While U.S. LNG supply is poised to skyrocket by the end of the decade, little new export capacity will come online this year, and additional volumes are expected to climb slowly through next year and into 2026 as projects work through various setbacks.

Currently, the United States has about 14.5 Bcf/d of liquefied natural gas export capacity. By the end of 2024, EnergyAspects expects that to rise to 14.9 Bcf/d. The capacity increase is largely due to the ongoing ramp up in commissioning Plaquemines LNG, which had feed gas flows average about 10 MMcf/d over the last week.

Plaquemines is expected to have between four and six of its modular trains in the commissioning phase and potentially its first cargo loaded by the end of this year. That could boost U.S. export capacity by around 300 MMcf/d, said EnergyAspects’ David Seduski, head of North America Gas.

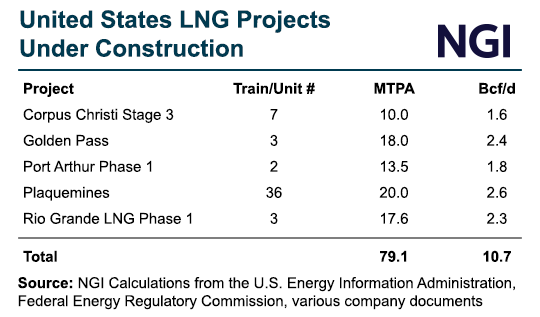

Cheniere Energy Inc.’s 10 million metric tons/year (mmty) Corpus Christi Stage 3 expansion project makes up the other part of the 2024 capacity increase. Cheniere expects to produce first LNG by the end of this year, and is planning to introduce natural gas to Train 1 in two months, management said in a call with analysts last week.

Although Stage 3 will ultimately add 1.6 Bcf/d to the terminal's export capacity, EnergyAspects anticipates only a small addition to U.S. feed gas demand during the last three months of the year.

Moreover, Rystad Energy estimated Plaquemines LNG could be the only U.S. project to start up by the end of the year.

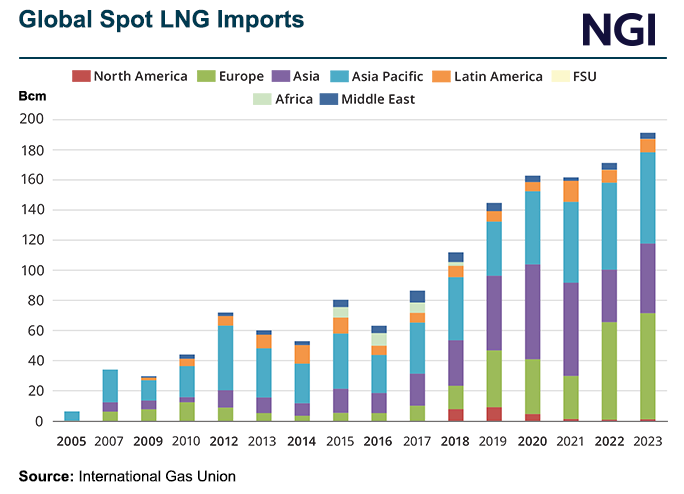

“This year has turned out surprisingly tight – even more than 2023 – going by current Dutch Title Transfer Facility and Asian spot prices,” Rystad Energy’s Kaushal Ramesh, vice president of LNG and Power Markets Research, told NGI.

Between existing and under construction facilities, nearly 25 Bcf/d of U.S capacity will be online by the end of the decade. More capacity in Mexico that would utilize U.S. feed gas is also under development.

Rystad expects 2025 to be only marginally weaker than 2024 because the supply outlook has tightened materially in the past few months between delays in final investment decisions for additional projects in addition to setbacks for ongoing construction.

The 18 mmty Golden Pass Terminal LLC project, a joint venture between ExxonMobil and QatarEnergy has faced several delays over contractor issues, but LNG production is now expected to start around the end of 2025, according to ExxonMobil management.

[Lower 48 Natural Gas Market Fundamentals: Join NGI's team of senior markets reporters to understand the supply and demand environment impacting natural gas prices, and where they may be heading into winter and beyond. Tune in to NGI’s Hub & Flow now.]

LNG developer, NextDecade Corp. said Phase 1 construction for trains 1, 2 and 3 is continuing at its Rio Grande LNG project, despite a federal appeals court overturning the project’s Federal Energy Regulatory Commission authorization last week. The decision could create delays for the project.

Additionally, Sempra Infrastructure’s 3 mmty Energía Costa Azul (ECA) LNG Phase 1 in Mexico has been delayed. The start of commercial operations has been pushed back from the summer of 2025 to the spring of 2026 amid labor and productivity challenges.

EnergyAspects forecasts that by the end of 1Q2025 the capacity gains at Plaquemines and Corpus Christi Stage 3 will accelerate as utilization ramps up further and more of the trains at each facility come online.

Total U.S. export capacity is forecast by the end of 1Q2025 to stand at 15.5 Bcf/d, before rising to 18.2 Bcf/d by the end of that year.

“That steep acceleration includes delays at Golden Pass as well, so the forecast has decreased in recent weeks,” Seduski told NGI.