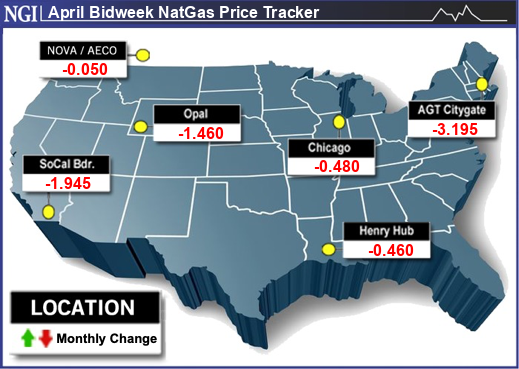

Though lingering chilly weather may bolster demand in some parts of the country in April, stubbornly high production and unseasonably strong storage inventories sent natural gas bidweek prices tumbling. NGI’s April Bidweek National Avg. dropped 69.0 cents month/month to $2.180/MMBtu.

Some of the biggest decreases were seen in the western United States, where losses of nearly $2.00 were common. Notably, however, April bidweek prices remained at a stout premium to the rest of the country as pipeline maintenance is set to shuffle gas flows heading into the region, even as snow and cold weather continue. Rockies production also remains off highs because of the cold.

The SoCal Citygate stood out from the pack as the lone location to record an increase month/month. April bidweek prices averaged $7.880, up 95.0 cents, as a host of maintenance events was planned in the next 30 days.

The largest curtailment of gas flows would occur on Line 5000, according to the Southern California Gas (SoCalGas) electronic bulletin board. From April 17-28, the utility expects 630 MMcf/d of capacity to be reduced for remediation work. Line 5000 runs between SoCalGas’ Blythe and Cactus City compressor stations within the eastern Desert Center in Riverside County.

Line 4000 also is scheduled to undergo maintenance from April 8-28. This work would restrict 375 MMcf/d on flows in SoCalGas’ northern zone. Toward the end of the month, a pair of inventory shut-ins also are planned at Honor Rancho that would limit injections and withdrawals at the storage facility. Maintenance planned at Aliso Canyon has been pushed to May.

Skiing In July?

Elsewhere in California, prices continued to slide despite the continuation of late-season winter storms. The latest storm to hit brought more rain, snow and gusty winds to the Golden State, even though it packed less of a punch than some prior storms.

Nevertheless, AccuWeather said the weather system added to the record levels of snow that have fallen on California since the start of the year. Snow totals are so high that local ski resorts have announced they would remain open for skiing through at least the end of July.

The Sierra Nevada’s snowpack is now well above average, according to AccuWeather. The southern third of the mountain range was at nearly 290% of the historical average for March 29. The snowpack in the northern third of the mountain range was nearly 190% of average.

The heavy precipitation this winter should bode well for hydroelectric generation in the coming months. The state’s two largest reservoirs, Oroville and Shasta, have risen above their historical average to date after years of being significantly depleted, AccuWeather said. The Don Pedro and Folsom reservoirs also have risen above their historical average to date.

The onslaught of moisture since late last year has reversed the years-long drought in California. More than 15% of the state is considered to be drought-free, according to the U.S. Drought Monitor.

Amid the improved water outlook, California Gov. Gavin Newsom announced on Friday the rollback of some water-use restrictions. The Department of Water Resources also announced it would increase the amount of water deliveries to 75% of requested water supplies this year — up from the initial plan of only 5% last year — as a result of the recent storms. This increase represents an additional 1.7 million acre feet of water for the 29 public water agencies serving 27 million Californians.

With a likely increase in hydroelectric power, one possible outlet for natural gas supplies may be storage. This would be an optimal path given the massive deficit in Pacific inventories. Only 73 Bcf sat in regional stocks as of March 24, which is around 55% below historical levels.

With a lower pull on natural gas likely in April, bidweek prices at the PG&E Citygate plunged $1.055 month/month to $6.680. Malin dropped $1.435 to $4.060.

Prices throughout the Rockies also dropped sharply, with Northwest Sumas sliding $2.055 to average $3.550 for April baseload delivery.

In Attack Mode, Bears Eye Permian

Even with the hefty discounts on the West Coast, April bidweek prices were significantly lower elsewhere across the country thanks to the onslaught of spring that’s driven down weather-led demand amid lofty production and storage levels.

Benchmark Henry Hub averaged $1.990 for April baseload gas, down 46.0 cents on the month. Similar declines spread throughout Louisiana, the Midcontinent and Midwest. Chicago Citygate April bidweek prices averaged 48.0 cents lower on the month at $2.010. Ventura dropped 62.5 cents to average $1.965.

The bargain natural gas prices for April baseload delivery occurred as total U.S. production continues to hover near record highs at around 100 Bcf/d and working gas in underground storage sits at unseasonably high levels on the cusp of the traditional injection season.

The Energy Information Administration (EIA) said overall stocks as of March 24 were at 1,853 Bcf, which is 441 Bcf above year-earlier levels and 321 Bcf above the five-year average.

Widespread price losses extended into Texas, most notably in the western part of the state.

Waha April bidweek averaged only 8.0 cents after trading in a range from zero to 25.0 cents, which is a decline of $1.235 from March. For comparison, Houston Ship Channel averaged 48.5 cents lower at $1.640.

While prices in West Texas remained positive, analysts have noted that light shoulder-season demand along with steady output in the Permian Basin would likely send regional prices back into familiar negative territory, especially if pipeline maintenance curbed throughput.

That theory could be tested as soon as this week. Kinder Morgan Inc.’s Permian Highway Pipeline said capacity would be reduced to 1.6 Bcf/d from April 1-11 in order to replace valves connecting to its Tejas Pipeline.

Flows through the company’s Gulf Coast Express (GCX) also would be curtailed in April for necessary inspections and planned maintenance at the Rankin, Devils River and Big Wells compressor stations. In a notice to shippers, GCX indicated that on Tuesday and Wednesday (April 11-12), flows would be reduced to 1.2 Bcf/d. From Thursday to Friday (April 13-14), flows would be cut to 1.6 Bcf/d.

“With Permian pipeline egress already constrained, these service disruptions will no doubt result in downward pressure on Waha prices,” said analysts at East Daley Analytics.

They expect pipelines out of the basin to run at more than 100% utilization during these maintenance events. “Capacity looks tight regardless. We forecast Permian egress pipelines would run at 97% of effective capacity in April with all systems functioning normally.”