Natural gas futures tried to shake off a stronger-than-expected government inventory print Thursday but settled lower as benign weather and LNG hiccups weighed.

At A Glance:

- EIA reports 92 Bcf injection

- West Texas cash flips negative

- Freeport LNG stays down

Following a nearly 16-cent decline, the May Nymex contract settled down 1.5 cents day/day at $1.638/MMBtu on its penultimate day as the front month contract. The contract managed to trade slightly positive in the late morning but quickly sank lower in topsy-turvy trading.

Meanwhile, the June contract, which takes over after Friday’s close, rose 0.7 cent to $1.986.

NGI’s Spot Gas National Avg. lost 14.0 cents to $1.165. Every region posted declines, including West Texas that fell back into negative territory.

U.S. natural gas markets are in the slow shoulder season period marked by mild weather-driven demand and rising inventory levels ahead of the summer season. Until higher cooling demand arrives, the restraint in activity by exploration and production companies has been a main source of support for prices, especially with liquefied natural gas exports recently stumbling.

Lower 48 natural gas production on Thursday held between 97.5 Bcf/d to 98.3 Bcf/d, down around 1.7 Bcf to 2.5 Bcf/d from year-ago levels, according to Wood Mackenzie and Bloomberg estimates. Executives with EQT Corp., the largest U.S. gas producer, on Wednesday said industry would be patient before increasing output.

With support from output cuts by EQT and others, the May contract has mostly hovered in the $1.70s in recent weeks, and early this month it probed toward $2. The contract mounted a rally early this week as LNG exports rebounded, but exports have since slowed. The contract tumbled below $1.70 on Wednesday.

“The market looks like it’s in a range,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI. “It’s trying to get some momentum to the upside, but it’s struggling. It’s waiting. Eventually there will be more demand, and you can see that in the forward prices for the summer months. We’re not seeing those fundamentals right at the moment.”

Summer-like cooling demand may not arrive until the second half of May. Near-term forecasts remained bearish, pointing to mild temperatures for the first half of May, according to NatGasWeather. For this weekend through May 8, models showed “very pleasant highs of 60s-80s besides locally hotter 90s in Texas and the Southern Plains and slightly cooler 50s across the unsettled Northwest,” the forecaster said.

Longer-range modeling for the May 9-17 timeframe pointed to continued light weather-driven demand. There was some potential for cooling degree day gains “as heat slowly builds over the southern United States,” NatGasWeather added.

Storage Surpluses

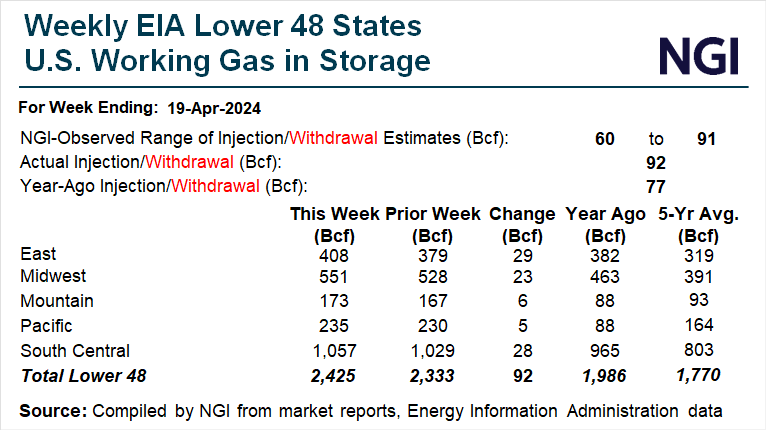

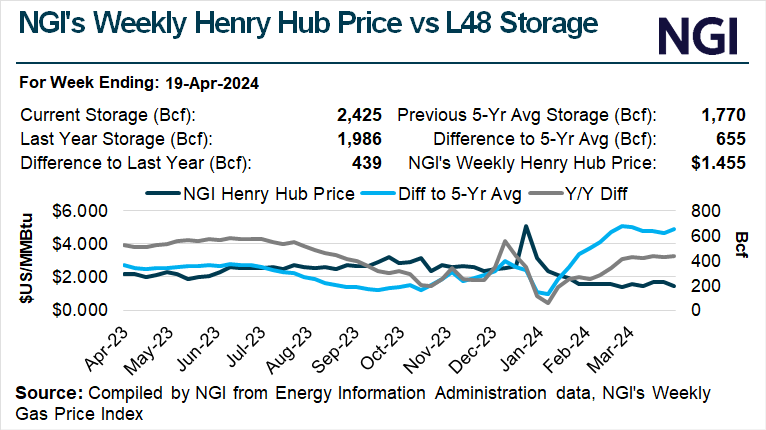

The U.S. Energy Information Administration (EIA) on Thursday reported a bigger-than-expected 92 Bcf injection for the week ended April 19.

