Natural gas futures rallied early Tuesday, bolstered by late August heat forecasts and expectations for a paltry storage result. However, after five days of gains, traders took profits by midday and sent the prompt month lower.

Spot prices inched ahead at midday, bolstered by a recovery in West Texas, where prices remained negative but far off recent lows caused by a Permian Basin supply glut.

Here’s the latest:

- September Nymex gas contract down 3.9 cents to $2.150/MMBtu as of 2:20 p.m. ET

- National Weather Service (NWS) data show mixed near-term outlook but more heat ahead

NWS forecast ongoing comfortable temperatures in the 70s and low 80s across northern markets through the current trading week, offsetting continued strong heat in the South and West. But the forecaster’s data showed lofty temperatures enduring across the South and spreading into the North next week.

However, after power outages delivered to the East Coast last week by the former Hurricane Debby, AccuWeather forecasters cautioned that another tropical storm had developed in the Atlantic Ocean this week. Tropical Storm Ernesto had potential to build up to hurricane strength as it passes Puerto Rico by midweek, they said. As of Tuesday, it was not expected to strike the Lower 48 directly, but its ultimate course could shift, the forecasters warned.

AccuWeather meteorologist Alex DaSilva said sea-surface temperatures in the Atlantic are well above average and highly conducive to the formation of powerful hurricanes that can deliver cooler air, flooding rains and power outages far from the eye of storms.

He reminded that AccuWeather, the National Hurricane Center and others have warned that the 2024 Atlantic hurricane season is expected to prove highly active. "Ocean temperatures across the Atlantic Basin as a whole remain near record levels," DaSilva said.

- U.S. LNG export terminals slated to receive about 12 Bcf/d of feed gas Tuesday, down slightly from recent activity but still close to August highs, per NGI data

- Wood Mackenzie estimates production at 100.6 Bcf/d, down from 30-day average of 102.1 Bcf/d

Liquefied natural gas send-outs were slowed in July by hurricane fallout. While choppy, feed gas demand from export terminals has rebounded in August. Calls from both Asia and Europe for American gas are steady as those continents begin to look toward needed supplies for the coming winter. Europe nearly filled its gas in storage this summer. But its capacity for storage is limited, and its dependence on U.S. LNG has surged amid the Russia-Ukraine war and European countries’ tenuous ties with the Kremlin’s energy complex.

“That is very good for any exporter of U.S. LNG to European markets,” RBN Energy LLC analysts said.

Production, meanwhile, is relatively soft this month amid a spate of maintenance events. But after those projects, output is expected to ramp back up to near summer highs above 102 Bcf/d.

- NGI’s Spot Gas National Avg. at $1.630, up 1.5 cents, according to MidDay Price Alert

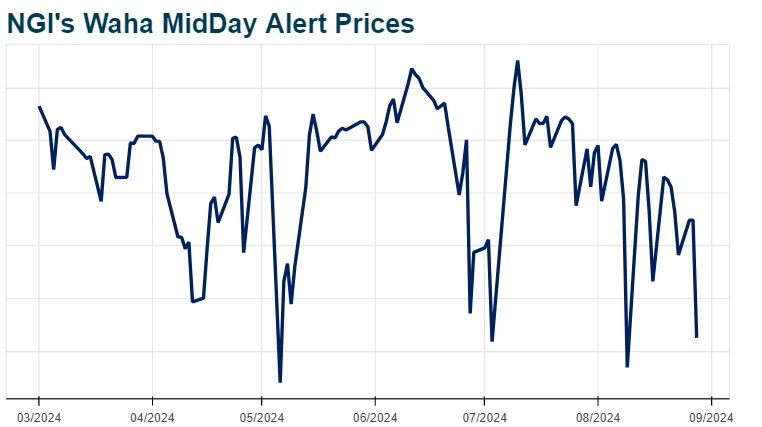

- Permian Basin benchmark Waha rose 69.5 cents to negative 36.0 cents; S. LA Regional Avg. down 2.5 cents to $2.030

Because of the lighter overall output and intense heat in the South Central, analysts are looking for a seasonally small storage print with the U.S. Energy Information Administration’s (EIA) inventory report on Thursday. Those factors added a boost for cash prices a second day this week.

NGI modeled a 1 Bcf build for the week ended Aug. 9. That is far from the 43 Bcf five-year average. Preliminary estimates submitted to Reuters ranged from a withdrawal of 8 Bcf to an injection of 30 Bcf, with an average increase of 19 Bcf.

As of Aug. 2, natural gas stockpiles totaled 3,270 Bcf, or 15% above the five-year average. But that surplus has dwindled from a 2024 high of 40% in March after a mild winter.

On the maintenance front, Kinder Morgan Louisiana Pipeline said it planned work at a compressor station in Acadia Parish, LA. Wood Mackenzie said this could impact southbound capacity on Thursday and again Aug. 18. The work interruptions could limit flows to Sabine Pass LNG in southern Louisiana.