Natural gas forward prices maintained a bullish hue in parts of the West as intensifying heat propelled demand expectations, but robust national supply and mixed weather outlooks fostered bearish sentiment elsewhere. Prices broadly retreated.

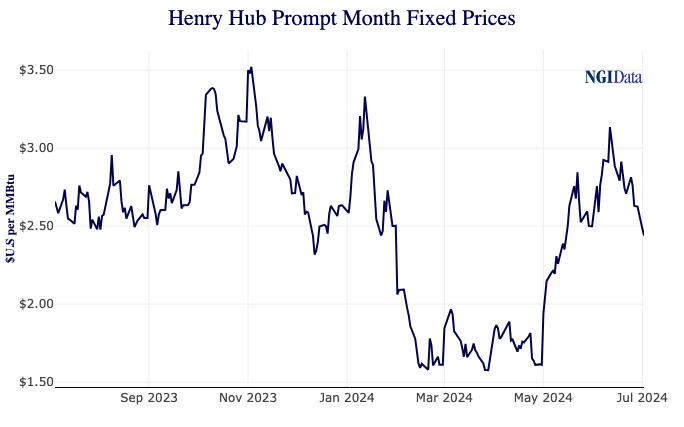

Front month fixed prices at benchmark Henry Hub fell 24.9 cents for the June 27-July 2 trading period to end at $2.440/MMBtu, NGI’s Forward Look data show.

Fixed prices tumbled week/week from the East to the Midwest and into Texas. Florida Gas Zone 3 slipped 28.5 cents to $3.106, while Chicago Citygate shed 32.4 cents to $1.977, and West Texas benchmark Waha lost 59.7 cents to 69.1 cents.

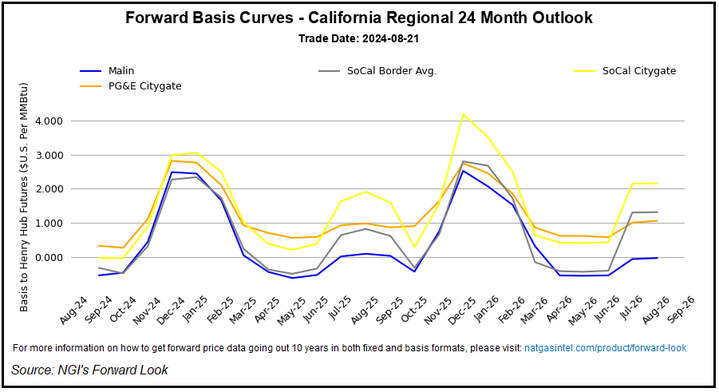

Prices also dipped lower at several hubs in the West, though declines were from relatively high levels – above $3.00 at several California locations. PG&E Citygate bucked the downward trend, rising 16.7 cents to $3.980, according to Forward Look.

National Weather Service (NWS) forecasts heading into the covered period called for searing heat across the southern two-thirds of the Lower 48 for the first half of July. The loftiest temperatures were expected in the deserts of the Southwest and California, where heat had indeed already intensified in early July. NWS data showed above-average heat advancing into the North later in the month, with hotter-than-normal temperatures projected nationally for the balance of summer.

However, chilling rains in the Midwest during the first week of July dampened demand in that key gas-consuming region, and tropical storm activity threatened cooler air and potential power outages to Texas and neighboring states this month. Renewable energy sources also curbed gas demand in Texas as the peak cooling season got underway, Snapper Creek Energy analyst Kyle Cooper told NGI.

“The heat is still impressive, but wind and solar generation have limited natural gas power burns to lower than some had hoped,” Cooper said. But the “primary driver” of the price slump, he said, is rising production that “limits upside.”

Wood Mackenzie on Wednesday pegged the seven-day Lower 48 production average at 101.6 Bcf/d, near highs for the summer so far and well above spring lows in the mid-90s Bcf/d.

High expectations for an active hurricane season also increase the odds of severe storms interrupting LNG deliveries from the Gulf Coast. This comes on the heels of lighter liquefied natural gas volumes in June amid a spate of maintenance events. The National Hurricane Center said Wednesday that Hurricane Beryl, while losing some of its power, had the potential to make landfall in southern Texas by Monday.

“Growing production has certainly not been offset by any increase in feed gas flows to LNG terminals, and that’s also hurting the situation,” Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI.

Futures To Steady?

Production momentum – and continued stout supply in underground storage – weighed down Nymex natural gas futures through the second half of June and the start of this month.

“Natural Gas has been stinking up the energy patch for the past few weeks,” Mizuho Securities USA Energy Futures Director Robert Yawger said. “And my observation is that many traders are not prepared to stick their necks out and take the leap of faith necessary” to launch a rebound.

He said technical support for prompt month futures was bound to kick in at some point in the first half of July, but a sustained rally was dependent on forecasts for exceptional heat bearing out.

Cooper agreed, though he added that even moderately above-average July temperatures would galvanize solid cooling demand. “I think the heat helps to keep prices from a continued freefall,” Cooper said. For the week ahead, “a choppy market near $2.50 would not surprise me.”

After several losses over recent sessions, the August futures contract on Wednesday shed another 1.7 cents and settled at $2.418.

Blair said the market had entered oversold territory and was due to at least level off. “Have to say that I was a bit surprised by the precipitous fall,” he said.

Blair also noted that forecasts call for elevated cooling demand through the summer, and production, while higher, is still well below the 107 Bcf/d record reached last winter.

Additionally, Blair said that, heading into July trading, the weekly Commodity Futures Trading Commission’s Commitment of Traders Report showed that the managed money sector was “very long” on natural gas – by a ratio of roughly 2-to-1.

“So it would not be surprising to me that some of this precipitous price drop” in recent sessions “may be in part due to the managed money sector reducing long positions,” Blair said. “And, if that is the case, then at some point in time they may be looking to be buyers once the market stabilizes.”

Storage Improvement

What’s more, a surplus of gas in storage relative to the five-year average continues to narrow and, barring a further jump in output, should further dwindle through this month. Heat “is most likely to be more on the above-normal side – and certainly no one is expecting below normal,” Blair said.

The U.S. Energy Information Administration (EIA) on Wednesday reported an injection of 32 Bcf into underground natural gas inventories for the final week of June. It was slightly below the 33 Bcf median found by a Reuters poll and, more important in terms of addressing the surfeit to historical norms, it was far below the five-year average build of 69 Bcf. The surplus stood at 19% for the June 28 period, down about two percentage points from the prior week.

Nine of the last 11 weekly EIA prints have lagged the historical average, trimming the surplus from 37% in mid-April. “The storage overhang will continue to narrow as we continue with hot weather,” Blair said.

Early estimates submitted to Reuters for the week ending July 5 ranged from additions of 46 Bcf to 62 Bcf, with an average increase of 52 Bcf. That compares with a five-year average injection of 57 Bcf.

Price Futures Group senior analyst Phil Flynn echoed Blair and said Mother Nature likely “would be the major factor driving prices” for the rest of summer.