Natural gas forward prices maintained a bearish tenor in parts of Texas and the West, but an atypical summer storage withdrawal and increased focus on the approaching winter cast a bullish hue elsewhere to send prices broadly higher.

Front month fixed prices at benchmark Henry Hub gained 9.2 cents in the Aug. 8-14 trading period to end at $2.222/MMBtu, NGI’s Forward Look data show.

Fixed prices advanced week/week from the Southeast to the North and across the Central United States. Gains were largest in the Southeast, as Transco Zone 4 added 11.5 cents to $2.461, followed closely by Transco Zone 6 NY in the Northeast, which gained 11.2 cents to $1.513. At Emerson in the Midwest, prices were 9.2 cents higher on the week to $1.654. The Midcontinent’s Northern Natural Ventura hub tacked on 8.9 cents to $1.815.

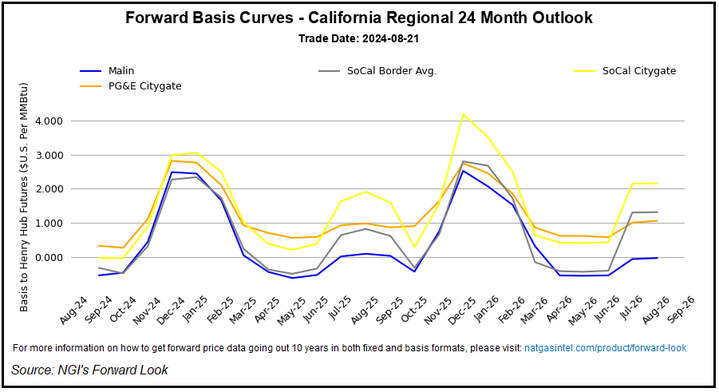

Meanwhile, losses continued in parts of Texas, where a supply glut remained an anchor. The regional benchmark Waha hub slid 34.8 cents week/week to negative 41.3 cents. Price weakness was also noted in California, where SoCal Citygate averaged $2.265, down 14.9 cents on the week.

Storage Improvement

Natural gas inventories held a substantial surplus to historical averages, pulling prices lower through the summer cooling season despite temperatures soaring into the 100s across major consuming regions.

Recent modest weekly storage injections trimmed the surplus to historical averages and contributed to the strengthening along the forward curve.

The latest storage report from the U.S. Energy Information Administration (EIA) outlined a 6 Bcf withdrawal for the week ended Aug. 9. It brought the total supply to 3,264 Bcf, 13% higher than the five-year average.

Reuters and Bloomberg polls ahead of the print showed median injection expectations in the low single digits, while some analysts expected a draw. NGI modeled a paltry 1 Bcf injection.

“There have only been three net summer withdrawals before this week: two in 2006 and one in 2016,” Snapper Creek Energy analyst Kyle Cooper told NGI.

“I think it highlights the power generation on strong electricity growth and continued coal retirements overcoming rising wind and solar capacity,” Cooper said. He also noted that exploration and production companies have again begun to curtail production voluntarily.

Wood Mackenzie pegged production down day/day from 101.3 Bcf to 100.4 Bcf on Thursday. Estimates point to Lower 48 production of 101.2 Bcf/d for the upcoming seven-day period.

Demand Seen Faltering

According to EIA, natural gas consumed for power generation climbed by 9% (4.1 Bcf/d) week/week as temperatures across the United States were above normal.

EBW Analytics Group senior analyst Eli Rubin noted that power sector loads spiked during a scorching start to August, with many key electricity hubs pressing $100/MWh and power sector gas burns topping 50.0 Bcf/d. Adding to gas demand was shallow wind output and cheap gas spurring 5.2 Bcf/d of fuel switching.

“This week, meanwhile, rapidly retreating weather may slash 23 cooling degree days (CDD) week/week — a startling 25% reduction in cooling demand,” Rubin said. He said electricity loads could plunge by as much as 12%, with the steepest losses across the Central and Southeast regions.

“Carryover effects for gas power burns could erase 30-35 Bcf of weekly demand,” Rubin said. He noted that while forecasts may rebound, “It is possible the hottest heat of summer may be in the rearview mirror.”

NatGasWeather forecasts show both the American and European weather models trended cooler on Thursday. The American model shed 13 CDDs, while the European model lost 6 CDDs.

[Want to visualize Chicago Citygate, Henry Hub, Houston Ship Channel or any of our 170+ spot natural gas price indexes? Check out NGI's daily natural gas price snapshots now.]

“There have been changes to timing of swings in national demand, and mainly due to cooler trends for next week as weather systems impact greater portions of the northern and eastern United States,” the firm said. Temperature highs are expected in the upper 60s to lower 80s as weather systems move across the North and East through Aug. 18.

However, the country’s southern half could be “quite hot,” NatGasWeather said. Temperature highs are expected in the 100s over much of Texas “for very strong” demand from the state’s grid operator.

Still, with the fall shoulder season approaching, “The inventory draw and seasonality should become a tailwind to prices as participants start preparing for winter heating demand,” DeCarly Trading analyst Carley Garner told NGI.

Price Futures Group analyst Phil Flynn agreed. “The charts and natural gas look very supportive, so it’s probably a good time to be prepared for winter.”

September New York Mercantile Exchange (Nymex) natural gas futures climbed to an intraday high of $2.301 after the storage print. It was down 2.7 cents to $2.192 at around 2:30 p.m. ET Thursday in profit taking.

Garner said resistance for Nymex gas futures is near $2.40. “If that level is surpassed, $3.00 gas is in play.”