Chesapeake Energy Corp. and Southwestern Energy Co., longtime rivals for control in the Lower 48 natural gas patch, agreed to merge Thursday in a combination valued at $7.4 billion, bringing together their estimable resources in Appalachia and the Haynesville Shale.

Total natural gas production, which comprises 92% of the combined output, was 7.9 Bcfe/d net in 3Q2023. Together, the companies also control 5,000-plus gross locations and an estimated 15 years of inventory.

The combined position covers 1.8 million net acres, including 650,000 in the Haynesville, 650,000 in Pennsylvania and 530,000 in Ohio/West Virginia. If all goes to plan, the tie-up could be completed by mid-year.

"This powerful combination redefines the natural gas producer, forming the first U.S-based independent that can truly compete on an international scale,” said Chesapeake CEO Nick Nell’Osso, who would lead the merged company. “The union creates a deep inventory of advantaged assets adjacent to high demand markets, allowing for the application of proven operational practices and the power of an investment grade quality balance sheet to drive significant synergies benefiting energy consumers and shareholders alike.

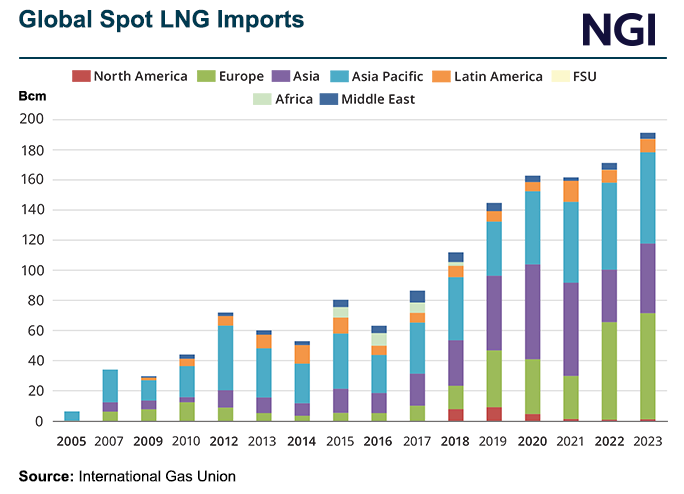

“The world is short energy, and demand for our products is growing, both in the U.S. and overseas. We will be positioned to deliver more natural gas at a lower cost, accelerating America's energy reach and fueling a more affordable, reliable, and lower carbon future.”

Southwestern CEO Bill Way said the combination would “drive improved margins and returns from our highly complementary portfolios through enhanced scale, capital allocation flexibility, and access to premium markets to supply growing global natural gas demand.”

Achieving ‘Great Things’

Dell’Osso and Way discussed the merger during a conference call on Thursday.

The tie-up, said Way, “provides an opportunity to achieve great things that neither company could do on a standalone basis. While there are many similarities in our asset bases and the operating practices, the integration of these two special cultures will allow the best of both to rise to the top to enhance returns and progress our competitive advantages. The benefits of scale are undeniable today.”

The U.S. oil and gas industry, the Southwestern chief noted, has of late “been consolidating into larger, financially stronger enterprises with best-in-class operating and environmental practices.” The Chesapeake-Southwestern merger provides “an increased ability to serve domestic and international end users” with low-emission gas supply.

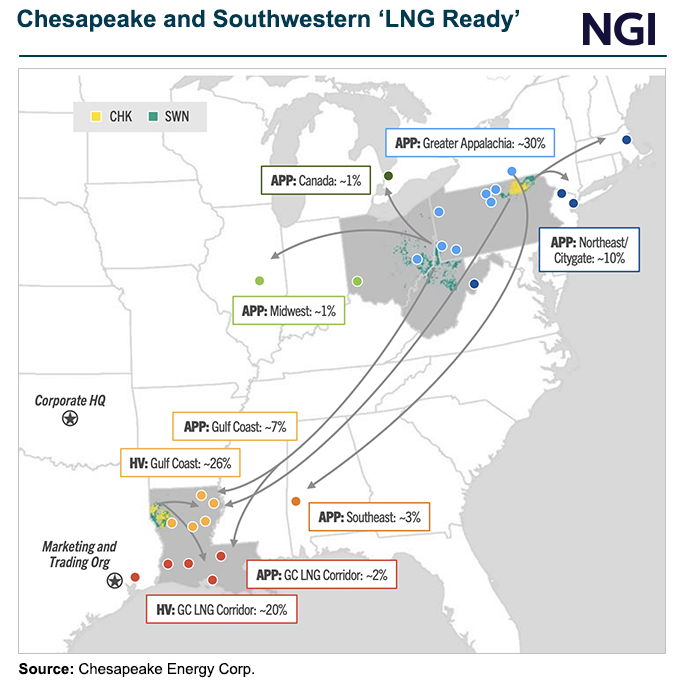

Once the merger is completed, a “global marketing and trading presence” is planned in Houston to expand the LNG marketing and trading business, thus enabling the new company to reach more markets and mitigate price volatility.

