Natural gas forwards underwent mixed changes during the May 30-June 5 trading period, though numerous hubs pushed higher as forecasts drove optimism around cooling demand potential into the second half of June.

July fixed prices at benchmark Henry Hub climbed 9.4 cents for the period to exit at $2.763/MMBtu, according to NGI’s Forward Look.

June Heat Rising

Nymex natural gas futures whipsawed for much of the May 30-June 5 period, though forecasts as of Thursday were pointing to toasty temperatures over key markets later this month, stirring bullish sentiment.

Both the American and European weather models as of Thursday were showing increased coverage of hotter weather during the June 15-22 time frame, according to NatGasWeather.

This would occur as “upper high pressure expands to rule most of the U.S. with highs of mid-80s to 100s, and with hotter trends over the eastern U.S. the past few days,” NatGasWeather said.

A hotter-than-normal pattern for the Lower 48 through the back half of June could shrink the Lower 48 storage surplus versus the five-year average toward 450 Bcf, according to the firm.

“Longer term, the expectation is that by late fall, surpluses will be in a much tighter situation, and this is likely part of the reason prices have rallied off early spring lows the past five to six weeks,” NatGasWeather said.

The supply outlook, meanwhile, remains a source of major uncertainty heading into the summer cooling season, according to EBW Analytics Group analyst Eli Rubin.

Signs indicate EQT Corp. “has already returned curtailed supply” to the market, while Chesapeake Energy Corp. “has guided toward reduced well turn-in-lines offering steadily lower production until later this year,” Rubin said.

Overall, “production is likely to rise — but may not do so immediately,” the analyst said.

Given the “likelihood of bullish demand,” the potential for “only minor increases” in supply points to bullish pressure on Nymex futures moving forward, according to Rubin.

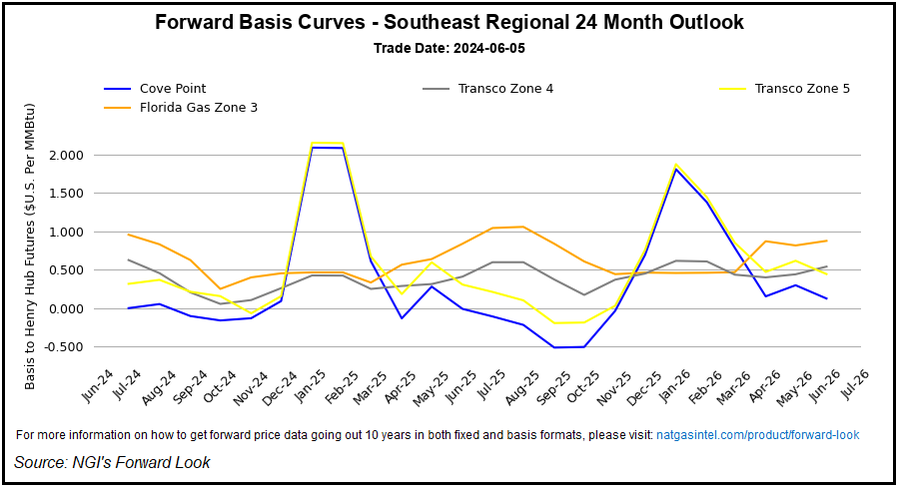

Southeast Basis Swings

Looking at regional price trends, summer basis differentials came under downward pressure at a number of Southeast and Mid-Atlantic hubs during the May 30-June 5 period as pipeline maintenance updates shifted the supply outlook.

Transco Zone 3 St. 65 July basis shed 20.4 cents week/week to end at plus-40.9 cents. Transco Zone 4 similarly dropped to plus-62.4 cents for July basis, a 16.2-cent swing lower, Forward Look data show.

Transcontinental Gas Pipe Line (Transco) notified shippers Wednesday that it had started “return to service work” at the Station 60 compressor. The compressor station in East Feliciana Parish, LA, has been running at a reduced rate since early May, crimping south-to-north flows and putting upward pressure on pricing points downstream. The operator estimated a return to service date of June 21.

Following an incident at Station 60 that occurred during maintenance in early May, the location has seen capacity restricted to around 775,000 MMBtu/d, or a drop of around 590,000 MMBtu/d from capacity prior to the restriction, according to Wood Mackenzie analyst Kevin Ong.

“Since the start of the maintenance, prices at both Transco Zones 4 and 5 have been at elevated levels both nominally and when compared to Henry Hub,” Ong said. “This suggests this maintenance has put upward pressure on prices in these two zones, and that prices should decrease once the maintenance ends.”

“Since the start of the maintenance, prices at both Transco Zones 4 and 5 have been at elevated levels both nominally and when compared to Henry Hub,” Ong said. “This suggests this maintenance has put upward pressure on prices in these two zones, and that prices should decrease once the maintenance ends.”