out.

Wood Mackenzie said its revised estimate for Friday put output back at around 99.8 Bcf/d, with freeze-offs revised down to around 1.2 Bcf/d. Furthermore, temperatures warmed over the holiday weekend, lifting freeze-off impacts in the Northeast. The firm showed production there at about 34.1 Bcf/d.

“However, impacts are still ongoing in the Rockies concentrated in North Dakota and Montana with around 400 MMcf/d, which we typically see continue into the spring,” Wood Mackenzie analyst Laura Munder said.

Meanwhile, storage inventories also are likely to recover quickly. Elliott’s impact on underground storage was significant. In the first indication of its impact on the supply/demand balance, the Energy Information Administration (EIA) reported a monstrous 213 Bcf withdrawal from storage inventories for the week ending Dec. 23.

There is one more gargantuan withdrawal to get through when the EIA publishes its weekly inventory report on Thursday. Estimates ahead of the report are wide ranging, with some withdrawal estimates greater than 270 Bcf. NGI is projecting a pull of 237 Bcf.

For comparison, only 46 Bcf was withdrawn during the similar week a year earlier and the five-year average pull is 98 Bcf. That means stocks could end 2022 more than 200 Bcf below historical levels.

However, after that, a string of light withdrawals should follow. This ultimately may improve deficits and put stocks closer in line with historical levels, analysts said.

Looking ahead to late January, there could be more supportive signs emerging. Weather, of course, remains a wildcard. Freeport LNG also does, especially after hopes of returning the liquefied natural gas terminal to service failed to materialize.

Freeport indicated the majority of the work to restart operations after a June explosion knocked the 2.38 Bcf/d terminal offline was “substantially complete.” However, after submitting responses to dozens of questions asked by federal regulators in a Dec. 12 request, the company estimates final approval could take longer than expected.

As such, it pushed back its expected restart to mid-January, at the earliest.

However, even with Freeport returning to service, and the possibility of a significant change in the weather later this month, EBW’s Rubin said it would almost certainly be too late to stop the bleeding in the gas market.

“Instead, Nymex natural gas will likely re-price in line with an oversupplied 2023 outlook, foreshadowing further notable downside during 1Q2023,” he said.

West Coast Woes

The bearish sentiment spreading throughout most U.S. gas markets is a far cry from the volatile, record high prices experienced on the West Coast.

A bitter winter made worse by long-standing infrastructure issues, a yearslong drought and lagging storage inventories have combined to wreak havoc on prices throughout California, the Desert Southwest and Rockies. That chaos continued in trading for January bidweek.

In California, SoCal Citygate January bidweek averaged $54.305, up $39.195 from last month. PG&E Citygate shot up $35.440 to $49.520.

With hydroelectric power supplies strained, natural gas has stepped in to fill the void. However, inadequate infrastructure to move gas supplies from regions awash in natural gas – i.e. the Permian Basin – means that lines that do carry gas into the West are running full.

The lack of spare capacity, along with additional flow restrictions anytime there is a maintenance event on one or more of the lines, has fueled gas prices in the region.

It doesn’t help that the continued pull on gas over the past couple of years has prevented a rebuilding of storage inventories in the EIA’s Pacific region made worse by Pacific Gas & Electric Corp.’s reclassification in 2021 of 51 Bcf of gas to base supplies, rather than working gas.

As of Dec. 23, stocks in the region stood at only 165 Bcf, which is nearly 36% below the five-year average, according to EIA.

The dire situation has played out across the Desert Southwest and into the Rockies as well.

KRGT Del Pool January bidweek prices averaged $46.610, up $32.390 on the month. Opal jumped $39.945 to average $51.325, while Northwest Sumas climbed $27.840 to average $42.925.

For comparison, prices across the Northeast – which experiences its highest and most volatile prices in the winter – averaged less than $25 for January bidweek. The most expensive gas in the region was at New England’s Algonquin Citygate, which saw prices slip 41.0 cents month/month to average $23.070.