September Natural Gas Futures Stumble into Final Session

The September Nymex gas futures contract on Wednesday limped along early on its last day at the front of the curve. It was down 1.1 cents to $1.893/MMBtu as of 8:40 a.m. ET.

The September Nymex gas futures contract on Wednesday limped along early on its last day at the front of the curve. It was down 1.1 cents to $1.893/MMBtu as of 8:40 a.m. ET.

With mixed weather patterns and a government inventory update only hours away, natural gas futures traded lower early Thursday.

Natural gas futures traded in a narrow band early Wednesday as traders contemplated favorable late-summer fundamentals alongside the specter of fall weather and the inevitable swoon in cooling demand that it delivers.

Natural gas futures were near even ahead of today’s government inventory report. Analysts were looking for an unusually small increase – or a withdrawal from storage.

Natural gas futures hovered in a narrow but positive range to launch trading Wednesday, with bulls focused on late August heat, lower production, and forecasts for an anemic storage print.

Natural gas futures were up early Friday and headed toward a fourth consecutive day of gains as traders digested a bullish storage print, lighter production estimates and a looming heat wave.

Natural gas futures searched for direction as Thursday’s session got underway, with market participants contemplating a mixed weather outlook and awaiting the latest government inventory data.

The market in early trading Friday appeared to be focused on the bearish leanings from revisions in the latest storage data and revised weather forecasts, including a cooler change in the second half of June, dragging prompt-month natural gas futures lower.

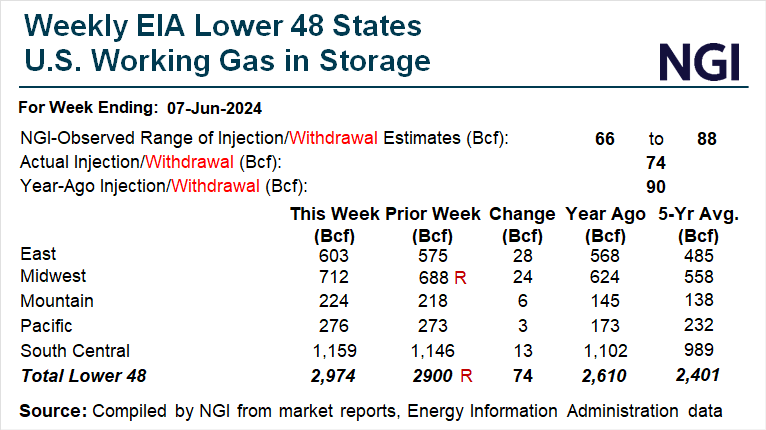

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 74 Bcf of natural gas into storage for the week ended June 7. The result was in line with expectations, but a bearish revision to last month’s storage levels sent futures lower.

Prompt month natural gas futures continued to slide in early trading Thursday as higher production volumes are butting up against hotter weather and an expected trimming of the storage surplus.