Natural gas futures forged upward through early afternoon trading on Wednesday, with the prompt month headed toward a sixth gain in seven sessions.

Here’s the latest:

- September Nymex contract trading up 6.1 cents to $2.209/MMBtu as of 2:20 p.m. ET

- Market braces for anemic print with Thursday’s Energy Information Administration (EIA) storage report

For the EIA result covering the week ended Aug. 9, NGI modeled a 1 Bcf build. If realized, it would fall far from the 43 Bcf five-year average. Polling by both Reuters and Bloomberg showed some analysts expected a withdrawal.

While still seasonally oversupplied, “chances for a rare midsummer weekly withdrawal tomorrow — and a possible third straight bullish EIA surprise — may offer” further “near-term upside for Nymex gas,” said EBW Analytics Group’s Eli Rubin, senior analyst.

He noted persistent heat in the West and South. Texas, in particular, is seeing extreme highs this month alongside erratic wind generation, he said.

On a year-to-date basis, wind generation measured by the Electric Reliability Council of Texas “ticked higher by 1.6% relative to January-August 2023,” Rubin said. “This change is not evenly distributed, however, with weak wind output in winter and summer, and very high wind figures in the spring. In July and August, for example. Texas wind generation is off” 10% year/year. “From a natural gas perspective, this decrease is equivalent to 0.25 Bcf/d.”

Should wind falter further in August, Rubin added, “it may pose substantial power price upside risks with lost wind replaced by inefficient combustion turbines, creating a steeper increase in the call on natural gas power generation.”

As of Aug. 2, natural gas in storage stood at 3,270 Bcf. That was 15% above the five-year average, but down from a 2024 high of 40% in March. Lighter production in recent weeks contributed to the supply/demand balance improvement.

- Wood Mackenzie pegs Wednesday production at 100.6 Bcf/d, down from the 30-day average of 102 Bcf/d.

- U.S. export terminals to receive around 12.5 Bcf of feed gas Wednesday, down from recent highs above 13 Bcf/d, per NGI data

Gelber & Associates analysts in large part attributed the slower output levels to maintenance work in Appalachia. However, they said, “if levels remain stagnant there well beyond expected maintenance timelines” – into the fall season – “it may indicate that producers have made more permanent cuts to output.”

The Gelber analysts said Sabine Pass LNG was “primarily responsible” for the decline in liquefied natural gas volumes, though it showed signs of an uptick on Wednesday.

Otherwise, export demand is holding steady, with calls for U.S. gas from both Asia and Europe as both continents begin to prepare for the coming winter.

- Cash prices at NGI’s Henry Hub averaging $2.165, up 2.0 cents, according to NGI’s MidDay Price Alert

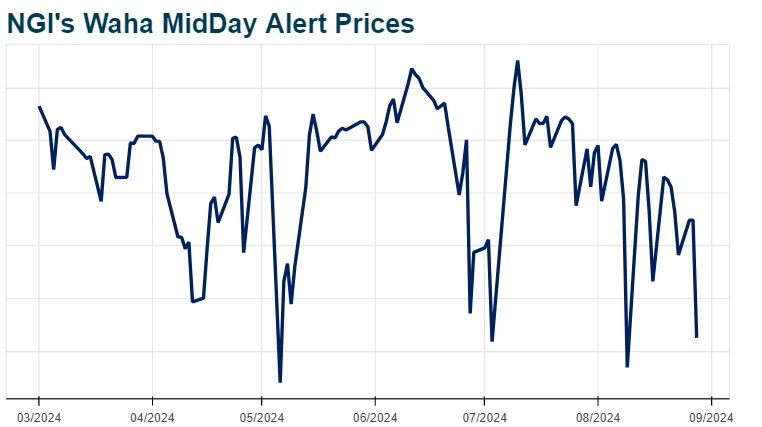

- Waha down 3.5 cents to negative 39.5 cents amid protracted fallout from a supply backup

Cash prices advanced for a third time this week, supported by lighter production and forecasts for widespread heat. Weakness in West Texas kept gains in check, however.

NatGasWeather said national demand was essentially average this week “due to comfortable temperatures across much of the northern half of the U.S.” offsetting “very warm to hot” conditions across the South.

Notably, the firm’s outlook called for “hot high pressure to expand over the interior U.S. late in the week through early next week with highs of upper 80s to 100s for strong national demand.”

Meanwhile, Hurricane Ernesto, upgraded Wednesday, was also gathering momentum in the Atlantic Ocean. But it was projected to veer north toward Bermuda and avoid the U.S. East Coast, said AccuWeather meteorologist Alyssa Glenny.