Against a backdrop of solid demand, possible production cuts and potentially modest August storage injections, natural gas forward prices during the Aug. 1-8 trading period found room to move higher.

Near-term weather forecasts suggested cooler weather for the next seven days in the Midwest and Eastern portions of the country. NatGasWeather said widespread rain from the remnants of former Hurricane Debby would move up the East Coast. While temperature highs are forecast in the 70s to lower 80s there, hot weather is expected to hold over the western and southern reaches with temperature highs from the 80s to 100s.

Further, the firm said sweltering heat is not yet exhausted for the majority of the country in the longer term. Overall, weather patterns remained bullish for the eight- to 15-day period. Fewer cooling-degree days are expected, however.

With more heat on the horizon, front-month fixed prices at the benchmark Henry Hub gained 14.3 cents for the trading period, climbing to $2.115/MMBtu at the close of the span, NGI’s Forward Look data show.

Fixed prices were higher week/week across most regions. Transco Zone 6 non-NY gained 20.0 cents to $1.370, while OGT gained 19.4 cents to $1.686. Transco Zone 5 added 18.4 cents to $2.258.

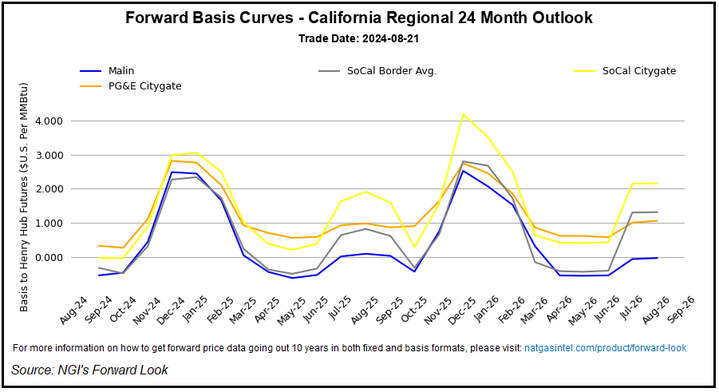

California hubs proved rare exceptions. PG&E Citygate fell 12.9 cents to $2.941 and SoCal Citygate slipped 4.3 cents to $2.439. Another exception was the West Texas regional benchmark Waha hub price, which fell 8.6 cents to negative 7.7 cents.

Basis prices also displayed relatively isolated weakness, as PG&E Citygate September basis fell 27.3 cents to 82.9 cents. Further out on the curve, the balance of summer (September-October) shed 14.3 cents to $2.892. The winter 2024/2025 strip lost 8.6 cents to $5.301.

Natural gas demand remained strong through the trading period as economics favored the fuel for power generation. Gas power burns pushed above the 50 Bcf/d level in August and hit an all-time high of 54.7 Bcf/d to start the month, according to Wood Mackenzie’s initial estimates. The first seven days of August have averaged 51.8 Bcf/d, up about 5.6 Bcf/d year/year.

However, Wood Mackenzie analyst Eric McGuire said natural gas price gains were less likely driven by power demand than by strong production and lower LNG demand.

“We saw some of the highest prints in the power burn data set we have ever seen this summer and the market didn’t care,” McGuire said on the online energy platform Enelyst. Prices remained deflated across the country through extremely hot weather conditions.

“What it did care about was the roughly 4 Bcf/d increase in production from May production levels and the fact that LNG exports really couldn’t get back on their feet all summer with maintenance immediately followed by hurricane Beryl,” McGuire said.

Yet, recent data showed improvement in feed gas demand at domestic liquefied natural gas facilities during the recent week. Wood Mackenzie data on Thursday showed LNG demand averaged 11.8 Bcf/d in the last month and 12.4 Bcf/d in the previous seven days.

On the production side, Wood Mackenzie estimated a 30-day average output of 102.2. Production over the last week was estimated at 102 Bcf/d.

“The key thing for natural gas prices is whether or not they have the ability to stay disciplined and keep the market from overproducing,” Price Futures Group analyst Phil Flynn told NGI.

EQT Corp., the Lower 48’s No. 1 natural gas producer, along with Chesapeake Energy Corp., said they would wait for prices to improve before ramping up activity. More producers may follow.

But EBW Analytics Group senior analyst Eli Rubin said, “Shutting-in production due to low prices is more ‘less bearish’ than ‘overtly bullish,’ as the market attempts to manage oversupply.”

NatGasWeather warned that unless production drops below 100 Bcf/d, natural gas inventory surpluses could continue to decrease at a slow pace heading into peak shoulder season.

Storage Tightening

Despite the slow contraction, however, storage has been tightening. NatGasWeather expects inventory surpluses to decrease further over the next few weeks from 441 Bcf/d to 400 Bcf/d.

Continued tightening of the supply/demand balance could provide added price support. That was confirmed by the latest U.S. Energy Information Administration (EIA) inventory report.

The latest EIA storage data outlined an injection of 21 Bcf natural gas into storage for the week ended Aug. 2.

The build was slightly below expectations. Before the report, estimates ranged from an injection of 16 Bcf to 35 Bcf, with a median of 26 Bcf. NGI modeled a 30 Bcf increase.

The injection was relatively modest compared with a build of 25 Bcf a year earlier and a five-year average increase of 38 Bcf for the week.

September natural gas futures reversed early losses following the reports release. The contract was up 1.9 cents to $2.131 at around 3:00 p.m. ET.

[Lower 48 Natural Gas Market Fundamentals: Join NGI's team of senior markets reporters to understand the supply and demand environment impacting natural gas prices, and where they may be heading into winter and beyond. Tune in to NGI’s Hub & Flow now.]

The latest increase lifted inventories to 3,270 Bcf, putting stocks 248 Bcf above the year-earlier level and 424 Bcf over the five-year average.

“The surprise to me is this is to the tight side again despite the large swing in renewables,” McGuire said.

The EIA report period saw hotter temperatures week/week, but some of that was countered by wind generation jumping 300% and solar strengthening slightly over the same period, NatGasWeather meteorologist Rhett Milne said on Enelyst.

Of note, South Central gas stocks declined by 5 Bcf, including a 7 Bcf draw from salts and a rounded change of 0 Bcf from nonsalt facilities, even with the higher wind output.

CLWS meteorologist Corey Lefkof said that while overall wind output was higher in the country in the review week, it was low in Texas and the Southwest Power Pool.