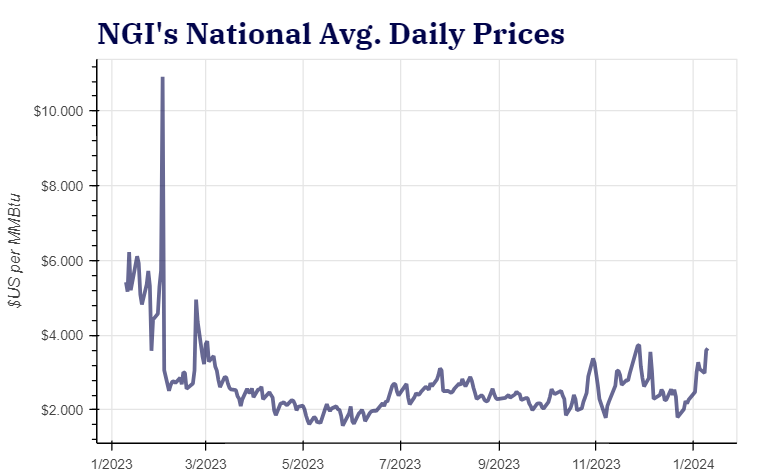

Henry Hub futures and cash prices lost ground over the course of 2023 amid record production and generally mild weather. However, aside from a decline Wednesday, prompt month futures posted gains every other session so far in 2024, in part because of enduring LNG demand strength. NGI’s Spot Gas National Avg. is also up notably since the start of this year, bolstered recently by the arrival of bitter cold temperatures and rounds of snowstorms.

‘LNG Ready’

Dell’Osso told analysts that the new company “will have unrivaled access to premium markets and the flexibility to seamlessly move capital and best operating practices across two premier basins to create capital efficiencies, maximize returns and reduce risks.

“We will have flexibility across basins, with access to more than 25 unique sales points to ensure the best prices for our products and reliable delivery for customers.”

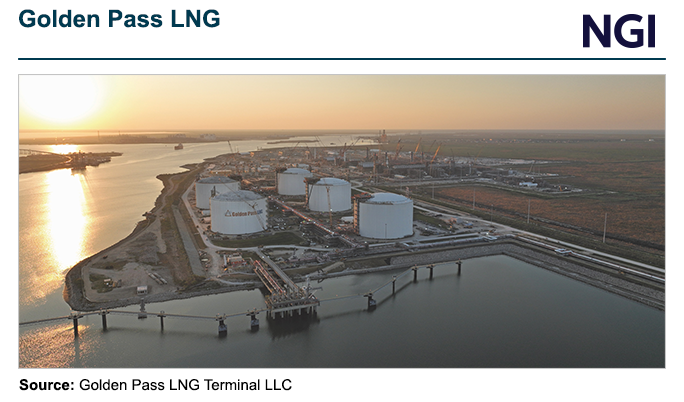

The new company “will be in the driver's seat to supply lower cost lower carbon energy to meet growing global LNG demand,” Dell’Osso said. “By combining our companies, we are LNG ready. We expect to ultimately link up to 20% of our production to international pricing to reprice our molecule to the global markets, which will enhance revenues and reduce pricing volatility.” Chesapeake has cut several liquefied natural gas deals, including one for the soon-to-be completed Golden Pass export terminal under construction on the Texas coast. Management late last year said it was working to link more of its Haynesville and Marcellus Shale supply to international benchmarks.

During the 3Q2023 call in November, Way said Southwestern was “shifting toward an improving macro environment, driven primarily by growing LNG demand.”

Chesapeake was co-founded by Aubrey McClendon, a brash leader who was at times dogged by unsavory headlines. McClendon made big deals and big statements on his way to creating, for a time, the No. 1 U.S. natural gas producer.

A masterful champion for U.S. natural gas during his tenure, McClendon was forced to resign in 2013. He died in 2016.

Dell’Osso, who had worked with McClendon and was the long-time CFO, took the helm in 2021. Way joined Southwestern in 2011 as COO and was tapped as the chief executive in 2016.

During the call Thursday, Dell’Osso also shared plans on how the new company would maximize the value of the combined production by providing 100% certified natural gas.

The executive team, he said, has often discussed “our strategic pillars and nonnegotiables, with respect to strategic decisions. They absolutely guide our decision making and ensure that any transaction serves to enhance returns, deepen inventory, strengthen our capital structure,” and lead in environmental, social and governance (ESG) initiatives.

“This combination checks all these boxes,” he said.

Selling Certified Natural Gas

Both independents have set ESG goals, with ambitions to sharply reduce their emissions. Chesapeake also has a goal to certify 100% of its natural gas production. Likewise, Southwestern in 2022 had completed certifying all the Appalachian production and was in the process of doing the same for the Haynesville portfolio.

Once the deal is completed, the company plans to “maintain its low natural gas emissions profile,” executives said, with a commitment to achieve net zero direct and indirect (Scope 1 and 2) greenhouse gas emissions by 2035. In addition, “transparent disclosure” would be provided “on measurable targets, investment in low-carbon solutions, and social and governance excellence.”

The merger also is set to improve efficiencies by unitizing the two companies’ overlapping operational infrastructure. Estimated annual operational and overhead synergies were at $400 million.

The proposed combination, approved by each board, has an enterprise value of about $24 billion. In the all-stock transaction, Southwestern shareholders would trade each share for a 0.0867 share of Chesapeake.

The combined company also is to be rebranded. Based on the details, Chesapeake would control 60% of the company with Southwestern, based in Spring, TX, near Houston, holding 40%. Once the merger is completed, the company would be headquartered in Oklahoma City.

The plans to rebrand under a new moniker will “mark a fresh start for both of our organizations and redefine the natural gas producer,” Dell’Osso told analysts.

The reconstituted board would increase to 11, initially composed of seven Chesapeake representatives and four from Southwestern. Chesapeake Chair Mike Wichterich is to serve as nonexecutive chair.

Kimmeridge Energy Management Co. LLC, which has holdings in many U.S. companies including Chesapeake and Southwestern, is “highly supportive of the merger,” said managing partner Mark Viviano. He said it “aligns with our long-standing framework for successful consolidation and is one of the few transactions in the sector where one plus one should turn out to be much greater than two.

“We believe it will be one of the few must-own stocks in the sector, especially as investors recognize the significance of a leading Haynesville position into a historic buildout of LNG export capacity along the Gulf Coast. It’s not just the material synergies from offsetting operations, but the valuation re-rating opportunity associated with greater investor relevancy.