Chesapeake Energy Corp. said Wednesday it would significantly slash spending and natural gas production this year in one of the biggest activity cuts announced yet for U.S. onshore operations in response to tanking prices.

The company, one of the largest natural gas producers in the Lower 48, plans to reduce capital expenditures (capex) in 2024 by 20% and cut production by 15%, compared to preliminary guidance released last quarter. The news provided U.S. gas futures with the biggest jolt in more than a week.

"We see that the market is oversupplied right now,” CEO Nick Dell’Osso said during a conference call to discuss financial results. “Capex reductions that we or anybody else in the industry take on have an impact to production several months out, as long as 12 months.

“For our business, we believe the right answer is to reduce production today...We believe we should hold onto that productive capacity and turn it in line when there is greater demand and the market is not oversupplied."

Chesapeake plans to achieve most of its production cuts by not turning wells in progress to sales. It also plans to drop rigs and completion crews. The company now plans to spend up to $1.35 billion this year and produce between 2.65-2.75 Bcf/d.

Activity cuts are mostly being split evenly between the Haynesville and Marcellus shales, where Dell’Osso said there are currently “pretty similar market conditions.”

Two completion crews in both formations would be dropped next month, along with one rig in the Haynesville. A Marcellus rig would be dropped by mid-year.

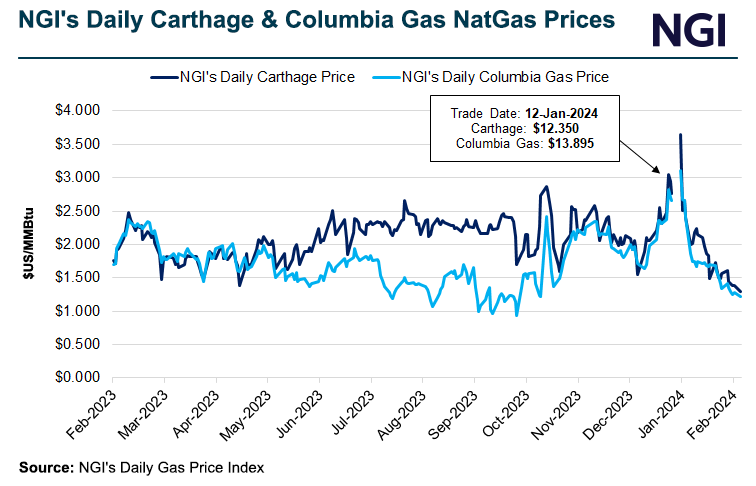

Indeed, spot prices in both regions have mirrored each other closely. They traded in a narrow range Tuesday as they have for most of the past year. NGI’s Carthage index in the Haynesville averaged $1.290/MMBtu, while NGI’s Columbia Gas index in Appalachia averaged $1.220.

Management stressed that the cuts only consider Chesapeake’s operations and not Southwestern Energy Co., which the company is working to acquire to form the largest U.S. natural gas producer. That deal is expected to close by mid-year.

Southwestern is the nation’s second largest gas producer, with about 600 MMcf/d more gas production than Chesapeake, said NGI’s Pat Rau, director of strategy and research. It also operates in the Haynesville and Appalachia.

“If Chesapeake follows the same approach with Southwestern, then that could be closer to 2 Bcf/d that comes off the market,” Rau said of the possibility for further cuts if the acquisition goes through.

“We will be paying very close attention to the underlying fundamentals, the underlying supply and demand situation in the market, and we'll try to bring gas online when we see there is demand that needs the gas,” Dell’Osso said of Chesapeake's operations.

He added that the plan is meant to keep the company nimble enough to respond to any commodity rebound, without spending significant amounts of capital to do so. It would position the company to have up to 1 Bcf/d of flexible, spare production ready by the end of the year.

When demand strengthens, management would first resume turning wells inline (TIL) and then bring back completion crews. After the TIL and the drilled but uncompleted inventory is depleted, rigs would be brought back to drive further production.

Dell’Osso said he’s confident demand will return.

“We expect there to still be a step change in demand in 2025 as incremental LNG capacity comes online and the market continues to grow for natural gas domestically,” he said. “We also think the supply dynamics will be better in 2025. Remember, there was a lot of capital cut across the industry last summer, and the results of those capital changes haven't shown up yet.”

While the bulk of the Lower 48 independent exploration and production companies have yet to issue their fourth quarter and year-end reports, some have appeared reluctant to slash production significantly, despite the downward spiral of gas prices.

Henry Hub prices dipped below $2 earlier this month and have fallen for nine of the last 11 trading sessions.

NGI’s Weekly Spot National Avg. price has also been under pressure for five weeks in a row, weighed down by near record production, mild winter weather, underperforming liquefied natural gas exports and high storage inventories.

Chesapeake's cut provided a shot in the arm for the market. Not only did prices quickly jump late Tuesday after the quarterly results were issued, but they continued climbing when the market opened on Wednesday, with the prompt contract ultimately finishing 20 cents higher at $1.77.

Chesapeake produced 3.43 Bcfe in the fourth quarter of 2023, versus 4.05 Bcfe in the year-ago period. Last year, the company produced about 3.7 Bcfe, compared with 4.0 Bcfe/day in 2022. The company finished selling its assets in the Eagle Ford Shale last year.

Fourth quarter net income was $569 million ($4.02/share), compared with net income of $3.5 billion ($24.00) in the year-ago period.

Full-year net income was $2.4 billion ($16.92/share), versus $4.9 billion ($33.36) in 2022. Commodity prices dropped over the year. Chesapeake reported an average realized price of $2.66/Mcfe in 2023, compared with an average of $6.77 in 2022.