The reported build was higher than the five-year average of 59 Bcf and the year-ago injection of 77 Bcf. The EIA print increased Lower 48 inventories to 2,425 Bcf, swelling the surplus to 655 Bcf, or 37% above the five-year average.

Prior to Thursday’s report, NGI modeled an 86 Bcf injection. A Reuters poll spanned injection estimates of 60 Bcf to 89 Bcf, with a median build of 89 Bcf. Bloomberg’s survey generated a median of 83 Bcf.

Strong wind and solar generation helped drive the build, NatGasWeather meteorologist Rhett Milne said on the online energy platform Enelyst.

Wind’s strength was expected to continue to help add to gas storage gains. “With weather systems tracking into the central United States the next several days, wind energy generation will be near highs of the year,” Milne said. “Winds will moderate next week but still be decently strong.”

Looking ahead to the week ending April 26, early estimates submitted to Reuters ranged from injections of 42 Bcf to 95 Bcf, with an average increase of 47 Bcf.

“Temperatures are so comfortable next week and wind energy generation so strong the next several days, we could be looking at a 100 Bcf build for the EIA report,” NatGasWeather said.

LNG Woes

U.S. feed gas usage for LNG exports fell to around 11.3 Bcf Thursday, according to NGI’s North American LNG Export Flow Tracker. In addition, Wednesday’s initial estimate of around 12.4 Bcf was revised lower to around 11.9 Bcf.

One factor behind the LNG slowdown was the Freeport terminal again going offline after its third train tripped Tuesday. In a filing to Texas regulators, the plant operator said the train had restarted. But with feed gas flows of around 55 MMcf/d over the past two days, that implies “they are only flowing enough gas to run onsite auxiliary power rather than flowing to any of the liquefaction units,” Criterion Research’s James Bevan, vice president of Research, said on Enelyst.

In addition, flows to other terminals have also slowed down, including to Corpus Christi and Sabine Pass. In addition, Calcasieu Pass “seems to be testing higher flows over the past few days,” Bevan said.

Meanwhile, Venture Global LNG Inc. introduced some gas Wednesday to the first phase of the 13 million metric ton/year Plaquemines LNG facility southeast of New Orleans. Earlier in the week, federal regulators granted permission to flow gas to the gas gate.

Tudor, Pickering, Holt and Co. in a recent note said progress at Corpus Christi Stage 3, Plaquemines and for the first phase of the Golden Pass export terminal could tighten market balances into early 2025.

Spot Market Stumbles

Extending declines from the past two days, physical cash prices moved lower on Thursday amid weak weather-driven demand and Freeport’s woes again capping demand for Permian Basin gas.

Prices in West Texas flipped back to negative at all but one hub on Thursday. The benchmark Waha hub declined 37.5 cents day/day to average a negative 31.0 cents. Oneok WesTex fell 11.0 cents to average 40.0 cents.

Maintenance on pipelines in the Permian has cut its flows to LNG terminals and consuming regions in the West. Permian output was estimated at 15.9 Bcf on Thursday, down about 0.9 Bcf day/day, Bloomberg data show.

In Arizona/Nevada, El Paso S. Mainline/N. Baja fell 27.5 cents to 95.0 cents. In California, SoCal Border Avg. lost 21.5 cents to $1.050.

Elsewhere, prices were mostly down as mild spring weather depressed demand. National Weather Service (NWS) forecasts called for severe thunderstorms across the central portion of the country and a further round over the weekend. Such storms bring heavy rains but not much gas demand as the systems tend to cool down temperatures. Above-average warmth could be expected in the Southern Tier states into Friday, NWS said.

Below normal temperatures over Chicago and New York City Thursday were expected to moderate heading into the weekend, according to Maxar’s Weather Desk. Lows in the 30s and 40s in Chicago on Friday were expected to warm into the 60s by the weekend, while New York could see a high of 76 by early next week, Maxar said.

In the Midwest, Chicago Citygate fell 11.5 cents to $1.250. In the Northeast, Transco Zone 6 non-NY fell 20.5 cents to $1.325.