Demand in the crosshairs of the approaching fall held enough support Monday alongside signs of tighter supply to drive natural gas prices higher.

At a Glance:

- Futures rally

- Heat blazes

- Cash mixed

By Jodi Shafto

onDemand in the crosshairs of the approaching fall held enough support Monday alongside signs of tighter supply to drive natural gas prices higher.

October Nymex natural gas futures settled higher Thursday on some bullish implications from the latest storage data and potential lingering strong demand on the possibility that hot weather may continue through September.

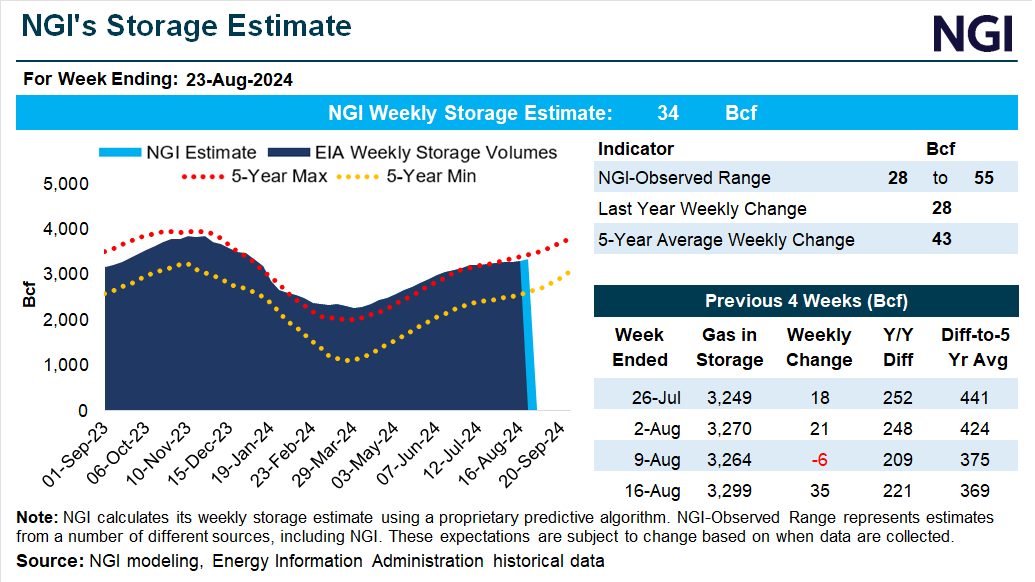

Natural gas futures reversed early steeper losses but held the downside following the latest storage data, which outlined a largely expected injection for the week ended Aug. 23.

In its first session at the front of the curve, the October Nymex gas futures contract early Thursday was lower and in a holding pattern amid an evolving supply/demand outlook.

Gasping on its final day as the lead contract, September Nymex natural gas futures pushed back against early losses to a $1.856/MMBtu low and rolled off the board with a gain.

Weak natural gas prices through most of 2024 challenged the industry’s profitability, but they helped to dramatically ease the pace of U.S. inflation and, by extension, nudged the Federal Reserve (Fed) to the doorstep of interest rate cuts.

The U.S. oil and gas sector maintained robust profits and upstream capital expenditures (capex) in 2023, despite a substantial drop in commodity prices, according to a new analysis by Ernst & Young LLP, aka EY.

Purchase a subscription or enter your email address to access.

By submitting my information, I agree to the Privacy Policy, Terms of Service, and to receive offers and promotions from NGI.

Already an NGI Subscriber? Sign in